- Community

- Topics

Turn on suggestions

Auto-suggest helps you quickly narrow down your search results by suggesting possible matches as you type.

Showing results for

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where in Turbo Tax do I add Schedule C - Line 2 for Returns and Allowances information?

Announcements

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in Turbo Tax do I add Schedule C - Line 2 for Returns and Allowances information?

Topics:

posted

February 27, 2020

7:19 AM

last updated

February 27, 2020

7:19 AM

Connect with an expert

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

1 Reply

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where in Turbo Tax do I add Schedule C - Line 2 for Returns and Allowances information?

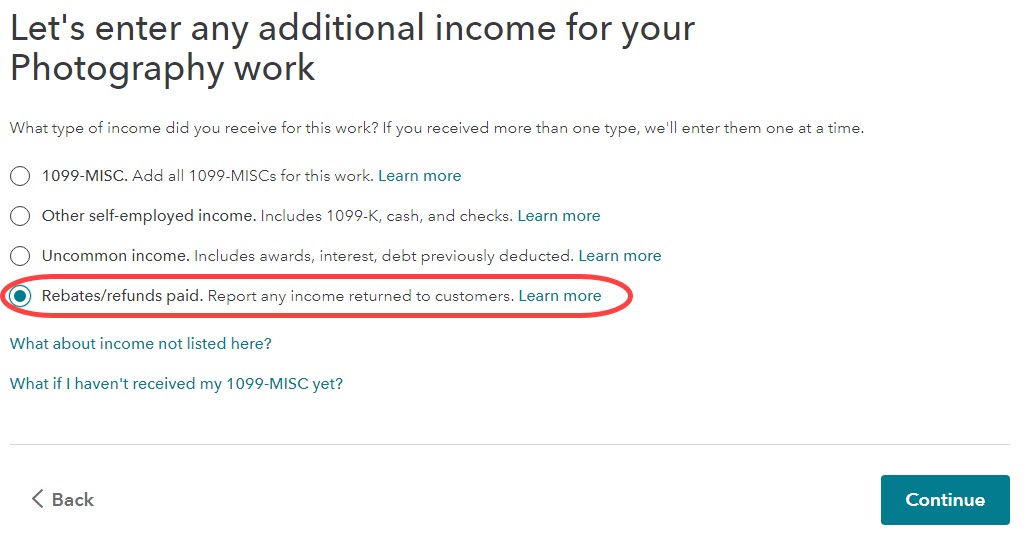

In TurboTax Self-Employed, the program refers to "returns and allowances" as "refunds and rebates." To enter returns in TurboTax, please follow these steps:

- In your return click on Income and Expenses and then click the Start/Revisit box in the Self-Employment section.

- On the Your 2019 self-employed work summary screen, click on Edit next to your business.

- On the Here's your [business] info screen, click on the box Add income for this work.

- On the screen, Let's enter the income for your[XX] work, mark the radio button next to Rebates/refunds paid and click Continue. [See screenshot below.]

- On the next screen, Tell us about refunds and rebates for your [XX] work, enter the description and amount of the refunds. You can just enter a total if you wish or you can click Add another row for additional lines.

February 27, 2020

11:48 AM

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bowwow

Level 2

jfreylee

New Member

rowepsy1

New Member

ria-kwon7877

New Member

waqarahmadus

New Member