- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where do I find my asset depreciation report?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

In TurboTax, the form is entitled Depreciation and Amortization Report (see screenshots below from the desktop version of Home & Business).

The form should be in your PDF if you saved your return, including filed forms and worksheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

In TurboTax, the form is entitled Depreciation and Amortization Report (see screenshots below from the desktop version of Home & Business).

The form should be in your PDF if you saved your return, including filed forms and worksheets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

Just to elaborate on @Anonymous_ 's response.

You need to save your tax return in PDF format. Save "EVERYTHING". Not just the forms required for filing, or the forms for your records.

In that PDF document you will find two IRS Form 4562's that pertain to that specific rental property. They both print in landscape format. One is titled "Depreciation and Amortization Report" and is most likely the one you need. The other is titled "Alternative Minimum Tax Depreciation" and will probable have all zeros for depreciation taken.

Remember, you have to add together the amounts in the "prior year depr" column and "current year depr" column to get the total amount of depreciation taken up to Dec 31, 2019. So if you sell the property in 2020 you'll want to add another year's depreciation to that total to account for the period of time in 2020 you will still own the property. That will help you achieve a rough estimate of your actual tax liability on any gain on the sale, as well as the depreciation recapture.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

I have searched exhaustively for that report and I cannot find it. I do not recall seeing anything that lists "save everything." So now that I'm trying to resolve this, I cannot find a way to access that information nor can I find a way to retrieve it from TurboTax. Seems to me that they would have a way to contact them to get it, but unless you pay the extra money for live assistance, I guess you're on your own. Sure would be better customer service if they made it available. If anyone knows of a way to get it besides the prior comments (which didn't work for me), future users would be helped.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

When you go to the option to print your return or save to a PDF, choose the option that says 'tax return, all calculation worksheets'. This option includes 'everything'. Your depreciation report in table format should be included.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

Thank you for the reply. When I go to the "documents" section, the only option I have is a tab that reads "Download Tax pdf." When i click on that, I get the download, but there is no option given to download all calculation worksheets, nor is the calculation worksheet included.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

@dachristianman If you are referring to a 2023 tax return that you completed and filed -

To access your current or prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

When you sign onto your online account and land on the Tax Home web page, scroll down and click on Add a state.

This will take you back to the 2023 online tax return.

Click on Tax Tools on the left side of the online program screen. Then click on Print Center. Then click on Print, save or preview this year's return. Choose the option Include government and TurboTax worksheets

If you are referring to a prior year tax return that you completed using the TurboTax online editions -

To access your prior year online tax returns sign onto the TurboTax website with the User ID you used to create the account - https://myturbotax.intuit.com/

Start the 2023 online tax return by entering some personal information then click on Tax Home on the left side of the screen.

On the Tax Home webpage -

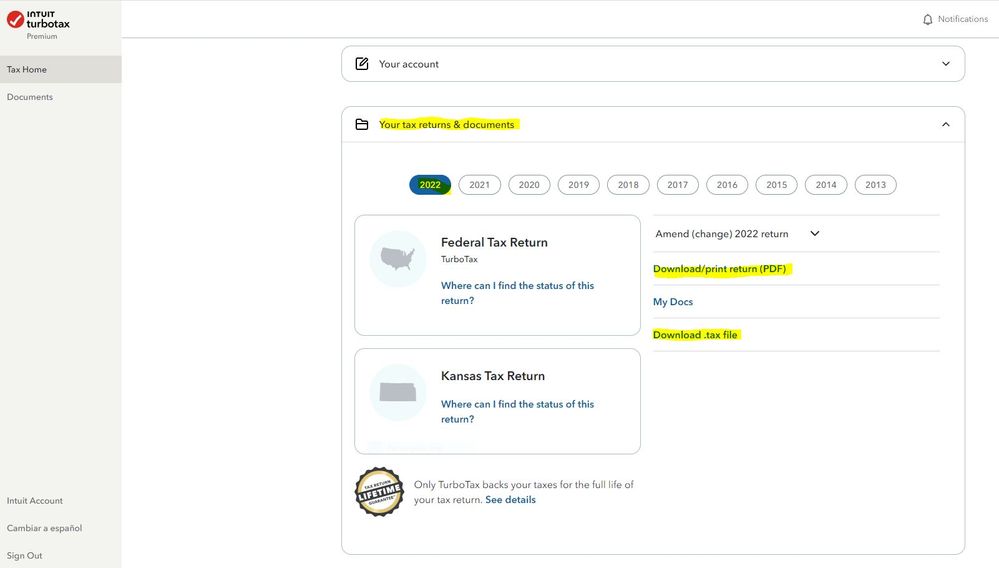

Scroll down to the section Your tax returns & documents. Click on the Year and Click on Download/print return (PDF)

If you used the desktop CD/Download editions installed on your computer, the only copy of your tax data file and any PDF's will be on the computer where the return was created. TurboTax does not store online any returns completed using the desktop editions.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

I am trying to retrieve the worksheet from my 2022 tax filing. There is not a "tax tools" button on the prior year's return screen. The only option available is the aforementioned "download tax pdf" button located on the right-hand side.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

@dachristianman wrote:

I am trying to retrieve the worksheet from my 2022 tax filing. There is not a "tax tools" button on the prior year's return screen. The only option available is the aforementioned "download tax pdf" button located on the right-hand side.

As stated you must start a 2023 tax return before the Tax Home link on the left side of the TurboTax web page becomes available. The 2023 return does not have to be filed or paid for, you only need to complete the personal info section of about 10 to 12 screens and Tax Home will then be a link on the left side of the online program screen. Clicking Tax Home will get you to this screen where you can access a prior tax year and download the PDF of the return. The PDF will include all forms, schedules and worksheets for the tax year you selected.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

Thank you. I found that screen, and I downloaded both the .pdf and the .tax file. I can open the .pdf, but the .tax file is some software that I don't have. The .pdf includes the Schedule E 4562, but that doesn't show the details of when the item began to be depreciated, nor any details on what is being depreciated.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

The tax file can only be opened by the TurboTax software for the tax year of the file.

In the PDF file do you have a Depreciation and Amortization Report? It will list all assets you have entered, the date put in service, the cost amount, the amount of deprecation for the asset and the amount of depreciation already taken.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

No. That is what I'm hoping to find. The closest thing I can find is the Schedule E 4562 and it is not detailed enough, but is pulling the information from somewhere.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

@dachristianman If what you are looking for is a report which shows the depreciation for each tax year, past, current and future. That is not included in the PDF download. That can only be obtained from the Asset Entry Worksheet in the TurboTax desktop software in Forms mode. There is a Quick Zoom to the Asset Life History.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

I'm looking for the year it was placed in service, initial value, and the depreciation schedule for the item and associated items. Is there a way for me to request the asset entry worksheet? Also, I'm not sure what you mean by a quick zoom to the asset life history.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I find my asset depreciation report?

@dachristianman Quick Zoom is a feature included on the Asset Entry Worksheet.

No, there is no way to provided the asset life history outside of the TurboTax software. It is only included if you are using the TurboTax desktop software installed on a personal computer and have entered an asset for depreciation. The Asset Entry Worksheet is created by the software along with the Asset Life History.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Idealsol

New Member

Kenn

Level 3

Farmgirl123

Level 4

eedavies4

New Member

user17524923356

Level 2