- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

I do not know why TurboTax has not updated how it handles the sale of MLP units. A prior contributor offered a solution which works for me, so here again "

On the MLP (K1) screen, show partnership ended, and that you disposed of your units by a sale. Further on the screen asking for sales and basis, enter zero for basis, enter the ordinary gain or loss in that box, and enter the inverse reported gain amount in the basis box

So an ordinary gain of 240 is entered in the basis box as -240. The end result is that the gain goes on form 4797

AND there is nothing that will duplicate the information on your form 1099 B from your broker that goes on form 8949.

On your entry from your broker statement for the sale of the MLP enter the total sales revenue, and the cost as shown,

and check the box below for incorrect basis. When the correct basis screen comes up enter a basis that will result in the correct capital gain or loss based on your sales worksheet calculations. You may want to provide a supplemental statement to explain this code B adjustment.

Then there is also the issue that the K1 interview assumes that sale took place in one time period, without providing for short term and long term sales. But that is not necessary since the 1099 B will have that information reported as

code B for short and code E for long since neither basis is reported by the MLP to the IRS. So you have to adjust the Code B basis to reflect short term capital gain or loss and ditto on code E.

All of the above has been posted previously by another contributor. I am only repeating it for those who did not read the original. But my question is. WHY IS THIS NOT BUILT INTO THE PROGRAM ITSELF. THIS WORKAROUND HAS EXISTED FOR SO LONG THAT IT IS TIME TURBOTAX MADE IT PART OF THE PROGRAM. !!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

Marvin could you please clarify to whom you are responding to, since your reply was under my comments, but your comments does not appear to apply to my situation or answer my question.

I was wondering where you are getting the "240" from. In your comments you mention the "ordinary gain of 240" should be entered on basis box as -240 is a theoretical since the early example provided by "giveittome" and answered by "Next champ" she had ordinary gain (600) and 90 (448) . In the my case my it appeared to me that my ordinary gain should be $ -3257.11 (Capital Gain/Loss: Total Gain-Ordinary Gain (635.89 -3893) = -3257.11) and I was hoping that Next Chap would be kind enough to look over my numbers to make sure I followed his stepwise approach correctly. Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

I made a few typos so let me try again. The sales worksheet attached to the K1 that I sold in 2020 showed the amount of ordinary income that is determined by the MLP itself .

'If you are interested, the reason that this is not all capital loss or gain involves the "recapture" of accelerated depreciation tax benefits when the MLP is sold. (and I mean fully disposed of, not a partial sale). Be that as it may, in the K1 interview , you are asked for sales and cost basis and also the amount of ordinary income or loss reported on the worksheet. That was 240 gain , which is carried to form 4797. Entering the gain there on the interview accomplishes that. Then enter in the cost basis box the same amount, but as an inverse. (if the ordinary gain is 240 enter -240 in the basis box. And then enter zero in the sales proceeds box.

The net result is that you have taken care of the 4797 entry,

and shown a zero gain on the sale itself, so that there will be no duplication with the entry from your broker statement for its reporting of sales proceeds and cost.

But you have to adjust the broker reported basis to produce the correct capital gain or loss, The sales proceeds are unchanged. When you do the worksheet, you indicate your proceeds, and your cost basis which should be the same as your broker reported. So assume 10000 proceeds

and 12000 cost. That 12000 has then to be reduced by

the adjustment to basis based on the recapture , which is an amount furnished by the MLP. so assume that adjustment is -6000. So your adjusted basis is 12000-6000 or 6000.

Your proceeds are 10000 so 12000-6000=4000 total gain.

If 240 has to be reported as ordinary gain, then 4000-240 is the amount of capital gain (or loss when applicable).

ie 240 ordinary 3760 capital gain- total 4000.

In my actual transaction, I had a capital loss and a positive ordinary gain

So I go back to the 1099 B entry on form 8949 and adjust the broker reported cost so that a gain of 3760 is produced and reported via form 8949. I report the basis adjustment on the "basis as reported is not correct" box and then enter the required amount to produce a 3760 gain. Remember that the PTP has not reported a basis to the IRS, so your 1099 B

is either sales category B or E (short or long non reported)

But there is one other factor. The sales worksheet sometimes does not distinguish between long and short term correctly, or it it does, it is as a percentage (for example 92long 8 short. Since the broker is showing both entries in B and E

if you held the MLP long enough, you have to make the above cost basis adjustment to both the short (B) and long (E) entries, using either the percentage furnished by the MLP

or what you calculate on your own. The ordinary gain going to 4797 is a single number that is not broken down into long and short.

Again this workaround is not original and was posted previously by another contributor, but I found this to be doable and eliminate the duplication of sales proceeds

and also the creation of those bothersome category C

and F 8949 that some workarounds produce.

So I hope this helps, and credit should go to whoever posted this originally. PS I have not mentioned the AMT amounts because AMT is no longer an issue for me.

So end result 4797 is ok, capital gain or loss is ok, and there are 2 "b" adjustments on 8949 B and 8949 E.

You may wish to attach info to explain the b, but that seems to have taken care of everything. Again my same question

why does TT not build this into its program? so those b adjustments are automatic once the ratio between short and long has been entered???

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

I do not know where the "social security # came into my text box .I did not type it. So just ignore that. The social security # has nothing to do with the workaround.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

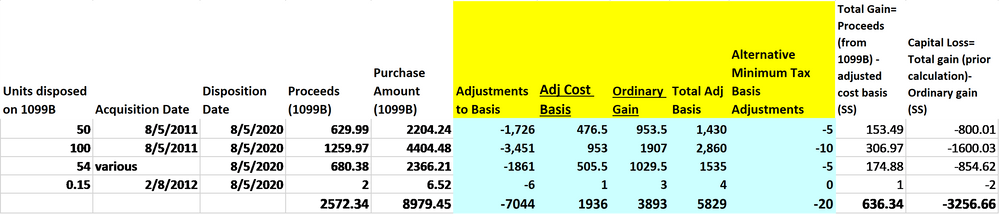

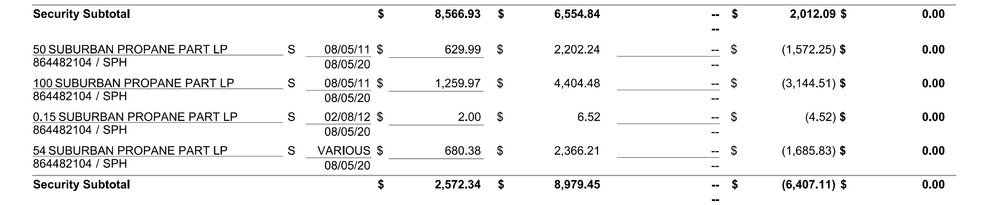

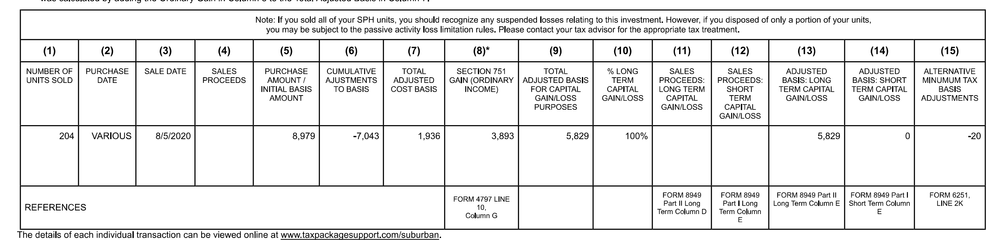

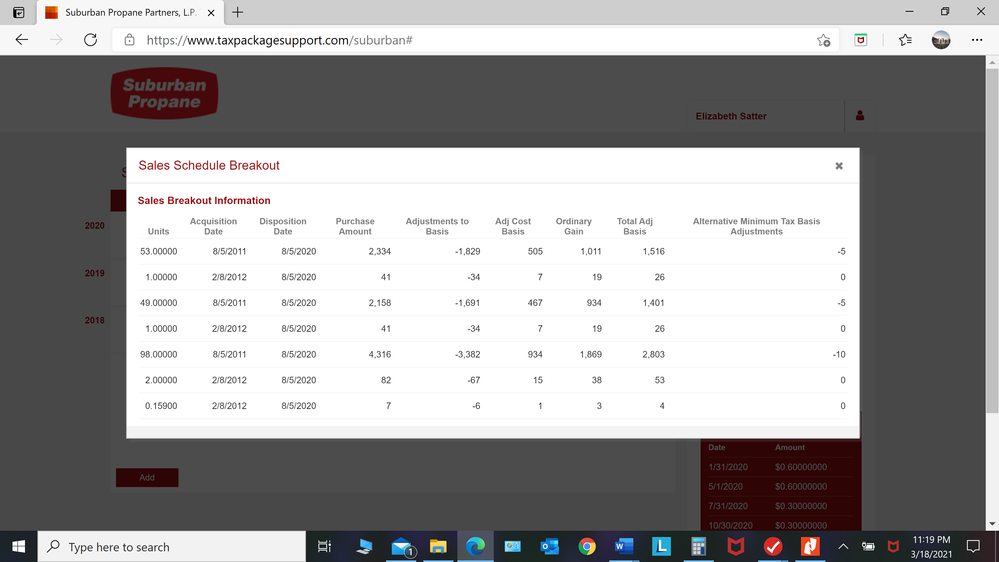

I imported my 1099 information from my Broker and K-1 files into Turbotax, then did some adjustments so that everything ended up on the correct forms in the correct areas. However, I assumed that since my Sales Schedule list an amount Total Adjusted Basis for Capital Gain Purposes and annotates that “this amount will be used on form 8949”. All I need to do was to go to the Capital Gain work sheet for each transaction, go to part III check box “form 1099-B has incorrect basis” then enter the basis that was listed on my Sales Schedule. And by doing this, this would correctly adjust the cost basis in part 1 of the worksheet and give me the correct gain loss.

However, I also need to calculate the Total Gain and Capital Gain/Loss just to ensure that this information is properly reported on form 8949 and form 4797, but I just want to make sure I understood

Total gain: Proceeds (from 1099B) - adjusted cost basis (SS)

Capital gain: total gain (from above calculation)- Ordinary gain (SS)

Attached is a spreadsheet with the information from my 1099-B and Sales Schedule (info highlighted yellow/blue) and my calculations for my Total Gains and Capital Loss (last two columns), and I was hoping you could just look to ensure that I correctly understood how to calculate these last two numbers.

Thanks

L

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

your images are not clear enough or my 83 year old eyes new glasses, but let me try again using my # from my sales worksheet,

First what does the MLP provide on the worksheet attached to the K1 and more important relative to the release of passive losses from prior periods: For ages, TT has not clarified the

interview sheet to show a total sale rather than a partial sale.

Numerous postings have pointed that out and still no modification so I use partnership ended rather than disposed of, since the latter could imply either partial or full disposition. Using ended leaves no doubt, and subsequent screens will call for how you disposed etc with a box for by sale. That will produce the desired entry on on form E

showing now available passive losses (current and prior period if you used TT in prior years. (passive losses only usable when you sell your units)

Any way the MLP gives you the broker reported (unadjusted) basis. , the amount of the basis adjustment, and the amount to be reported as ordinary gain on form 4797.

It is up to you to figure out the rest. So, for example, using rounded # from my sale, my total proceeds were 13800.

My broker reported basis 16500. and the broker gain or loss is 13800-16500 or -2700. I am assuming the time period is all long term, but in real life, a portion can be short and the remainder long with 1099 B in sales category B and E

Anyway, the MLP reported a basis adjustment of 10000.

So my adjusted basis is 16500-10000 or 6500. on the sales worksheet. My total gain or loss to be reported to the IRS

is my proceeds 13800 less my adjusted basis 6500 or a preliminary gain of 7300 However, the MLP reported on the sales worksheet that there is an ordinary gain of 8400

so there must be a capital loss of 8400--7300 or ll00 loss

(overall gain 7300 consisting of 8400 ordinary income, and 1100 capital loss. ) Depending on the holding period that loss is either short or long or a portion of both.

So assume it is all long. Go back to the broker entry on the 1099 B where you have entered the broker reported proceeds and the broker reported cost, and adjust the cost to produce a loss of 1100. (check the basis incorrect box

and on the next screen enter the basis that will result in a 1100 capital loss in my example 13800 sales adjusted basis is 14900, There will now be a B code adjustment oh form 8949 to reflect this and I think everyone is happy

with the correct sales, the correct 4797 and the correct

or so I think capital gain and loss.

And if you did not read the prior post when you enter the proceeds on the K1 screen enter zero for sales, the ordinary gain in the ordinary box and the inverse in the basis box

sales zero ordinary gain 8400 and basis -8400.

That eliminates the duplication between the K1 and the broker 1099 , Again if there is short and long holding period, you may to allocate the basis adjustment to show the correct capital gain or loss on Sales category B and E.

Hope that helps, and nothing here is original. Previous contributors were the sources not I.

But there are many issues related to the sales of an MLP

that go far beyond the immediate tax return, namely how to handle UBTI that exceeds $1000 if the MLP is held in a tax deferred account such as an IRA. However that is not an immediate concern if the MLP is in a taxable account.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

How did you get the capital loss: $7600? I tried to do the math, but couldn't get the answer. ("In this case, for step 2, you have a cap loss of $7600. ")

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

@manbeing Note that a couple years ago TT moved their old forum to this new site. All the posts that moved were re-dated to June 4, 2019. I mention that since this thread is really old, and its tough to tell how the later posts apply to the earlier ones. But with that said, the math goes like this:

- Sales proceeds is easy: the amount you sold for, or $500

- Cost is hard. Its not what you paid originally (10,000). Its what you paid, adjusted by the K-1 adjustments (-2500). So cost is actually $7500.

- So profit/loss is sales - cost or -7000.

- But the IRS doesn't tax all losses the same way. In this case, the total -7000 is split. There's $600 of Ordinary Income, and there's -7600 of Capital Loss. Combined, -7600+600=-7000.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

Hi, I just don't know where the -7600 of Capital Loss came from?

You mentioned that "(you work out the cap gain/loss by using the K-1 worksheet).", but I couldn't figure it out using the example above.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

@manbeing Can you clarify which part of the math is confusing? Or what answer you're coming up with?

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

Thank you for your help/clarification on this subject. I have one more wrinkle that perhaps you could address. I sold all my units in Energy Transfer at the end of last year. In previous years there were posts saying to separate the ET K1 into 3 K1s in TT to correctly account for the subcomponents in ET (ET, USAC and SUN). However, the sale was at the top level with only one sales schedule. How do I answer the interview questions especially for USAC and SUN to unlock the passive losses for them and to indicate they are sold?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

@DaveT3 There's no need to split the Cap Gains / Basis Adjustments, since that all happens on the 1099-B. So the only thing that you have to account for on USAC and SUN is the Ordinary Gain. That should be split out for you in the K-1 (line 20AB maybe?). But if its not, it won't impact anything: you still report that each sub-K1 is a complete disposition, through a sale, and proceed as normal.

**Note also, I'm not a Tax Preparer/CPA. Just a volunteer, seasoned, TurboTax user.

Use any advice accordingly!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter sales information for an MLP? I received a Sales Schedule on my K-1 but I also received a 1099-B from my broker.

Thank you; yes, the ordinary gain is split out on 20AB. I don't see the AMT adjustment split out but maybe it doesn't matter.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

pmc8969

New Member

hativered

Level 2

nestog33

New Member

regena767lott

New Member

redbullcaddy

New Member