- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

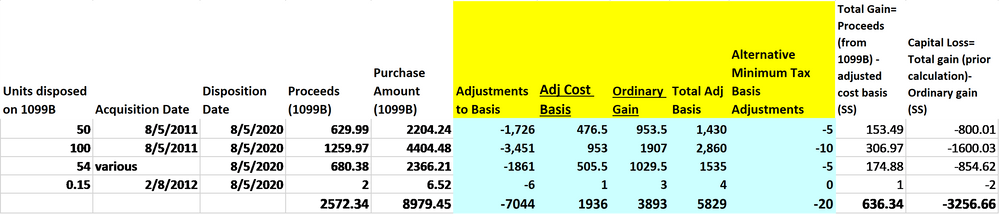

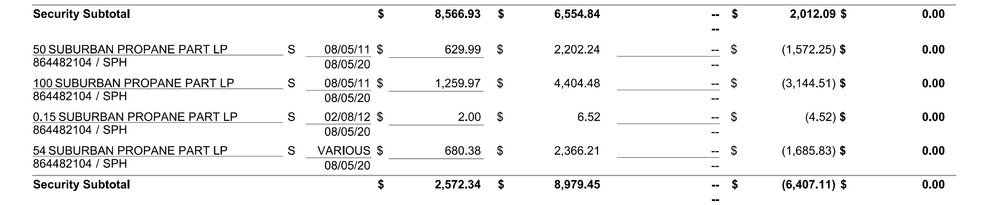

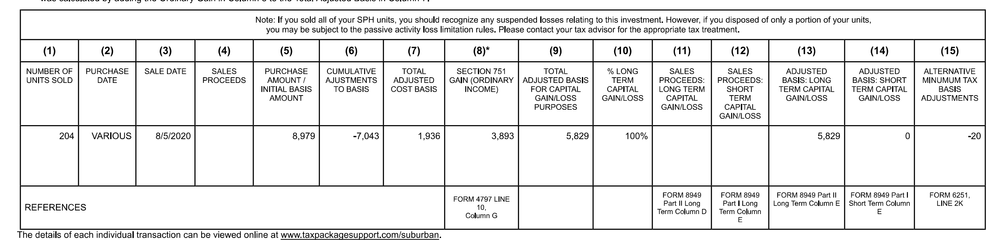

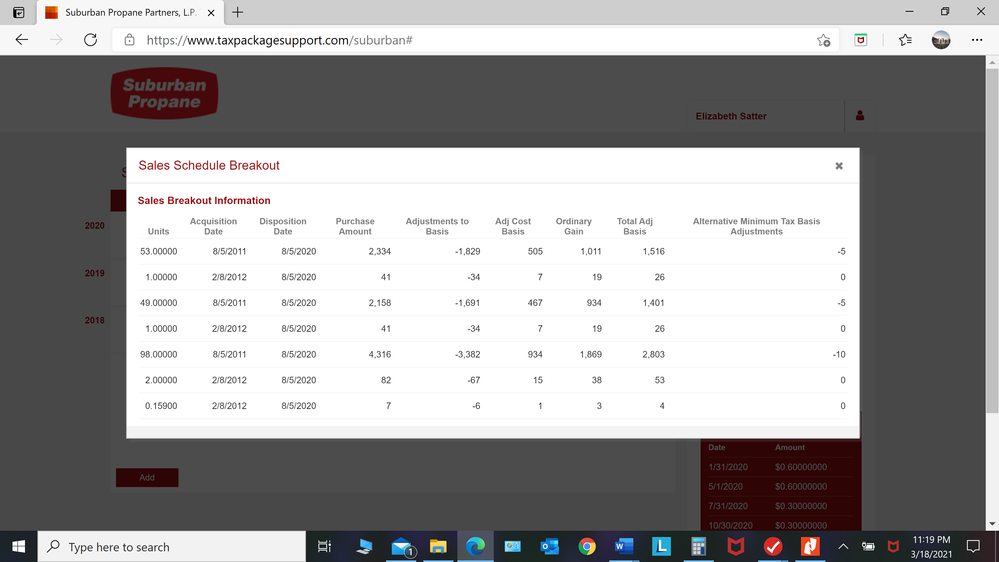

I imported my 1099 information from my Broker and K-1 files into Turbotax, then did some adjustments so that everything ended up on the correct forms in the correct areas. However, I assumed that since my Sales Schedule list an amount Total Adjusted Basis for Capital Gain Purposes and annotates that “this amount will be used on form 8949”. All I need to do was to go to the Capital Gain work sheet for each transaction, go to part III check box “form 1099-B has incorrect basis” then enter the basis that was listed on my Sales Schedule. And by doing this, this would correctly adjust the cost basis in part 1 of the worksheet and give me the correct gain loss.

However, I also need to calculate the Total Gain and Capital Gain/Loss just to ensure that this information is properly reported on form 8949 and form 4797, but I just want to make sure I understood

Total gain: Proceeds (from 1099B) - adjusted cost basis (SS)

Capital gain: total gain (from above calculation)- Ordinary gain (SS)

Attached is a spreadsheet with the information from my 1099-B and Sales Schedule (info highlighted yellow/blue) and my calculations for my Total Gains and Capital Loss (last two columns), and I was hoping you could just look to ensure that I correctly understood how to calculate these last two numbers.

Thanks

L