- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

From what you have said, it sounds like you have taken the annual election called the De Minimis Safe Harbor Election. This annual election allows you to expense assets that cost $2500 or less. When you expense the entire cost of an asset in 2016 you are getting a 100% write off. There is no need for section 179. TurboTax is taking you back to the main/overall business section because you must enter the asset manually/yourself into the Expense section using Other Miscellaneous Expenses. If you want to use section 179 instead of taking the annual election, you would need to say no to the annual election, then enter the asset in your Asset Summary and take section 179 when offered while entering the asset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

From what you have said, it sounds like you have taken the annual election called the De Minimis Safe Harbor Election. This annual election allows you to expense assets that cost $2500 or less. When you expense the entire cost of an asset in 2016 you are getting a 100% write off. There is no need for section 179. TurboTax is taking you back to the main/overall business section because you must enter the asset manually/yourself into the Expense section using Other Miscellaneous Expenses. If you want to use section 179 instead of taking the annual election, you would need to say no to the annual election, then enter the asset in your Asset Summary and take section 179 when offered while entering the asset.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

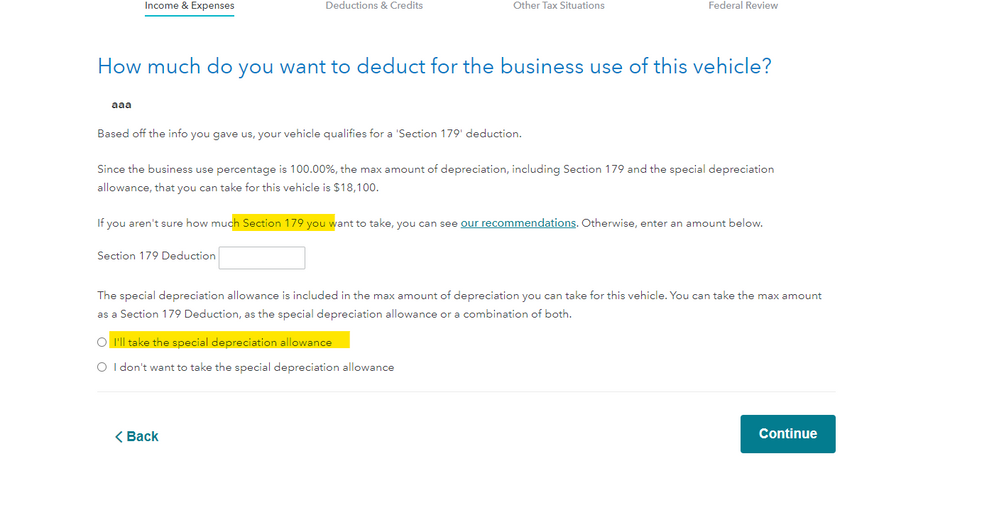

I am certain I qualify for the section 179 deduction on my 2019 Nissan Altima SR that I bought in August of 2019 and with the bonus credit I can write off $18,100 on. I was asking where I enter the information?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

No, my vehicle cost more than $2,500 and I can deduct $18,100 of the purchase price with the section 179 deduction using the bonus deprecation

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

would like to speak with someone to discuss the pros and cons. Is this possible?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

Does anyone know if the IRS will put the additional credit I will be due, towards back taxes that I owe instead of carrying the credit to the following tax year?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

Has anyone got a solution for this? Full vehicle expense deduction in the year purchased for business? Where do you encounter Sect 179 in TT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

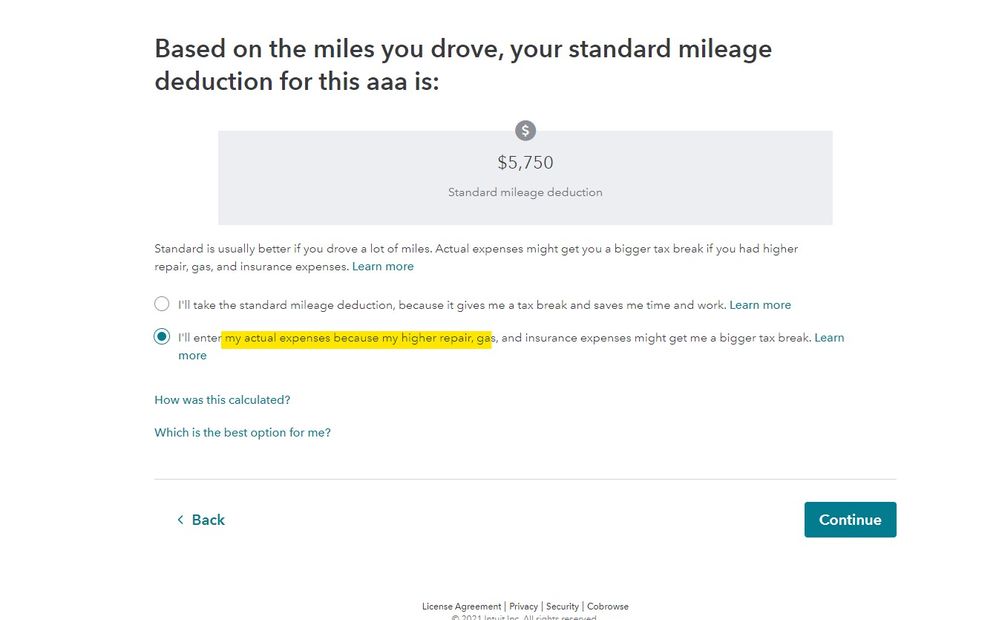

To consider the pros and cons of accelerating vehicle depreciation, please note that if the actual expenses, including depreciation, are claimed in the first year of business use for the vehicle instead of using the standard mileage method, then only the actual expenses are used the entire time you use the vehicle for business.

If instead you use the standard mileage the first year, you can choose over the life of the asset between the actual expenses or the standard mileage rate method each year.

TurboTax recommendations regarding Section 179:

Taking the 179 deduction enables you to increase your deductions in the year you place a property in service, and thus decrease your net income. If your business is operating at a profit, it is to your advantage to claim the section 179 deduction so that you get the maximum allowable deduction to decrease your tax liability. Since cash flow is so important to small business owners, taking the deduction is a great way to reduce your cash outflow by decreasing your tax liability.

Your total section 179 deduction for 2020 is limited to $1,040,000, so if you place several assets in service in a certain year, it may be better to take the regular depreciation deduction for certain items.

You can only take the section 179 deduction to the extent of your net income for the year. If you try to take the deduction for a year in which you have a net loss, you will simply carry the deduction forward indefinitely until you show a profit.

Reminder: In future years, if your business use percentage drops to 50% or below you no longer use the asset in your business, you may have to report the section 179 deduction as income. This is known as recapture.

The IRS can garnish a refund for back taxes, not the Section 179 deduction specifically. For more information, see:

Who Can Garnish an Income Tax Refund? - TurboTax Tax Tips & Videos

Federal Guidelines for Garnishment - TurboTax Tax Tips & Videos

For more information about depreciation, see: What is a Section 179 deduction?

Depreciation of Business Assets - TurboTax Tax Tips & Videos-which includes information about Section 179 and the special depreciation allowance, or bonus depreciation.

Section 179 will be encountered when entering the Business Asset. The Section 179 option will be available after entering the cost of the asset. Follow through the interview and TurboTax will explain the Section 179 option and special depreciation allowance options.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

In the tab "Business", under "Business Income and Expenses", under "Business Asset Summary", I tap add an asset.

A screen comes up titled "Describe this asset"

There is no option for entering a vehicle

The options are :

Computer, video photo telephone

Tools, Machinery, Equipment, Furniture

Real Estate Property

Intangibles, Other property : Land improvement....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

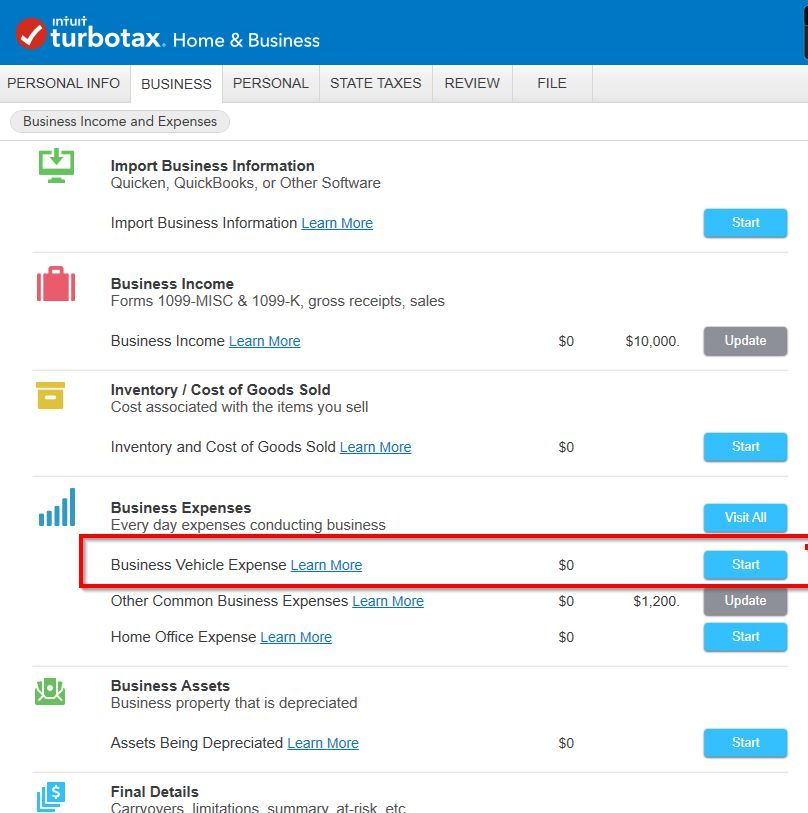

As I recall, Vehicles has its own spot in the business list, not under Assets. Look lower down. Or maybe it's in the Business Expenses near the bottom.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

Made a screen shot. Vehicle does not go under Assets.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

Thank you KathrynG3, but this doesn't tell me exactly how to point & click and enter the section 179 deduction terms for my asset in TurboTax online. I've tried using the "jump to" link, but it only allows me to complete a section 179 recapture - i don't have to recapture anything, it's a new asset/vehicle this year. Any guidance you can provide is appreciated. i'm using TTO SE

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where do I enter my Section 179 deductions for my business using Self Employed TurboTax?

In the vehicle expenses section you MUST choose the ACTUAL expenses option so you can enter the vehicle as an asset then choose the options that works best for you ... just follow all the interview screens :

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

v8899

Returning Member

Omar80

Level 3

becky_krage

New Member

MaxRLC

Level 3

MaxRLC

Level 3