- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

I’m small manufacturer (bags, accessories etc). I elect to do cash based accounting and treat my inventory of raw materials as “non-incidental materials and supplies”. Where on the schedule C should I be deducting the cost for all these “non-incidental materials and supplies” that I used to make my goods this year?

Options I’m considering:

OPTION 1: claim these “non-incidental materials and supplies” on line 38 of COGS, then carry that number down to line 42 (leaving all other lines in COGS blank).

OPTION 2: claim these expenses on line 22 “supplies”.

OPTION 3: claim these expenses on part v “other expenses”, and title the deduction “ Non-incidental materials and supplies for cost of goods sold”

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

It doesn't really matter, they all will have the same result.

However, be aware that you can only deduct the "non-incidental materials and supplies" in the year they are SOLD, just like Inventory. So I don't really see any purpose in not claiming it as Inventory.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

The reasoning behind why I choose to use the exemption that allows me to treat my inventory as non-incidental materials and supplies is that I would have an extremely hard time determining my ending inventory if required to do so using the traditional COGS method. (I’m a small sewing business and have tons of work in progress and lots of raw materials that I’ve already cut up and stacks of small pieces all over my studio. If I wanted to treat my inventory as inventory in the traditional sense I would be required to physically measure all those little pieces to come up with my ending inventory, needed to figure the COGS. That would literally take weeks. It’s much easier, and more accurate, to just calculate what “non-incidental materials and supplies” I used on each item that I sold.

And yes, I definitely know that you only deduct the inventory treated as “non-incidental materials and supplies” in the year that the products are actually sold.

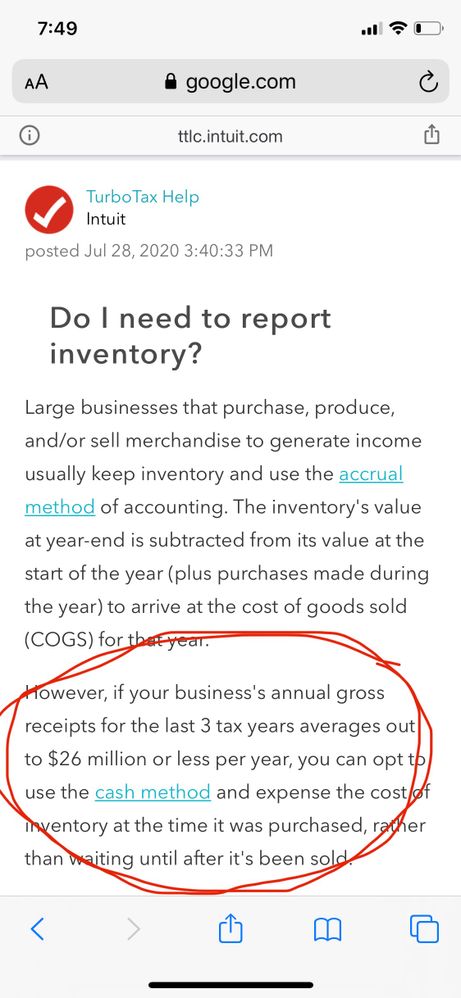

(I know some people misinterpret the rules but it’s pretty clear if you take a few minutes to read the tax code) ... on that note it kind of freaks me out that TurboTax seems to be advising people go ahead and expense inventory before use?!?! See below:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

Yeah, TurboTax give out A LOT of incorrect information, but I'm glad that you are aware of the rules.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

Gah. Crazy.

so as far as where to post those non-Incidental M+S you really don’t think it matters? I realize all roads lead to the same result but seems like there should be a correct place to list it. The one benefit I see to listing it on line 38 (then carried to 42) is it ends up getting transferred to section 1 and comes off my gross profit, so it shows a better reflection of what my income is before I claim other expenses. Not that really matters I suppose.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

There are those manufcturing business models where the products and materials you buy are just not feasible to cost track into the product that is sold. An example would be if you hand make clothing. You'll buy cloth material by the bolt. But trying to cost out from a bolt only that material used in your manufacturing process, just isn't possible or feasible.

In such a case, if your business gross income is under something like $1M, you can just expense all your materials and not use COGS at all. But you do still have to account for those materials withdrawn from the business for personal use. You do that by simply not expensing it to the business. It's treated as an owner's draw.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

From an accounting point of view, you are probably right, putting it under COGS would be best.

But I always put it under Supplies or Other income. I don't like using the COGS section when there is no Inventory.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

@Carl I’m going to type a detailed response (not because I want to correct you or say that you can’t do that, but because I think this will help other small makers understand ways of accounting for their costs).

The tax code is very clear that if you are treating your inventory as non-incidental materials and supplies you are still required to use a method that clearly reflects your income and ONLY the non-incidental M+S that were actually USED to make your goods that sold in the tax year are expensed/deducted. If you are simply expensing all your raw materials in the year purchased rather then the year the items you created out of those materials sold then you are not treating those materials as non-incidental materials and supplies, as required. If you see anywhere in the tax code that says a small business under say 1mil can go ahead and expense all their inventory that’s treated as non-incidental materials and supplies please share. (If you are referring to the De Minimis safe harbor election that some people were interpreting to say that you can do that, that is incorrect and has been clarified since that election was first created. Currently, it clearly states in the code that if you are accounting for Inventory as non-incidental M+S those M+S do not qualify for the De Minimis election.

When you say it “isn’t possible or feasible for for some manufacturers to cost out what was used from a bolt of fabric” that’s a prime example of when a business should be using the traditional inventory method to calculate their COGS and keeping an inventory. Businesses like that just count up what fabric is left on the bolts at the end of the accounting period and subtract that from the sum of the inventory count at last closing + new purchases.. that tells them what their cost was for the current period.

I use bolts of fabric in my sewing business. I treat my inventory as non-incidental materials and supplies. I’m able to do that and comply with the requirements easily. When I purchase a bolt or a yard of fabric I take the cost of that purchase and divide it by square inches. Let’s say my calculation tells me I paid $.10 a square inch for that bolt I just purchased. When I make an item out of that fabric I determine how much fabric I’m using. Let’s say I’m making a shirt that will require 200 square inches of fabric.. 200x .10 = 20 .. I now know that my fabric cost to make that shirt was $20. Any other raw materials and supplies that also went into making that shirt are added to that fabric cost and the total tells me what my COGS is for that shirt. That’s the amount I deduct at the end of the accounting period... whatever wasn’t used stays on my non-incidental materials and supplies list for the next accounting period and isn’t deducted/expensed until I use it, and the item it was used in has sold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

@AmeliesUncle I understand what you mean. Technically those materials and supplies are still inventory since you do have to keep track of when non-incidental materials and supplies get used up but it does feel weird to use the COGS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where deduct costs for COGS when treating Inventory as “non-incidental materials and supplies?

In my computer business I'm not licensed as a retailer. I'm licensed as a service based provider. That way, I don't have to deal with state sales tax paperwork. But I still use COGS.

When I need to replace a part in a computer, such as a hard drive for example, I go out and purchase that hard drive from a retailer. Of course, that retailer charges a sales tax which is clearly identified on the receipt.By law, I can't charge my customer any more than I paid for it. If it did, then I would be selling product at a profit, and would therefore be required by the state to collect and pay sales tax. All my my business profit is made on the labor. Not a penny is made on product.

My beginning and ending of year inventory balance will always be zero. In COGS, my cost of product sold will always be exactly the same as what I sold it for. In this manner if I'm ever audited (as I was in 2007 or 8), I've got a clear paper trail showing no profit from the sale of product. Though I am not required to use COGS, I can and I do just for this reason.

Now this doesn't apply to the situation in this thread. Where I see a problem though, is say you purchase $1000 worth of material and expense it. Then the business closes for whatever reason a week later. Where's the accountability for all that unused material? It can't be claimed as a loss, unless it really was a loss. IN such a case, that would probably require some type of proof I would expect.

But I digress. It falls in line perfectly with the oxymoronic rule set. 🙂

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ALIKA027

Level 2

aschrancz

New Member

eremartin1

Level 1

fasteddie577

Level 6

CarlosZeBusDriver

New Member