- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The reasoning behind why I choose to use the exemption that allows me to treat my inventory as non-incidental materials and supplies is that I would have an extremely hard time determining my ending inventory if required to do so using the traditional COGS method. (I’m a small sewing business and have tons of work in progress and lots of raw materials that I’ve already cut up and stacks of small pieces all over my studio. If I wanted to treat my inventory as inventory in the traditional sense I would be required to physically measure all those little pieces to come up with my ending inventory, needed to figure the COGS. That would literally take weeks. It’s much easier, and more accurate, to just calculate what “non-incidental materials and supplies” I used on each item that I sold.

And yes, I definitely know that you only deduct the inventory treated as “non-incidental materials and supplies” in the year that the products are actually sold.

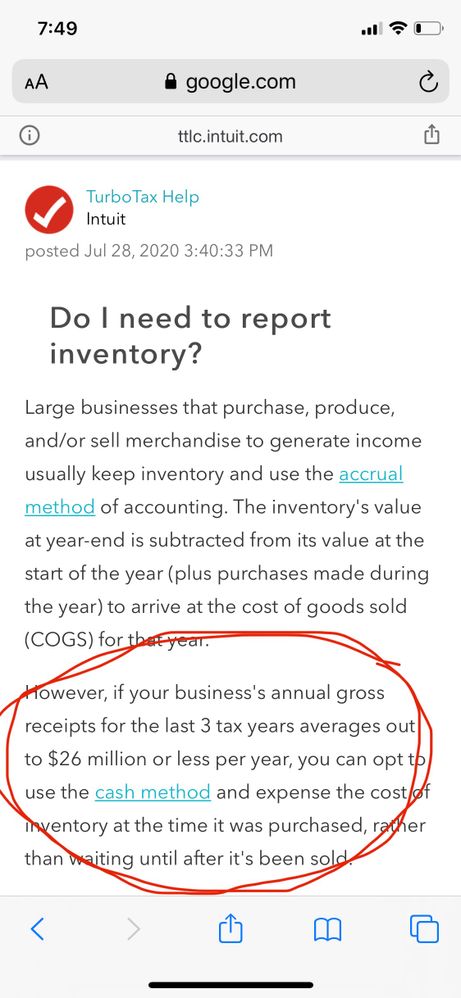

(I know some people misinterpret the rules but it’s pretty clear if you take a few minutes to read the tax code) ... on that note it kind of freaks me out that TurboTax seems to be advising people go ahead and expense inventory before use?!?! See below: