- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Thank you so much for your response (especially since we - wife and I - are getting a bit anxious to find the right answer - specifically for entering the correct information in Turbotax - after several days of scrounging through the Internet (i.e. finding needle in a haystack) after we received the K-1s on April 1 (rest of the Turbotax returns data entry was already completed by Mid-March). We really appreciate your response.

To clarify things a bit more I just talked to the GP of the partnership and they confirmed that we received two K-1s because they correspond to the two separate (but equal) amounts we have invested in the partnership (i.e. two classes of investments in the same partnership). These classes of investments differ such that for classA, the distribution percentage is higher but percentage of profit shared with investor upon sale is lower. Similarly, for ClassB investment, the percentage of distribution is less but percentage of profit upon sale of property is higher.

So let's name the K-1s that we have received from the partnership as "ClassA K-1" and "ClassB K-1" respectively. In Turbotax, we have created two K-1 entries, one for "ClassA K-1" and another for "ClassB K-1" with different distribution amounts (reported under Line 19 Code A) corresponding to the two different investment classes with the partnership.

Now, in both of the K-1 forms, the Line 20 Box Z Section 199A Information is identical. Since the partnership invested in two different properties (e.g. PropertyA and PropertyB), the section 199A information is reported under two columns as shown below (Note: Not actual amounts from the K-1 ).:

PropertyA PropertyB

QBI or Qualified PTP Items

Net rental real estate loss 1,000 -30,000

…..

…..

W-2 Wages 2,000 1,217

Qualified Property 36,200 64,251

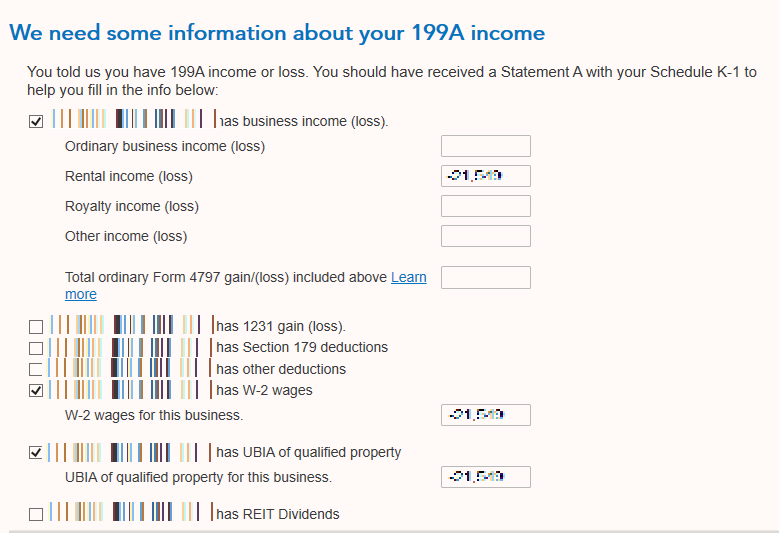

However, Turbotax only has one column for entering the amounts against “Net Rental real estate loss”, “W-2 Wages", "UBIA of Qualified Property" as can be seen in image below:

Which brings me to my question: Do we need to add the amounts in the two columns from the Schedule K-1s and enter it in the respective rows in Turbotax? If not, what is the correct way to enter the Line 20 Box Z Section 199A information from the two schedule K-1s into Turbotax?

Based on your response above, it sounds like we add the two columns and enter them for BOTH K-1 entries in Turbotax - is that correct?

Thanks again.