- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

I am using a 2018 Premier Turbotax CD for a Mac. A trust k-1 reported foreign income (and tax payments) distributed to me with respect to dividends payed to the trust by the ADR of a foreign corporation and by mutual funds that owned foreign companies.

I don't understand the term "sourced at beneficiary level" in that context. All of it was sourced at the trust and then distributed to the beneficiaries.

Does it want all to know about all income disbursed to me on the k-1, and then a breakdown of US versus Foreign income?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

The wording is confusing. I believe the exact wording on the k-1 worksheet (not the interview) is "sourced or allocated at the beneficiary level" or at "trust level."

What is going on is that some trust income (and deductions/credits for foreign taxes) stay with the trust and some go to the beneficiaries depending upon the wording of the trust itself and what was paid in a given year.

Given your facts of trust income actually distributed to you, it would all be "sourced" or "allocated" to the beneficiary.

For the foreign tax credit, what TT needs is the amount of foreign tax paid from your income (e.g. trust distributions to you) AND the amount of trust income allocated/distributed to you from US sources and from foreign sources. Then it can calculate how much of a credit you can tax.

TT needs to compute the ratio for your total (not just trust but all income) from foreign sources compared to US sources. Why? Because your credit is limited to the smaller of

(foreign income / worldwide income ) * US tax

and foreign tax paid.

This effectively means you can rarely use your whole credit unless you have a high ratio of foreign income (not likely for US residents with minor overseas investments).

Also note that for small amounts (<$600 I think) of foreign tax paid credit from mutual funds there is a simplified reporting/calculation.

Does that help? If not please ask for more clarification.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

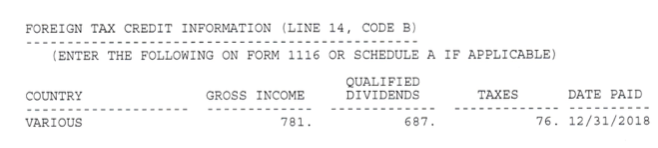

TurboTax for K-1 Box 14 has three lines: "Gross Income Sourced at Beneficiary level", "Gross Income Sourced at Beneficiary level: U.S. Source", and "Gross Income Sourced at Beneficiary level: Foreign Source". My K-1 under foreign tax credit has "country", "gross income, " "qualified dividends," "taxes." My K-1 main page (Part III) has "Ordinary Dividends" and "Qualified Dividends", nothing before and nothing after until Box 14.

I have no idea how to map the document I've got with the form TurboTax is showing me.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

This is the exact question I have but I have yet to see an answer to it.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

@Anonymous @clearviewhi sorry I missed seeing the added info.

What is going on is the TT needs to know the proportion of foreign income to US/wordwide.

So you are correct that $781 appears to be the gross foreign source include for you as a beneficiary.

Take a look at the rest of the K-1 to determine your total gross income as a beneficiary. For trusts with just investment income that is probably given in Box 14 code E (net investment income). [This might be different, I'm not sure, if the trust runs a business, rents real estate, etc. Then the numbers in box 6 and 7 might or might not be includes. I'm not sure. Let me know if you have those.]

Then by definition your gross US income sourced at the bene level is the difference (total gross - foreign gross).

Please do verify that box 14 code E sums to the total of the other income boxes. If not ask again because I might have something wrong. Note that box 2b is a subset of what is in box 2a so don't count that twice.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

Ok, this is starting to make some sense - thank you. TT is asking for Gross Income at Beneficiary level. My k-1 has income in boxes 1, 2a, and 2b. Do I add these 3 amounts up to arrive at the Gross Income at Beneficiary level? if so, then my Gross Income at US Level would be the difference of (1+2a+2b) - Foreign Source Gross income. Does that sound correct?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

Almost. Do not add in box 2b. That amount is already included in box 2a. [box 2a is total dividends, box 2b is the part of box 2 that comes from qualified dividends, so it is always <= box 2a]

Please check with box 14 code E. It should equal box 1 + 2a ... if not ask again.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

I don't have a code E in box 14.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

For box 14 I have a B code for foreign taxes. I put the total of box 1A as the sourced income at bene level, and the foreign source income from the tax credit information sheet I got. But how do I come to figure out the U.S. income? is it the gross bene plus the foreign income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

For the gross income sourced at a beneficiary level, add together all the income listed on the K-1. Do not include box 2b (qualified dividends), since it is included in box 2a (ordinary dividends).

The gross income includes the foreign income, so don't add that in again.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

Does TT use the "Gross Income Sourced at Beneficiary Level" and/or "Gross Income Sourced at Beneficiary Level: U.S. Source Income" if married filing jointly and we both have foreign source income (passive category)?

From the Form 1116 that's generated (only 1 form is generated, I assume since both are sourced from the same foreign income category), I can see it's using our (roughly) combined adjusted gross income amount for line 3e on Form 1116. I'm mostly interested in how TT will incorporate the 2 values noted above for a single K-1 into the combined Form 1116 when married filing jointly?

For example, I can see where the "Gross Income Sourced at Beneficiary Level: Foreign Source Income" number is being combined with foreign source income that's reported on our 1099-DIV/B statements and entered into Line 1a on Form 1116, but I would like to know more specifically how the other 2 values are being incorporated into the return; are one or both part of the combined value that gets entered into Line 3e on Form 1116?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

This is not easy stuff. Good questions.

@pakman04 wrote:

Does TT use the "Gross Income Sourced at Beneficiary Level" and/or "Gross Income Sourced at Beneficiary Level: U.S. Source Income" if married filing jointly and we both have foreign source income (passive category)?

The first thing is that, as you deduced, the 1116s are not per spouse but per return. You may have more than one 1116 if you have different categories of foreign income and/or different countries.

From the Form 1116 that's generated (only 1 form is generated, I assume since both are sourced from the same foreign income category), I can see it's using our (roughly) combined adjusted gross income amount for line 3e on Form 1116. I'm mostly interested in how TT will incorporate the 2 values noted above for a single K-1 into the combined Form 1116 when married filing jointly?

For example, I can see where the "Gross Income Sourced at Beneficiary Level: Foreign Source Income" number is being combined with foreign source income that's reported on our 1099-DIV/B statements and entered into Line 1a on Form 1116, but I would like to know more specifically how the other 2 values are being incorporated into the return; are one or both part of the combined value that gets entered into Line 3e on Form 1116?

1116, line 3e is your wordwide gross income. It is quite a complicated calculation. I think that what's going on is there is no single line on a 1040 that captures total gross income. All the elements are added up while subtracting the above the line deductions when calculating adjusted-gross income (AGI). So it needs to be a separate calc. (See below). (Or if using desktop TT right click on line 3e and choose "data source.")

It will include the Total K-1 Trust income sourced at the beneficiary level. (That itself is the sum of US and Foreign income sourced to a bene.)

The reason this is done is because line 3f is the ratio of foreign income to worldwide gross income. This is used in line 3g to calculate the proportion certain deductions that are proportional to the foreign income. the 3g deduction gets added certain other deductions in line 4, 5 and you get a sum of deductions relevant to the foreign income. That is subtracted from the foreign income and entered on line 7, carried down to line 15.

The important thing is that line 15 (foreign income minus certain deductions) divided by your taxable (not gross) US income is computed and entered on line 19. That is the ratio of your foreign income to you US taxable income.

Say you had $300 of foreign tax on $1k of foreign income and $100k of US taxable income at that point. The ratio of foreign income to US taxable is 1% and entered on 1116 line 19.

That % is then applied to your US tax (line 20, 1116). Say you owed $20k US tax. $20k times 1% = $200. Your foreign tax credit against US Tax is $200 even though you paid $300 in foreign tax. You get to carry forward the unused $100 in case you can use it in the future (but my experience says that rarely happens if this is just minor investments).

Things might be simpler if you can use the simplified foreign tax credit, but you can only do that for investment income and only if the tax is < $300 ($600 MFJ). And my head hurts to much from all this to look into it further.

FYI 1116 line 3e calc from the TT "data source" help:

Form 1116 (COPY 1) : Line 3ea

Calculated Gross income from all sources:

This is total income before deductions and is the sum of:

Form 1040, line 1 plus

Form 1040, line 2b plus

Form 1040, line 3b plus

Schedule 1 (Form 1040), line 1 plus

Schedule 1 (Form 1040), line 2a plus

Schedule C, line 7 (all copies) plus

All gains reported on Schedule D minus Schedule D, line 11, Subtotal Line A(Form 4797, Gain from Part I) plus

All gains reported on Form 4797 plus

Form 1040, line 4b plus

Schedule E, line 3 total plus line 4 total plus

Schedule K-1 Worksheet - Partnerships Box 16, Code B (if it has a value); otherwise income reported on line 1, 2, OR 3 plus any amount on line 4 plus

Schedule K-1 - Partnership Additional Information page 1, Box 11 section,Code A, line 1 (if positive) and line 3 and line 4 and Code I, line 5

Schedule K-1 Worksheet - S Corporations Box 14, Code B (if it has a value); otherwise income reported on line 1, 2 or 3 plus

Schedule K-1 - S Corporation Additional Information page 1, Box 10 section, Code A, line 1 (if positive) and line 3 and line 4 and Code H, line 5

Schedule K-1 Worksheet - Estates and Trusts, Box 14 Code B : Foreign Tax Information section, line 7 (if it has a value); otherwise income reported in Part III lines 5, 6, 7 and 8 plus

Schedule F, line 11 (all copies) plus

Form 4835, line 7 ( all copies) plus

Schedule 1 (Form 1040), line 7 plus

Form 1040, line 5b plus

All positive income amounts on the Other Income Statement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

Very helpful, thanks! Yeah foreign tax credit is the thing that always throws me off every year it seems like. =( It seems simple enough at first and then I'm down the rabbit hole trying to cross-reference my raw data against TT's interview questions.

> Schedule K-1 Worksheet - Estates and Trusts, Box 14 Code B : Foreign Tax Information section, line 7 (if it has a value); otherwise income reported in Part III lines 5, 6, 7 and 8 plus

I'm using TT Online, but I assume line 7 in the Desktop platform correlates to "Gross Income Sourced at Beneficiary Level: Foreign Source Income" ?

Do "Part III lines 5, 6, 7 and 8" above also correlate to information taken from the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

Here's an image of the K-1 (Trust) Box 14, Code B section from the desktop. You might be able to see the same thing if you get a PDF of your return (with all worksheets/calculations).

In my test I entered $5k in K-1 box 2a (ordinary dividends) and $118 in Box 14, Code B. I also entered the numbers on line 5 (total/us source/foreign sourced to bene). I typed into the forms not the interview, which is not a great idea but faster for these test cases.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "gross income sourced at beneficiary level" mean when TT is asking for details about foreign income reported in box 14 of a trust k-1?

@jtax Thanks, but I don't see an image?

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

flyday2022

Level 2

tbduvall

Level 4

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

trust812

Level 4

pchicke

Returning Member

heueh9456

New Member