- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- What category does TT on Box 14 fall under?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What category does TT on Box 14 fall under?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What category does TT on Box 14 fall under?

TT equals Tax on Tips? It does not have a box 14 description since it is not supposed to be entered in box 14. Use Other for the description.

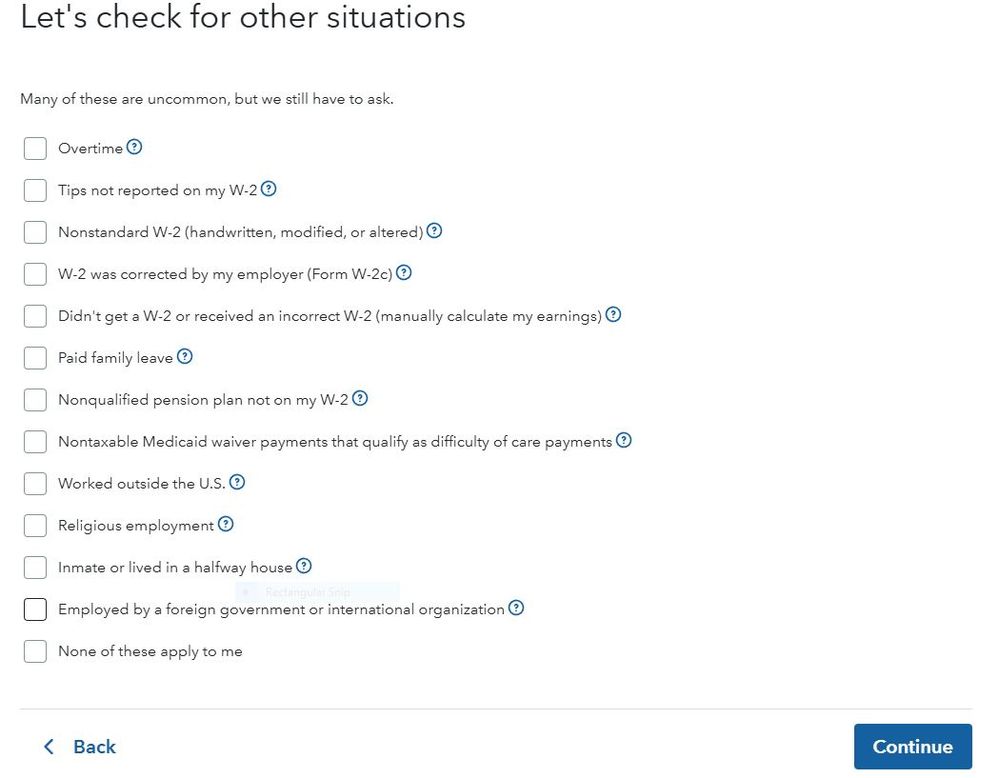

After you complete the W-2 the following screen is where you start the interview for the tax on Tips by checking the box Tips not reported on my W-2 and then Continue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What category does TT on Box 14 fall under?

My GUESS is that means the amount of qualified overtime. Next year, the 2026 W-2s will have Box 12 with code "TT".

Check your last pay stub to see if the "TT" amount is reasonable close to the extra "half" amount (the 50% extra for overtime, not the base pay) of overtime that you were paid (only count overtime paid for over 40 hours, not overtime for other reasons). If it is reasonable close, that is probably what it means.

*IF* that is what it means, for Box 14 just select "other". But then be sure to answer the questions about overtime.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

troy9173

New Member

helenmetzger

New Member

jennifergalla

New Member

kw7271

Level 1

rebecca-a-gelb

Level 2