- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

Yes, with a capital lease the lessee depreciates the property and deducts the interest payments. If the lessee pays the property tax then the lessee would deduct those also. The lessor would report ordinary income equal to the difference between the lease proceeds and the cost of the property. The portion of the lease proceeds that represents interest would be reported as interest income. Any interest on a loan the lessor has on the property would be deducted by the lessor as interest expense.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

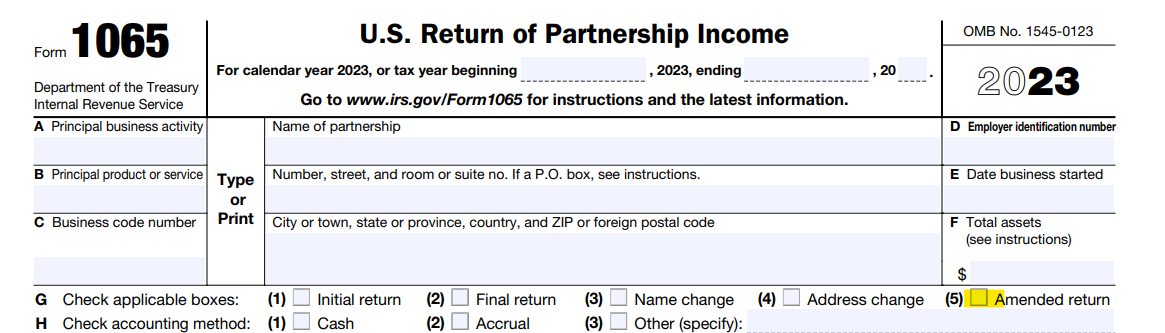

To prepare an amended Form 1065, you would complete a new return with the correct information and entries, check the "Amended return" box on the top of page 1 and mail it along with a copy of the original return to the address listed in the instructions to Form 1065: Form 1065 instructions

Since you are cancelling the return, your amended return will show no dollar entries so attach a note stating why you are amending it.

You will see an option to amend your personal tax return, by completing Form 1040-X, on your home page when you log into TurboTax. Look at the bottom of the page, under Your Tax Return and Documents. Click on the year you want to amend and choose the Amend (Change) option.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

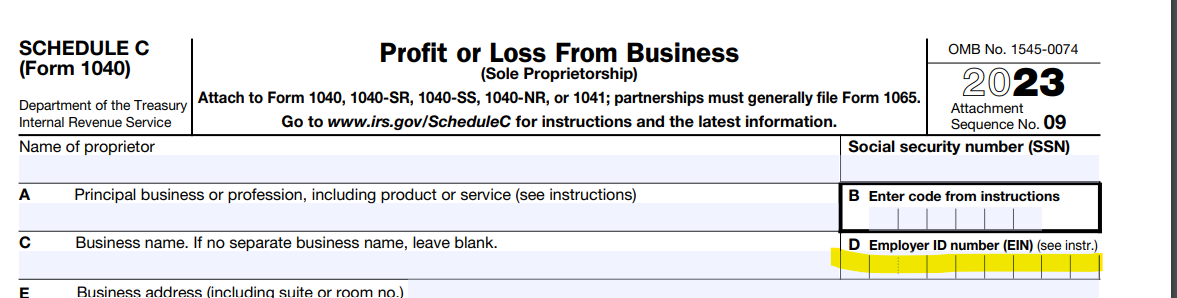

You need to amend the Form 1065 as it included two K-1 forms assigning income to each of you. When you complete the amended Form 1040, you will report that income as self-employment income on schedule C's. If you don't amend the Form 1065 to remove the K-1 income reported, the IRS will see the schedule C income and add to it the K-1 income, doubling your income reported.

For a husband and wife partnership treated as a disregarded entity, there is no partnership return filed. You each report your share of the partnership income and expenses on your respective schedule C's. You enter the partnership ID number in box D on the the top of the form. Your net income on each schedule is treated as self-employment income for each of you on which self-employment (social security) tax is assessed. There are no "wages" as such, just self-employment income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

...

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Wyldaisy

Level 3

mstsuzanne

New Member

lmaldonado595

New Member

Listonash

New Member

Couchdon

New Member