- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

You need to amend the Form 1065 as it included two K-1 forms assigning income to each of you. When you complete the amended Form 1040, you will report that income as self-employment income on schedule C's. If you don't amend the Form 1065 to remove the K-1 income reported, the IRS will see the schedule C income and add to it the K-1 income, doubling your income reported.

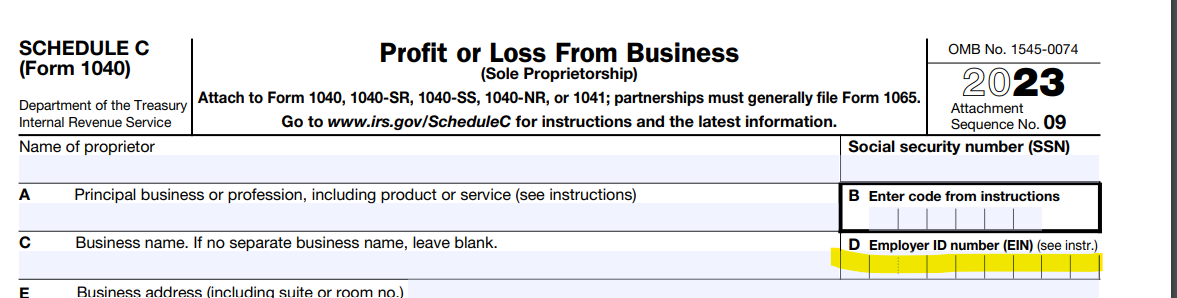

For a husband and wife partnership treated as a disregarded entity, there is no partnership return filed. You each report your share of the partnership income and expenses on your respective schedule C's. You enter the partnership ID number in box D on the the top of the form. Your net income on each schedule is treated as self-employment income for each of you on which self-employment (social security) tax is assessed. There are no "wages" as such, just self-employment income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"