- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Solo401K. Is the employee deferral and the catch-up additive. do I enter $25000 for elective employee deferral or do I enter 19000? Software question not tax law

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo401K. Is the employee deferral and the catch-up additive. do I enter $25000 for elective employee deferral or do I enter 19000? Software question not tax law

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo401K. Is the employee deferral and the catch-up additive. do I enter $25000 for elective employee deferral or do I enter 19000? Software question not tax law

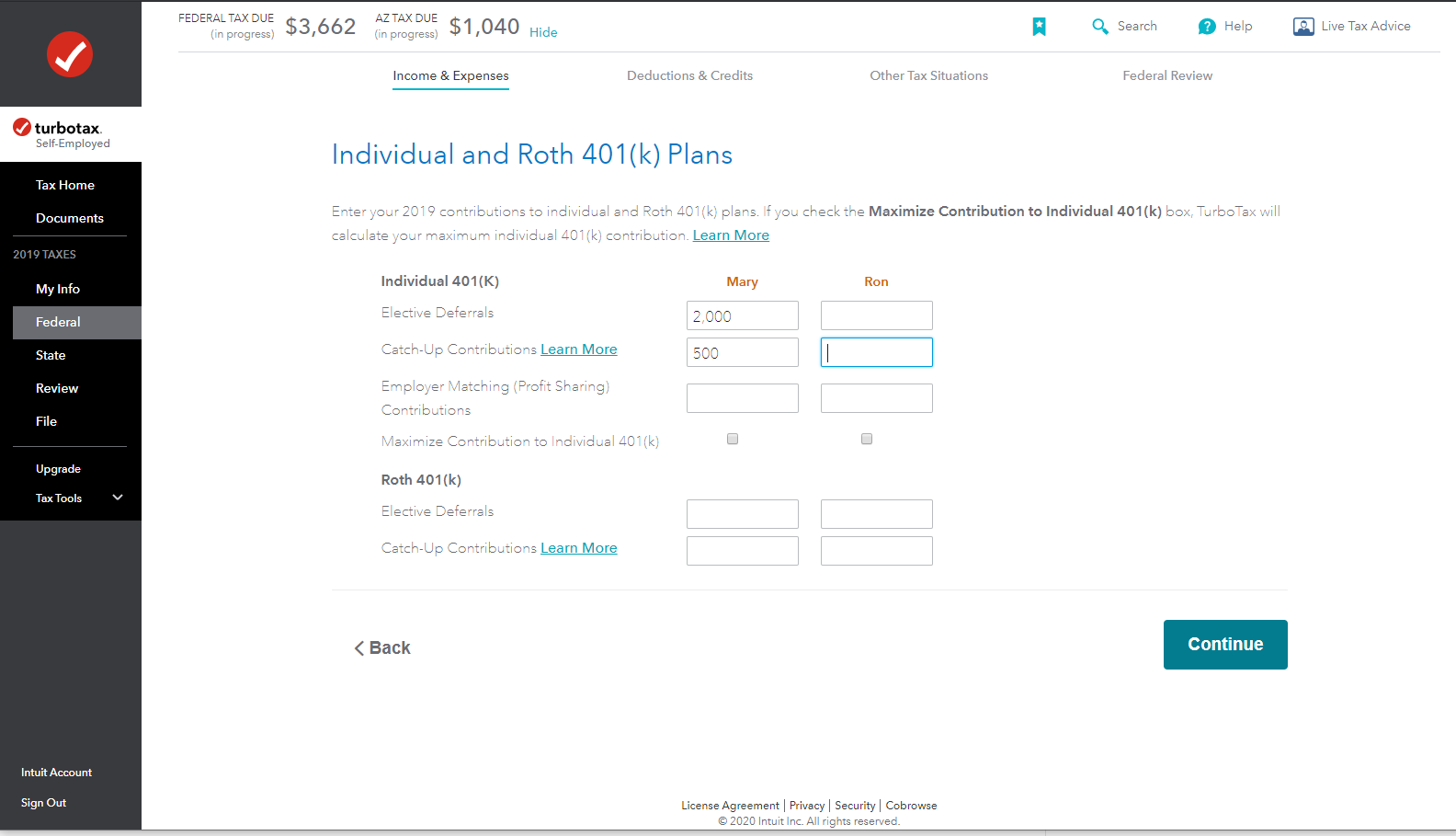

Enter Elective Deferrals as $19,000 and Catch-Up Contributions of $6,000 separately.

Type 'Solo 401K' in the Search area, then click on 'Jump to solo 401k'.

Continue to screen for Individual and Roth 401(k) plans (screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Solo401K. Is the employee deferral and the catch-up additive. do I enter $25000 for elective employee deferral or do I enter 19000? Software question not tax law

Enter Elective Deferrals as $19,000 and Catch-Up Contributions of $6,000 separately.

Type 'Solo 401K' in the Search area, then click on 'Jump to solo 401k'.

Continue to screen for Individual and Roth 401(k) plans (screenshot).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Once a year Accountant

Level 3

VAer

Level 4

tbduvall

Level 4

SB2013

Level 2

SkymanCR

New Member