- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Sold Rental property - How to handle remaining depreciation on Roof

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Rental property - How to handle remaining depreciation on Roof

Hi

I'm using Turbotax Business. My LLC sold a rental property at a profit, but not sure how to handle the remaining depreciation on the roof which is a separate asset in Turbotax from the main property since I replaced the roof a few years back.

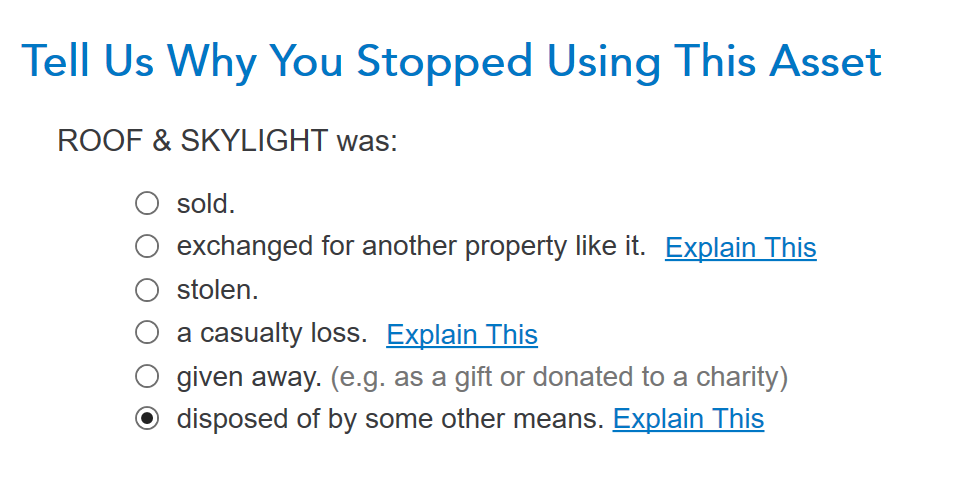

Do I select "sold" or "disposed of by some other means? If I should select "sold", how do I put a value of what it was sold at from the overall selling price of the house and what do I do with the depreciation that was taken already and what about the remaining depreciation? If I should select "disposed of by some other means, and no value is tied to it, what should I do about the depreciation that was already taken and the remaining depreciation that's left?

Thanks

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Rental property - How to handle remaining depreciation on Roof

The way I suggest you handle this is to allocate the sales price amongst all the assets related to the house. For example, Lets say the sales proceeds were $206,000, the cost basis of the house was $100,000 and the cost basis of the land was $50,000, you would allocate the proceeds as follows:

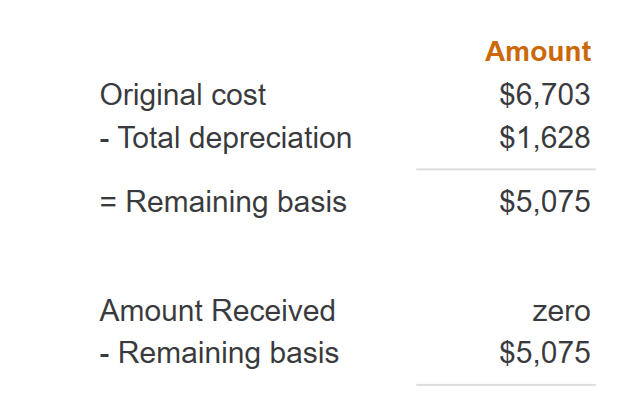

Roof & Skylight - $5,075

Land - $50,000

Building - $150,925

This will result in no gain on the disposition of the Roof or the land, and all the gain would be on the building. You could also allocate the proceeds on a pro-rata basis, but the total gain will be the same.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Rental property - How to handle remaining depreciation on Roof

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tshorty

Level 1

Jeff-W

New Member

mbin

New Member

s d l

Level 2

bradnasis

New Member