- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Sold Rental property - How to handle remaining depreciation on Roof

Hi

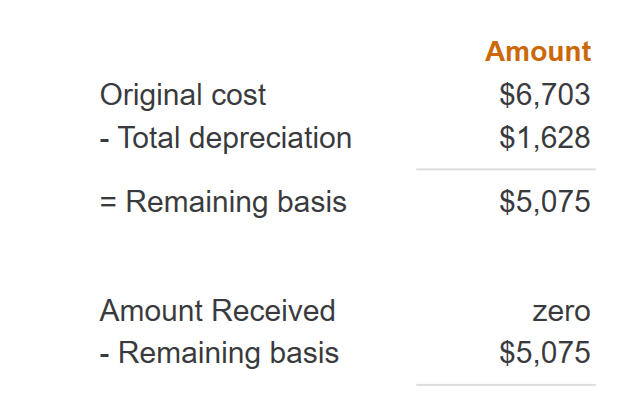

I'm using Turbotax Business. My LLC sold a rental property at a profit, but not sure how to handle the remaining depreciation on the roof which is a separate asset in Turbotax from the main property since I replaced the roof a few years back.

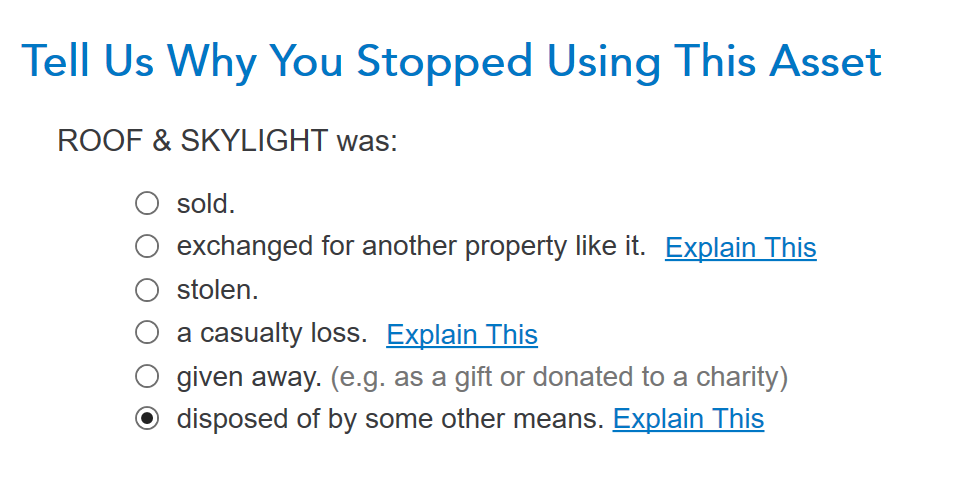

Do I select "sold" or "disposed of by some other means? If I should select "sold", how do I put a value of what it was sold at from the overall selling price of the house and what do I do with the depreciation that was taken already and what about the remaining depreciation? If I should select "disposed of by some other means, and no value is tied to it, what should I do about the depreciation that was already taken and the remaining depreciation that's left?

Thanks

Topics:

February 2, 2021

7:10 PM