- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- S-Corp Health Insurance: Report on 1120S?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp Health Insurance: Report on 1120S?

I'm the sole member of an LLC filing as S-Corp. I have my business pay for my health insurance premiums and I report it in my W-2 wages.

Do I report it as a self-employed health insurance deduction on my 1040?

Do I report it as an employee benefit plan or anything on my 1120S?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp Health Insurance: Report on 1120S?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp Health Insurance: Report on 1120S?

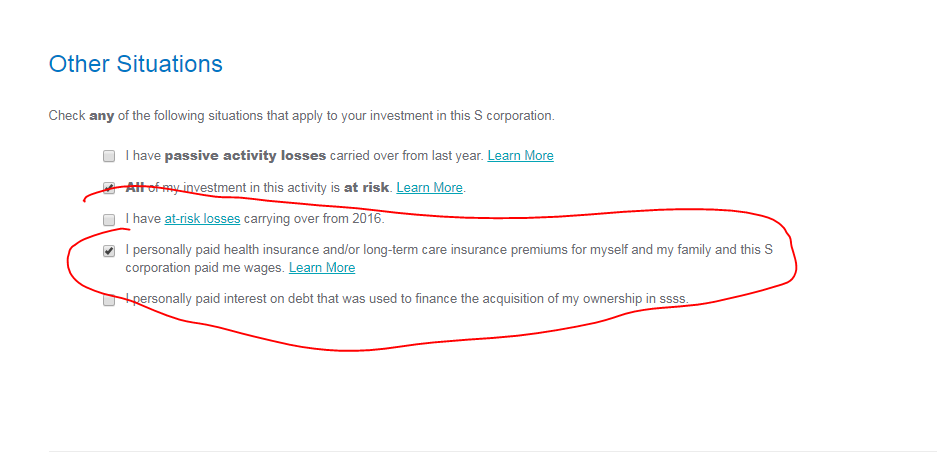

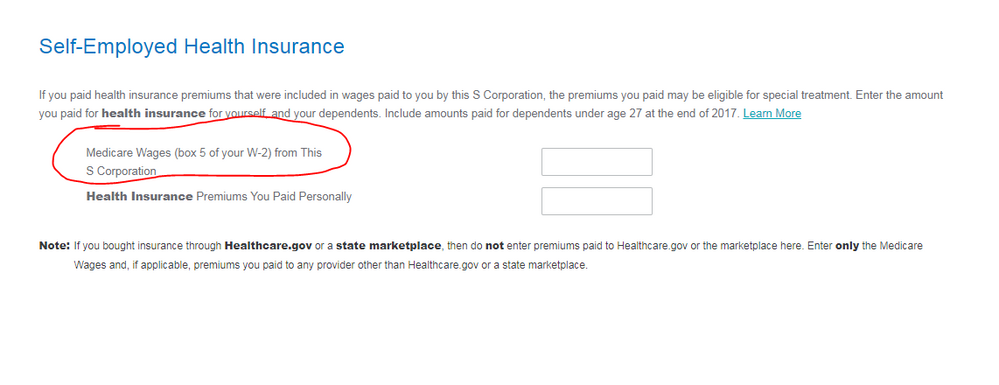

In the K-1 entry section look for these screens ....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp Health Insurance: Report on 1120S?

in practice on the S-corp return, i've included the Health insurance on the same line as wages for the officer. as per the instructions for line 18.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

S-Corp Health Insurance: Report on 1120S?

Ok ... those are as different as apples and oranges. The insurance paid by the corp on your behalf will be included in the box 1 amount on the W-2 that is issued to you and sent to the SS administration. NOW for the insurance deduction on the form 1040 you must indicate how much of the box 1 amount was the insurance premiums and by entering it in the K-1 section.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

donnapb75

New Member

feliciameowhiggins

New Member

amy

New Member

pchicke

Returning Member

xiaochong2dai

Level 2