- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Reporting 1099-G Box 6 income for an LLC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

Our business, a multi-partner LLC, received two $10K grants during 2020 to help stave off financial effects of the pandemic. We received a 1099G from each entity but I don't know where to enter that income in TT.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

Look at your 1099-G in box 6. If there is an amount in box 6, then that amount is taxable.

To enter the taxable grant into TurboTax

- Federal

- Wages and Income

- Other Common Income

- Other 1099-G Income

- Yes, I received a 1099-G for government payments

- Continue and enter your 1099-G information.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

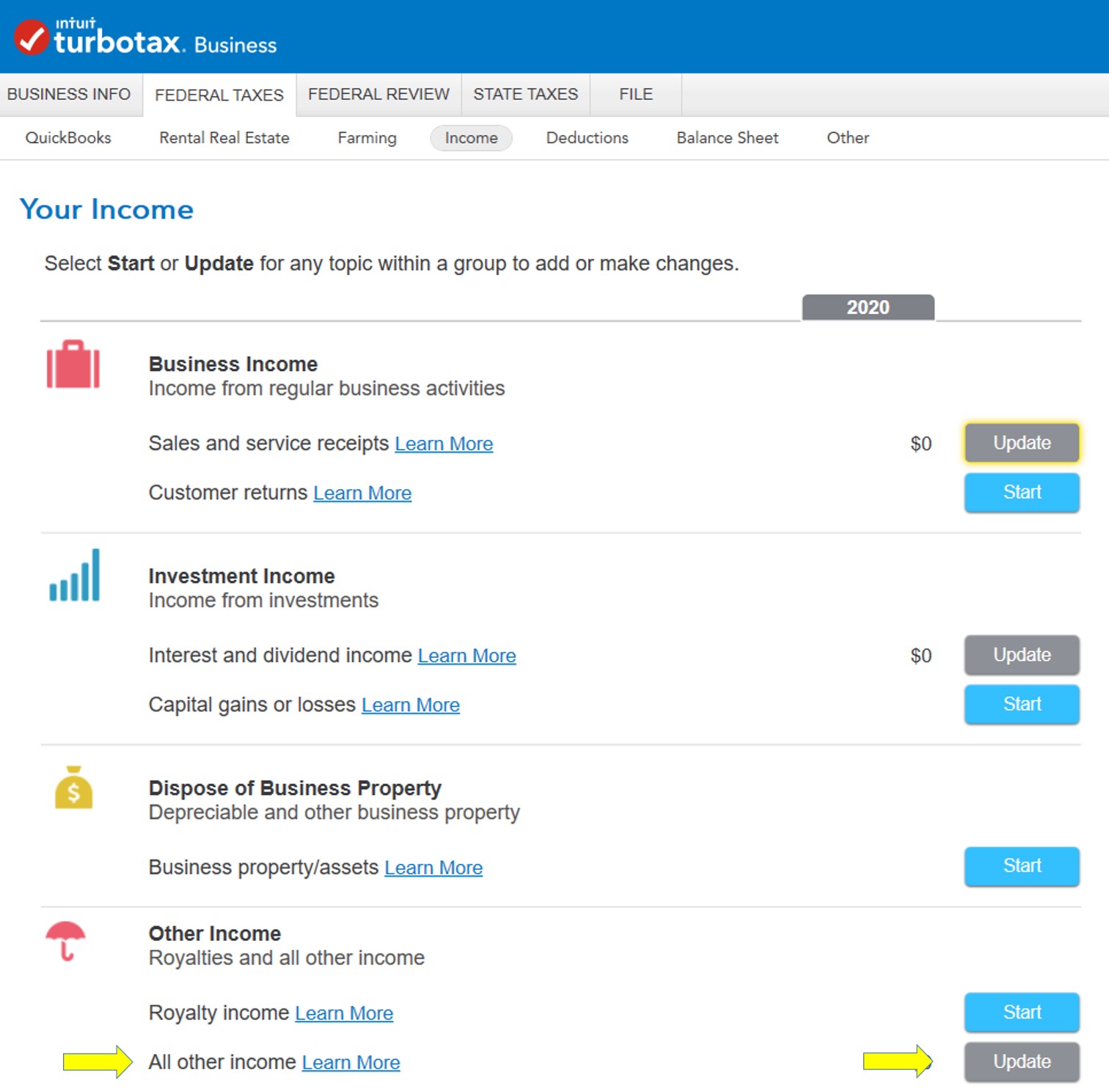

I have a similar 1099-G for a $2500 grant - box 6 taxable income. It was paid to my business using the EIN tax payer ID, not my SSN. Using TurboTax Business, where can I enter a 1099-G ?

The only place I see on the Federal income page is the "Other Income" / "All Other Income" - but this does not mention putting a 1099 there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

Yes, you can enter your 1099-G paid to your business there.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

THANK YOU

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Reporting 1099-G Box 6 income for an LLC

My LLC received a 1099-G for income we did not receive. The business is also now closed. How do I dispute this if I am not filing taxes? The business was closed. We did not receive any monies

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

bravehomesnc

New Member

CShell85

Level 1

pdon-musicfan

New Member

Rockpowwer

Level 2

ynong0222

Level 1