- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Received 1099 with personal name instead of business name (S-Corp). How do I correct this?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099 with personal name instead of business name (S-Corp). How do I correct this?

Hello:

I received a payment from Amazon that should have gone to my LLC, but it went to me on a 1099-MISC as Royalties and the form has my name and Social Security number. I already filed my LLC tax forms but I included the income on the 1099-MISC I received in anticipation -- from what I have read -- that is where it belongs.

I followed the instructions on my personal filing -- which I have yet to submit -- saying "LLC Income from (payer's EIN)" with the stated amount and then added the other entry saying "Nominee Income to (LL's EIN)" under Turbotax's Less Common Income tab under Miscellaneous Income, 1099-A, 1099-C line item.

I am hoping that is OK. If not please let me know, but the other thing is... Do I need to add the 1099-MISC itself as an entry at all? How can the IRS track an Amazon payment to a company with any certainty? It seems like something is missing.

The LLC generated K1s to me that I am also including in my personal return.

Thanks so much for your time and attention. I hope you can help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099 with personal name instead of business name (S-Corp). How do I correct this?

I forgot to mention that it is a multi-member LLC with 2 partners.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099 with personal name instead of business name (S-Corp). How do I correct this?

If you reported the 1099-MISC information as income on your partnership tax return you should not report it on your personal return. The 1099-MISC is an informational return and is not required to be reported in detail on a tax return. The income must be reported and you have reported it appropriately. Your K-1 from the business already reports your share of that income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099 with personal name instead of business name (S-Corp). How do I correct this?

Hello

I received a 1099-K under my name and SSN instead of my LLC business's EIN. From what I read in these posts, I would have to report the 1099-K in my 1040 in Schedule C, and in the expenses, enter the 1099-K amount as a negative number along with the message (Nominee income to EIN XX-XXXXXXX).

I would then report the 1099-K in the LLC's tax returns. Is this correct? I see some experts mention NOT to enter it in the personal return while some say to enter it and then take it right back out as a negative number without tax consequence.

Can you please let me know how this should be done? I would really appreciate your response and clarification.

Thank you so much!

Christian

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Received 1099 with personal name instead of business name (S-Corp). How do I correct this?

You could enter the income and indicate that it is Other Income as opposed to Self-employment income. Then, make a negative adjustment to Other Income by following these steps:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Find Less Common Income in the list of income sources

- Use the Show More option to expand the choices and choose Miscellaneous Income, 1099-A, 1099-C

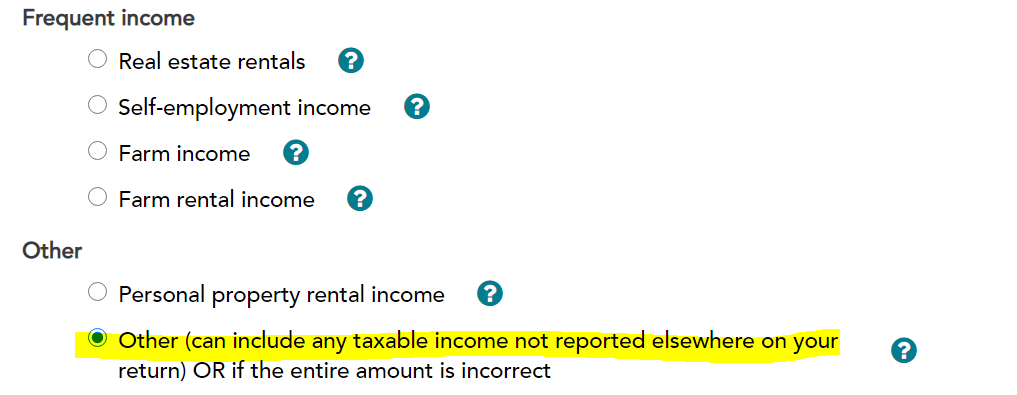

- Choose the Other Reportable Income option and find Other Taxable Income in that section

- Enter a description for your adjustment and the amount as a negative number

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

exintrovert

New Member

pivotresidential

New Member

ilenearg

Level 2

Newby1116

Returning Member

jstan78

New Member