- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

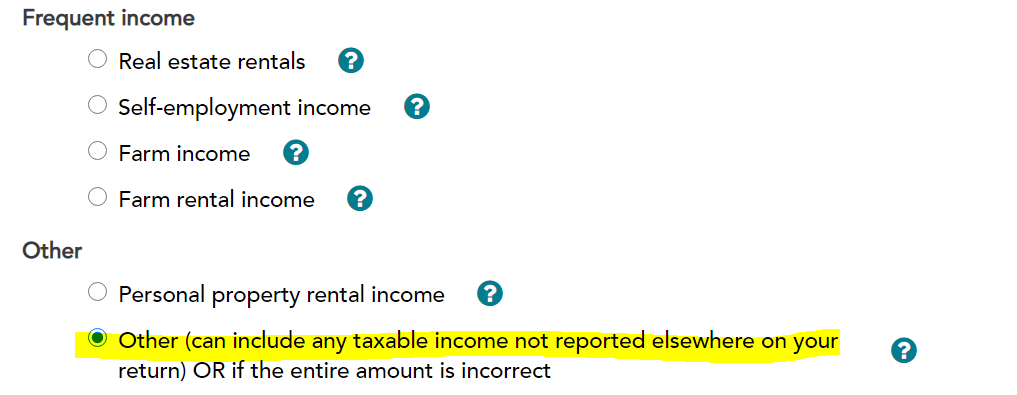

You could enter the income and indicate that it is Other Income as opposed to Self-employment income. Then, make a negative adjustment to Other Income by following these steps:

- Choose the Federal option on your left menu bar

- Choose Wages & Income

- Find Less Common Income in the list of income sources

- Use the Show More option to expand the choices and choose Miscellaneous Income, 1099-A, 1099-C

- Choose the Other Reportable Income option and find Other Taxable Income in that section

- Enter a description for your adjustment and the amount as a negative number

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 10, 2023

5:50 AM