- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

I run a LLC partnership with 2 others. It's our first year. We mine Ethereum (cryptocurrency). I use Koinly to help track all of our transactions (payouts from pool and what they were worth the day we received them). and gives a sheet 8949 that reports that income. However, where do I report this income in Turbo Tax Business edition? It doesn't specifically have a cryptocurrency income section. Would it go under other income? We did not sell most of the Ethereum we mined this year (we have sold some, but we put those proceeds back into business and to pay business expenses) and I am reporting that as short term capital gains. Just want to figure out how to report the mining income / where is the appropriate location to report it.

Thank you.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

If you're mining crypto then that's your trade or business and you're going to report that as ordinary income subject to self employment tax with an LLC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

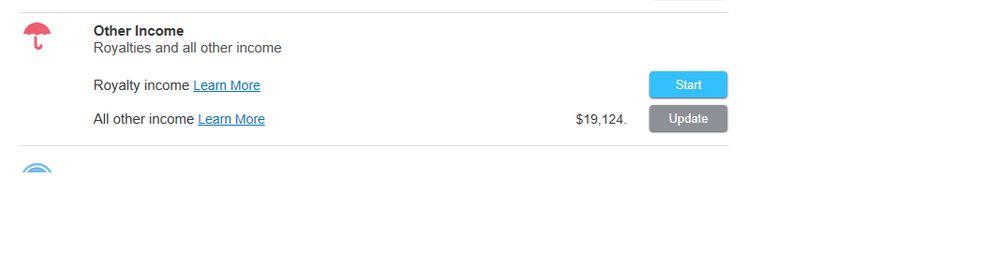

In the business edition, there is no specific spot, so I currently have it under other income and listed it. Let me know if this looks correct.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

Not familiar with TTBiz BUT I don't think it goes there because it's NOT Other Income but income that's subject to self employment taxes. There should be another place where you enter BUSINESS income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

If you are filing a form 1065 for the partnership then the sales are entered just like stock sales ... " gives a sheet 8949 that reports that income" the broker even gave you the required info to enter in the same manner as the IRS form 8949.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

Critter-3 -

Mining of crypto is not selling crypto and does not go on 8949. When they sell the crypto is when it goes on that form.

ABP_Mining_Investments -

You need to tag the deposits as a Deposit then Mining which should remove it from the 8949. If it isn't removed, then Koinly is doing it wrong. It should show up as Income on their reports.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Where to Report LLC Cryptocurrency mining income (turbotax business edition desktop)?

I agree with @Ataim in that mining for crypto is ordinary income, and depending on the specific facts, will either be hobby income or business income subject to SE tax.

Also keep in mind the date of replies, as tax law changes.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

loreyann

New Member

smiklakhani

Level 2

RichInPitt

Level 3

rhett-hartsfield1

New Member

rafaxxxxxxlol

New Member