- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: What figure to enter from K-1 line 20 code Z stmt? Check entry error.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Hi David!

Thank you. This is all for the same entity, not a passthrough.

Some of the amounts in the 199a Information list are already listed above:

These are listed above:

Ordinary Income (already listed in box 1)

Section 179 Deduction (already listed in box 12)

Self-Employment Earnings (already listed in box 14-A)

The following two were not listed in the above and are new to the statement.

W-2 Wages

Unadjusted Basis of Assets

I was just not sure where to list the Self-Employment earnings for the statement portion.

Thanks,

Peter

Thanks!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

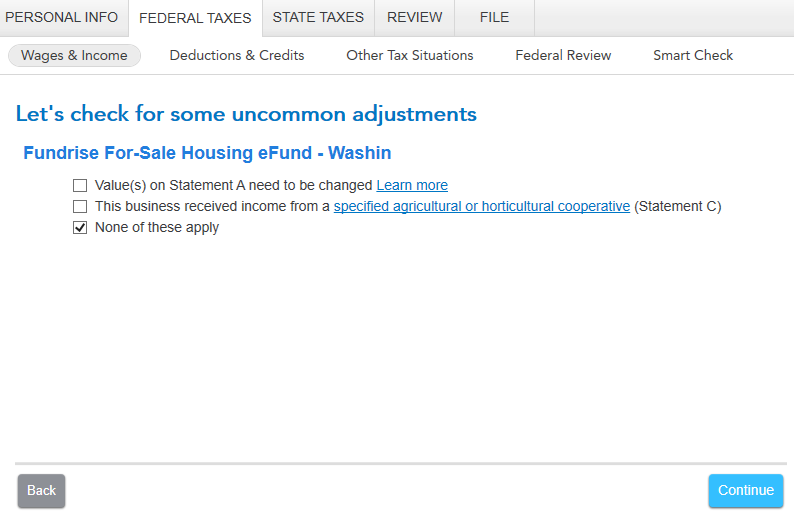

In your situation, TurboTax will pick up what it needs from your box 14 entry for self-employment income. You won't need to enter it on those "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens.

You will need to enter the W-2 wages and Unadjusted Basis of Assets ("UBIA") on those two screens. These amounts don't have a corresponding "box" on the K-1; you only get those amounts reported to you on that Section 199A Statement that comes when you have a box 20 code Z on your K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Excellent!!!

Thank you very much!!!!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Thanks David for the detailed explanation. I followed your instructions (even deleted and created new forms), but I still get the error. I have 3 Schedule K-1's ... 2 of them don't have values for lines 1 - 3 (so I specified "Other" for them in TT). The other K-1 schedule has a value for line 2. The 2 forms that TT indicated need review are the first 2 ("Others" in TT). Could it be the way TT interpreted the 2 "Others" forms differently (all 3 have value for Line 20 code Z).

Hope you (or anyone) can help!

thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

More information may help resolve your issue. For example, did you receive three separate K-1s from three different partnerships; do any of those K-1s report more than one entity on the box 20 code Z Section 199A Statement; and, for the K-1s that don't have box 1, 2, or 3 income, what boxes do have amounts and what Section 199A income is reported?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

The 3 K-1s are from the same "company" (Fundrise) but they are for 3 different "funds". Each has their own EIN. Does that mean 3 different partnerships? These are real estate funds and each cover different geographical regions in the US.

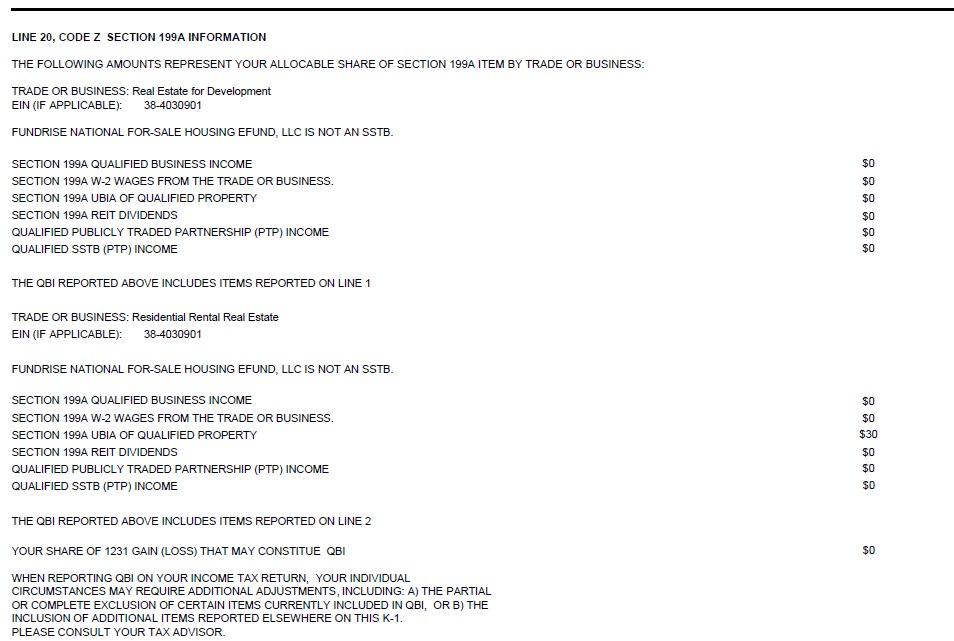

I'm not sure what you meant by "entity" but in the Box 20 STMT area, there are 2 sections with different "TRADE OR BUSINESS' names, but they share the same EIN (this is the same EIN as in Box A of the schedule: Real Estate for Development and Residential Rental Real Estate. However, only the latter one has the for "UBIA OF QUALIFIED PROPERTY". This is the value I entered during the interview portion for Box 20 code Z.

The K-1 that does not have the error (and has box 2 income), the Box 20 STMT section has some information about "aggregating group" for 2 different businesses from the previous year. It also has Box 20 code Z value.

For the 2 K-1s that don't have box 1, 2, 3 income, none of the boxes has amount (in section III) except for box 20. And for Box 20, there are values for codes V, Z and one has value for code AA. (As mentioned above, the code Z section has 2 "TRADE OR BUSINESS" sections).

I hope that helps explain my situation better. Please let me know if it's not or if you need further info.

Again, thank you so much for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

You have three different K-1s to enter. After you enter one, you'll get back to the summary screen where you add another. Match the entries on the actual K-1 to the boxes in TurboTax.

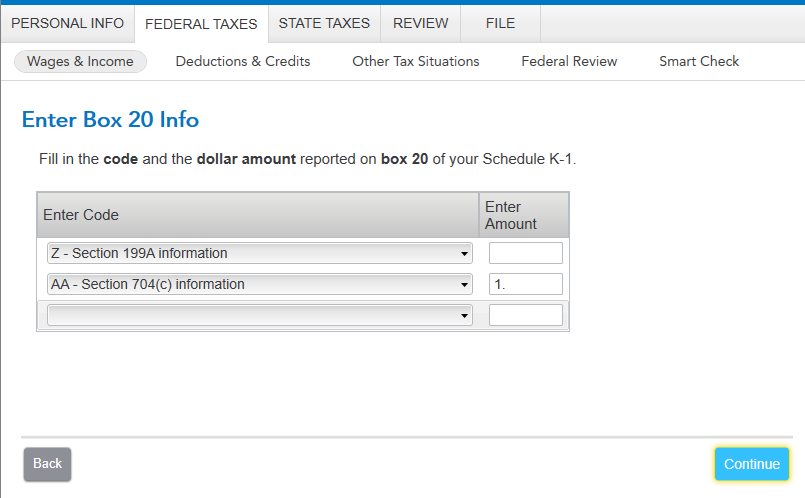

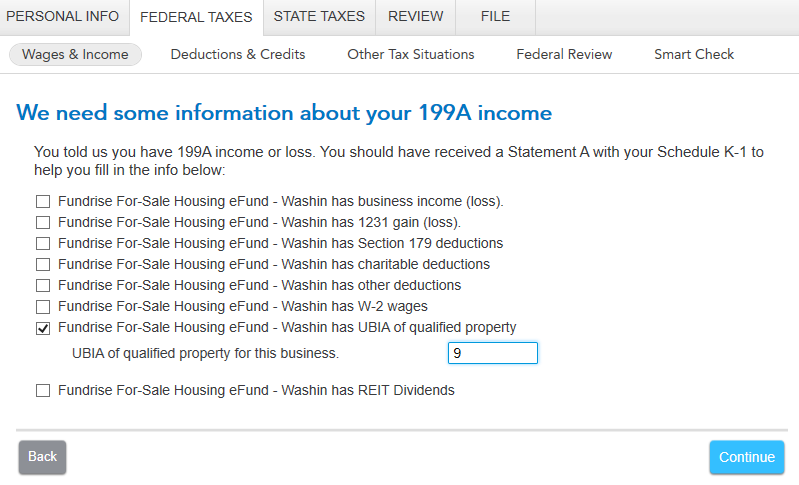

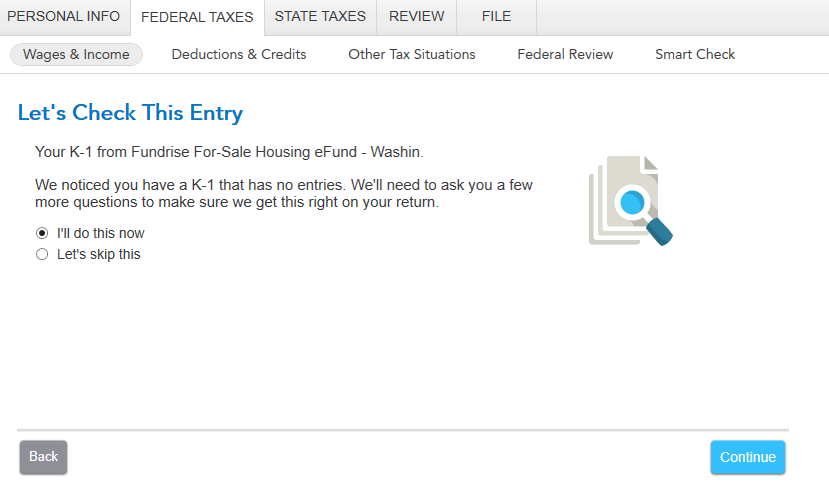

For each of these K-1s, enter your code Z on the "box 20 screen". You don't need to enter an amount on that box 20 screen, but you do need to click Continue after you have entered the code Z. The next screen is "Describe the Partnership" and the next screen is "We see you have Section 199A income" and then you should get "We need some information about your 199A income", followed by "Let's check for some uncommon adjustments". When you get to those last two screens, and check the box on a line that corresponds with a line on your Section 199A Statement, other boxes will "open up" to enter the amounts from your Section 199A Statement/STMT.

Note that Unadjusted Basis of Assets amount goes on the "....has UBIA of qualified property" line.

To get back to the K-1 summary screen and find the Schedule K-1 to edit, click the "magnifying glass Search" icon on the top row, enter "k-1" in the search window and press return or enter, and then click on the "Jump to k-1" link to find the K-1 you need to edit.

Here are screenshots of the "We need some information about your 199A income or loss" and "Let's check for some uncommon adjustments" screens where you enter the information from your K-1 Section 199A Statement/STMT:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Hi David,

Thank you for your continued help with my issues with the schedule K-1. I followed your steps but I'm still getting the same result with TurboTax (I ended up using the Windows Desktop version and it has the same result).

It seems straightforward but I'm not sure what's missing or what I'm doing wrong. I'm attaching screenshots of the screens from TT to show you what I have and the selections I made (and values entered). For the purpose of finding out what's going on, I added 2 schedule K-1s: One that did not have the issue (it's the one that has box 2 income) and one that resulted in verification error (it does not have box 1, 2, 3 income). The screenshots below are for the 2nd K-1. I also attached the STMT section of the K-1 where I got the 199A code Z values.

I have tried different ways of entering the data but with same result. I hope you can spot what or where I did wrong. This is the only thing that prevents me from filing my tax this year (I had to file an extension).

Thank you!

Thuong

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

Hi tmn140. I see on your partnership statement, the UBIA (Unadjusted Basis Immediately after Acquisition) was $30, but you entered $9. This is one obvious error. Also, we don't see a screenprint of the so-called error the review generated. Do you have multiple K1s, or just one? Do you have any blank K1s or additional unfinished K1s floating around in your return? If you have only 1 K1 and continue to get this error, there may be some junk data floating around in your tax return. Delete your K1 (or all K1s) and re-enter. It doesn't take long. If you have multiple K1s from different businesses (or multiple K1s for the same business), delete them all, and re-enter. Lastly, create a new return and re-enter all of your data. Somehow, you've managed to trash out your return. If you can't manage this on your own or with calls to TurboTax, you will need to hire a professional tax preparer.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

What figure to enter from K-1 line 20 code Z stmt?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

DavidS127 did a great job of explaining what figure to enter for line 20, code Z. As he explained, "You don't need to enter an amount on that box 20 screen, but you do need to click Continue after you have entered the code Z. The screen prints also provide some visual guidance. If your K1 was properly generated, it will have the specific line items and amounts that can be carried from the partnership to your return. Also, if you click on DavidS127, you can see other postings that he has provided. Reading these other postings may say the same thing in a different way or in a different context, and that may be helpful.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

David, I floated this question by you on another thread but see this one that's similar so I figured it could not only help myself, but others with a similar situation. Please see below:

I have a similar concern with my 199A but in my case, there are no pass throughs but I have for Box 20, Code Z, two locations for rental income (loss) with each location having it's own "unadjusted basis of assets". I am not sure how to enter both of these? When I select "Code Z" in TT and leave it blank, it later asks me for more information about my 199A income...where I can select that my funds has "UBIA of qualified property"...but there is only one field where I can put my unadjusted basis of assets. How do I capture both of these basis values. Also, other than what I already put in box 2 for "net rental real estate loss", do I need to enter this loss somewhere else, as it's also shown on my statement under my 199A/CodeZ details? Thanks for your help!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

I have K-1 with a loss showing in 20 Z - error message says it shows no income

Can I unselect Z , as losses have no purpose for QBI? And if not, what to do?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

QBI losses in one year carryover and are netted against QBI income (positive QBI) in following years. If the system will not let you enter negative QBI numbers, then, to be accurate, you will have to track these carryovers manually and enter the net of QBI income and carryover QBI losses in subsequent years. This is a hassle, but if you are working with large figures, this will save you from a bad outcome if you are audited.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What figure to enter from K-1 line 20 code Z stmt?

No - do not unselect Code Z. The negative amount will be carried over to next year and netted against next year's QBI income in calculating any deduction.

When entering the information from the K-1 in your return,

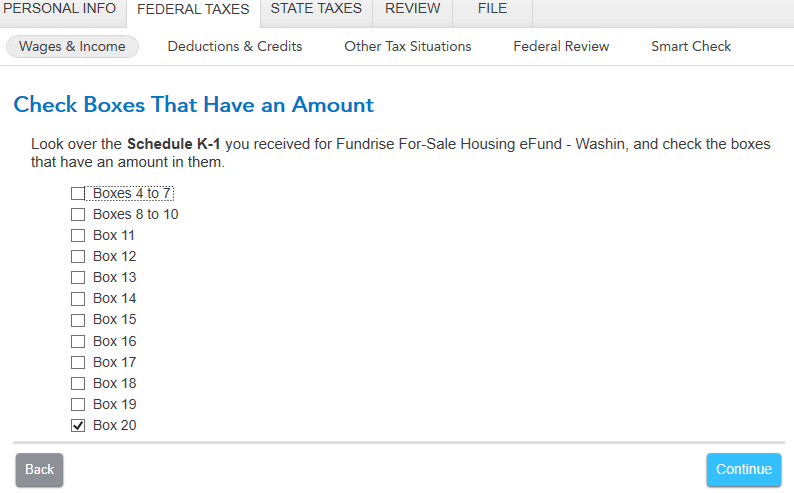

- On the screen, Check Boxes that Have an Amount, make sure Box 20 is checked and click Continue.

- On the next screen, Enter Box 20 Info, enter the information. Put each code and amount on a separate line. If you have several entries for Code Z, leave the amount box blank. You will be asked for details later in the interview.

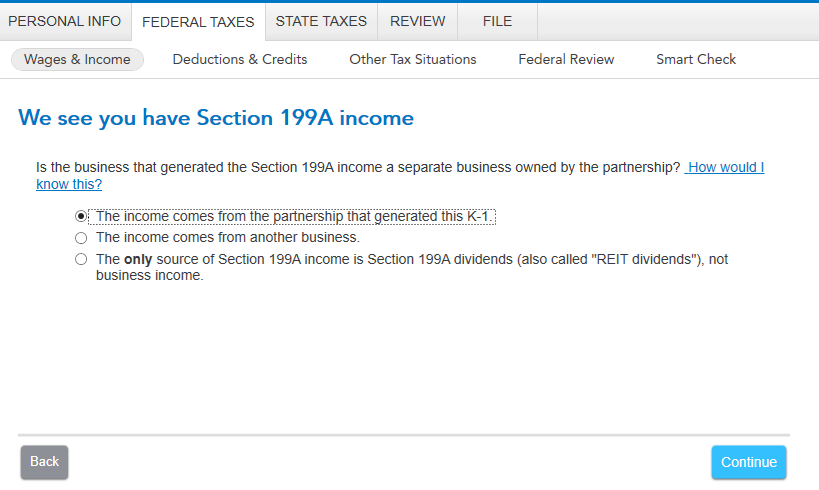

- You will eventually come to a screen, We see you have Section 199A Income. Mark the appropriate radio button--usually The income comes from the partnership that generated the K-1. Click Continue

- On the next screen, We need some information about your 199A income, mark the appropriate boxes for the type of income and enter the amount in the box that appears,. Click Continue when done.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kkarnes

Level 1

Lee-K

Level 2

ScottAHermann

Level 1

waxdoll

Returning Member

Lightner

Level 2