in Education

- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

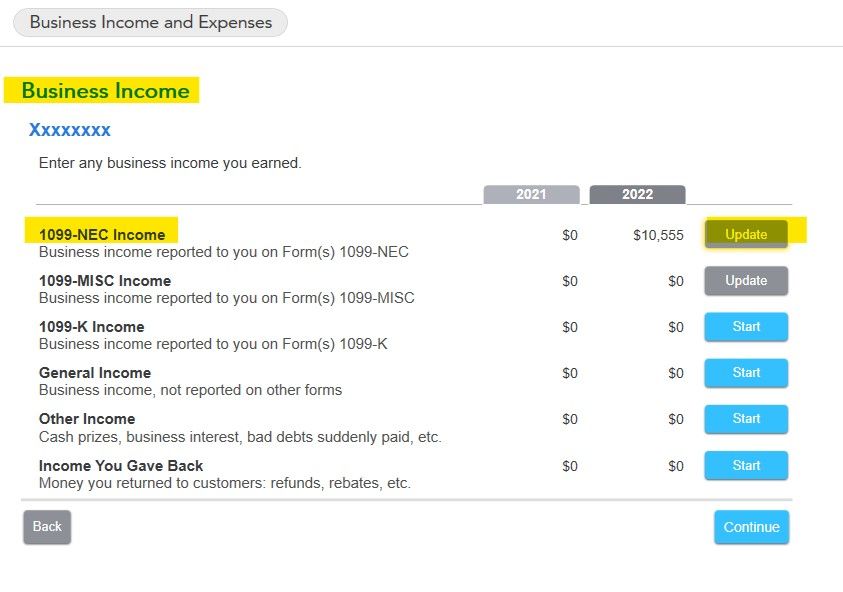

As a workaround, until we can get the error removed, try

- Deleting the 1099-MISC with amounts in Box 3 and

- Enter the form as a 1099-NEC with the amount in Box 1

The results will be the same on Schedule C. And the 1099-NEC will link to Schedule C without an error.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

This worked for me. I saw a previous workaround that involved going into the "Forms" and deleting the Misc 1099and adding income to the Other Income line. That made me very nervous. Thanks for this suggestion.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

Even though I received 1099-msc form not 1099-nec? Thanks

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

It depends - why did you get the 1099-MISC? @FIFICOLE Was it for self-employment income or something else? If it was for self-employment, you can enter it as a 1099-NEC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

Hello, the income is for Solar Electricity Production (electricity sold to the electric company). When will this error be corrected? I have spent almost an hour trying to figure out what I did wrong. (pretty annoying). Every other year there was no issue.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

I'm experiencing the same issue. My 1099-MISC is the result of obtaining a sign-up bonus for transferring money into a new brokerage account. Does this work around apply to this situation as well?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

Is your income being reported as income in a Schedule C in your Federal 1040 income tax return? If so, the workaround outlined by @DawnC should allow you to bypass the issue and electronically file your tax return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

TurboTax is attempting to use schedule C. I just received a 1099-MISC with income listed in box 3 "other income".

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

its a major glitch

I am getting this too as of today

Where is TURBOTAX? anyone with potential schedule C and self employed income is going to get this error when logging back in after the updates they did the last few days

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

This is the first time I've ever gotten a 1099-MSC for income.

TIA

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

I'm receiving this same error after trying to adjust my previously filed tax return upon late receipt of a 1099-MISC. I do not feel comfortable with the 1099-NEC substitution since I received the 1099-MISC from my W2 employer for incentive bonus pay. When will TurbotTax fix this error??

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

Seems to be an error with Turbo Tax as no such box is checked. Probably either workaround should work but the best is probably to just report it as an NEC form.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

If your 1099-MISC was received as something other than self-employment income you need to enter the form identifying the reason. You can either go back and review all the questions for your 1099-MISC entry or delete the form and start the 1099-MISC entry over. You should never report a 1099-MISC as a 1099-NEC. If you received the 1099-MISC as business income, you are not required to enter the 1099-MISC specifically and can merely enter it as Other Self-employed Income in the Income section of your Schedule C.

To delete and re-enter your 1099-MISC in TurboTax Online you can follow these steps:

- Within your return, click on Tax Tools in the black menu on the left side of the screen

- Click on Tools

- Click on Delete a Form

- Scroll down to your form and click Delete

- Under Federal in the black menu bar click Wages & Income to get back into your tax returns

- Open or continue your return

- Select the magnifying glass and search for 1099-misc. Select the Jump-to link

- Answer Yes to Did you get a 1099-MISC?

- If you already entered a 1099-MISC, you'll be on the 1099-MISC Summary screen, in which case you'll select Add Another 1099-MISC

- Enter the info from your form into the corresponding boxes

- If you need to enter boxes 4–6 or 8–17, check My form has other info in boxes 1–17 to expand the form

- Describe the reason for the 1099-MISC, for instance, bonus pay

- Carefully read through and select an answer on the Does one of these uncommon situations apply? screen

- Continue answering the following questions until you get to the Did the bonus involve work that's like your main job? screen and answer No

- Continue and answer I got it in 2022 on the How often did you get income for xxx? screen

- Continue and answer No on the Did the xxx involve an intent to earn money? screen and Continue

- If you have another 1099-MISC you can enter it or answer No and Continue

- Proceed entering/reviewing your return

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

What does "a link to schedule c should not be linked when the MWP qualifying as difficulty of care payments exclusion box has been checked" mean?

I have a 1099-MISC for income earned as a consultant. I didn't get this error a couple weeks back when I ran Smart Check I have no idea where the "difficulty of payments exclusion box" is. The worksheet flagging this 'error' is saying to use Schedule C with "Consultant" in the box. Unlinking that on the worksheet really gets the wheels turning! But not I think correctly.

One expert is saying enter the info as a 1099-NEC. It may come out the same, but this isn't accurate. Another expert is saying never do that.

Fix this TurboTax.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

EY11

New Member

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert

HollyP

Employee Tax Expert