- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Vehicle sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

I bought a used car for $8,000 in 2012 and used it for personal & self-employed business. I took mileage deductions but no depreciation - unless TurboTax automatically depreciates through mileage. I sold it for $1700 in 2019. How do I handle the sale now when TurboTax wants to know about basis for gain/loss and depreciation equivalent? If I leave everything blank it says the $1700 sale price is taxable income.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

Right, I've done that but my question is, since I never claimed depreciation on the car, is there away to avoid having to claim the any of the sale price as income. Or, does claiming the mileage deduction every year count as depreciation? I did the gain/loss section and depreciation equivalent section and that shows a $1360 gain in TurboTax which they want to report as income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

Is paying income tax on the sale proceeds unavoidable?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

A portion of the Standard Mileage Deduction that you took on the vehicle includes an amount for Depreciation.

To figure depreciation under the straight line method, you must reduce your basis in the car (but not below zero) by a set rate per mile for all miles for which you used the standard mileage rate.

The annual depreciation amount per year included in the Standard Mileage per IRS Publication 463 (Page 23) Car Expenses

- 2012 - $0.23

- 2013 - $0.23

- 2014 - $0.24

- 2015 - $0.22

- 2016 - $0.24

- 2017 - $0.25

- 2018 - $0.25

- 2019 - $0.26

There is a maximum depreciation amount that you can take each year. Per IRS Publication 463 (Page 20) Car Expenses

- 1st year - $11,160

- 2nd year - $5.100

- 3rd year - $3.050

- 4th and later years - $1,872

If your Original Purchase Price less the Depreciation on the business portion of your car is less than the Sale Proceeds you might have a gain on the sale depending on the business use percentage of your vehicle.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

When you take the per-mile deduction, and portion allowed for each mile "is" depreciation. As you know, the per-mile deduction changes every year, which means the amount of depreciation per mile also changes every year. When you sell or otherwise dispose of the vehicle, you are required by law to recapture all prior depreciation and pay tax on it. So to report it correctly you need the business miles driven each year (which you should already have) and you need to know how much depreciation was taken for each mile, in each year. To get that, see the chart at https://www.smbiz.com/sbrl003.html#dsm so you can do the math to figure the total depreciation taken for all years you owned the car and claimed any business use.

Your cost basis on the car is what you paid for it, minus all depreciation taken. So with your sales price, I would expect you to "NOT" have a taxable gain unless you drove a few hundred thousand business miles each and every year you claimed business use. But even so, this does not negate your requirement to correctly report the sale of this vehicle.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

you may have a gain or loss on the sale of the vehicle. it really consists of two portions a business portion and a personal portion.

to compute the business portion take your business miles divide by your total miles and multiply by the cost of the vehicle. the personal portion is the total cost less the business portion

for each year 2012 through 2019 multiply the business mileage by the rate supplied. add up the amount for each year. this is the business depreciation the IRS says you took. subtract this from the business portion of the vehicle. if the result is negative the IRS says use $0. this is the remaining business basis, if any of the vehicle.

now multiply the sales proceeds by the business miles divided by your total miles. this is the portion of the proceeds allocable to the business portion. from this subtract your remaining business basis. this is your business gain or loss. if a gain, compare this to the business depreciation. if more, the excess is capital gain and the amount equal to the business depreciation taken is ordinary income - depreciation recapture. if a gain but less, it is all ordinary income - depreciation recapture. if a loss, this is an ordinary loss.

now from the total sales proceeds subtract the business portion

from the cost of the vehicle subtract the business portion

compare the personal portion of the proceeds to the personal portion of the vehicle. if a gain it is a capital gain. if a loss it is not deductible. in reality you should not end up with a personal gain

can TT handle this - don't know.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

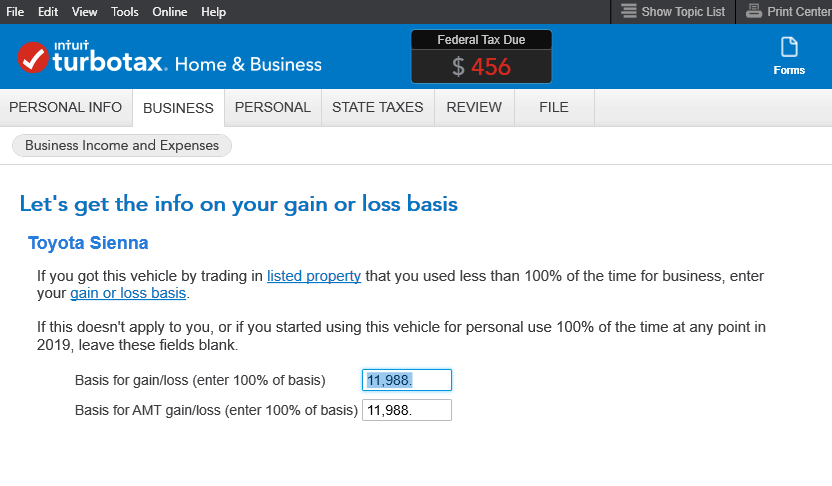

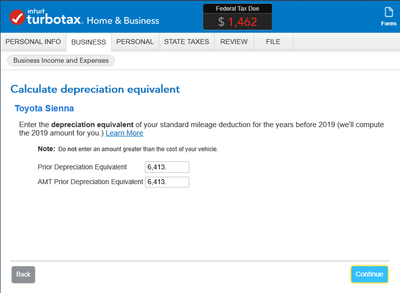

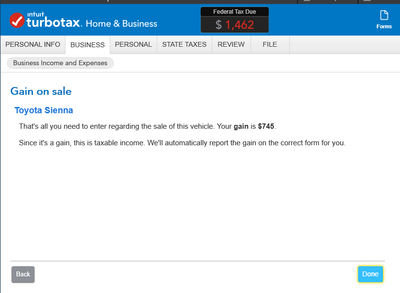

I'm still lost. I've read through the responses and I still can't figure out how to do mine. I started using my van for business in 2016. I'm estimating it was worth $18,400 then. I sold it November 2019. I have $6413 in depreciation based on the calculation using the standard mileage dedication tables you provided. I traded it in for a new vehicle and they gave me $1800 for it. Based on usage of 41.36% this means I made $754 on the sale.

For basis for gain/loss I did $18,400 -$ 6,413 and got $11,988

Then the next screen asks for depreciation equivalent so I entered in the $6413.

Then it tells me I have a gain of $745. How is that possible? I'm sure I am entering in something somewhere that I shouldn't be, but the directions make no sense.

If I don't put anything in the depreciation equivalent box I get a loss. HELP!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

The basis entry should have been the FMV when put into service of $18,400 times the business use percentage (41.36%), or $7,610.24.

You should enter 41.36% of the sale amount as the sales proceeds ($744), so the loss on sale should be $453 (basis of $7,610.24 - deprec $6,413 - sale $744).

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

I still can't get the numbers you say. The questions turbo tax asks is very confusing. I don't know what numbers to put in which box. If I put anything in the prior depreciation box it says I have a gain. Can you please tell me which box to enter which value. WHat you say makes sense, but turbotax has it all mixed up and confusing! You can't enter negatives or do the simple math. See above screen shots in my previous post. Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

@Gatorvet01 wrote:I'm still lost. I've read through the responses and I still can't figure out how to do mine. I started using my van for business in 2016. I'm estimating it was worth $18,400 then. I sold it November 2019. I have $6413 in depreciation based on the calculation using the standard mileage dedication tables you provided. I traded it in for a new vehicle and they gave me $1800 for it. Based on usage of 41.36% this means I made $754 on the sale.

For basis for gain/loss I did $18,400 -$ 6,413 and got $11,988

Don't enter it in the vehicle section. Say you converted the vehicle to personal use.

Then report it in the "Sale of Business Property" section, using (1) 41.36% of the $18,400, (2) 41.36% of $1800, and (3) the depreciation of $6413 (as a side note, you calculated the depreciation using ONLY the business miles, right?).

One other note: I don't remember if the "Sale of Business Property" section asks for the Unadjusted Cost Basis (41.36% of $18,400) or the Adjusted Basis (41.36% of $18,400 MINUS the depreciation of $6413), so be sure you enter whichever it asks for.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

Reading the comment below, leaves me confused.

----------------------------------------------------------------------

The basis entry should have been the FMV when put into service of $18,400 times the business use percentage (41.36%), or $7,610.24.

You should enter 41.36% of the sale amount as the sales proceeds ($744), so the loss on sale should be $453 (basis of $7,610.24 - deprec $6,413 - sale $744).

------------------------------------------------------------------------

Wouldn't basis of $7610.24 - $6414 - $744 = POSITIVE $453. Isn't that a GAIN? The comment says it's a LOSS of $453.

My biz basis of car was $7610, and I depreciated .the car by $6414. (I avoided tax on that $6414).

My Biz sale value is $744.

How does that provide me a LOSS of $453? (I sold the car for $1800, with a biz sales value of $744 - where is the LOSS? Please explain this to me)

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

The sale amount of $744 is less than the cost basis of $1,196, so you have a loss of $452:

Sale $ 744

Basis $ 1,196

Loss $ -452

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

Thanks for your reply. But, for that first example (someone elses), in your reply - where did the $1196 figure come from?

------

Let me provide my example, and see if you can help me?

I bought the car in 2010 for $2500.

I sold it March 29, 2023 for $400. (junkyard sale).

I have $1600 in depreciation 2010 to 2023 (based on depreciation portion of standard mileage deduction).

I used the vehicle about 20% for my rental property (on average). So, 80% of usage is personal use.

Is my 'cost basis' 20% of $2500? (ie: $500 ?)

Is my 'sale price basis' 20% of 400? (ie: $100 ?)

Do I subtract my cost basis from (selling price + depreciation) to arrive at gain or loss? (500 - (100 + 1600) ) ?

Do I have a income gain, or loss, for tax reporting? (Is it -$1200 loss, or gain?)

I think if i understand WHY I am doing all these calculations, it would help me understand the TT forms. Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Vehicle sale

Purchase: FMV times business use = $7610.24

Depreciation of $6414

Cost basis now is $7610.24-6414 = $1196

Sale price $744

Gain of $1196-744 = $452

Thomas just switched the order of listing, a simple accident that changed the math.

The example you submit is very different and states that standard mileage was used. I did answer that question as well and my response is here.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Christine329

New Member

trock69

New Member

Broncobear

Level 2

nickdef1

New Member

jennifer-frericks

New Member