- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

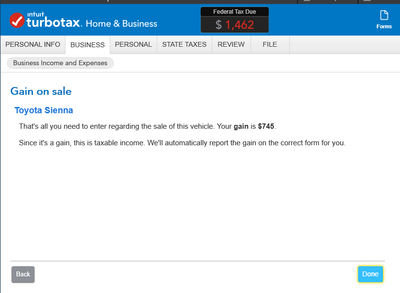

I'm still lost. I've read through the responses and I still can't figure out how to do mine. I started using my van for business in 2016. I'm estimating it was worth $18,400 then. I sold it November 2019. I have $6413 in depreciation based on the calculation using the standard mileage dedication tables you provided. I traded it in for a new vehicle and they gave me $1800 for it. Based on usage of 41.36% this means I made $754 on the sale.

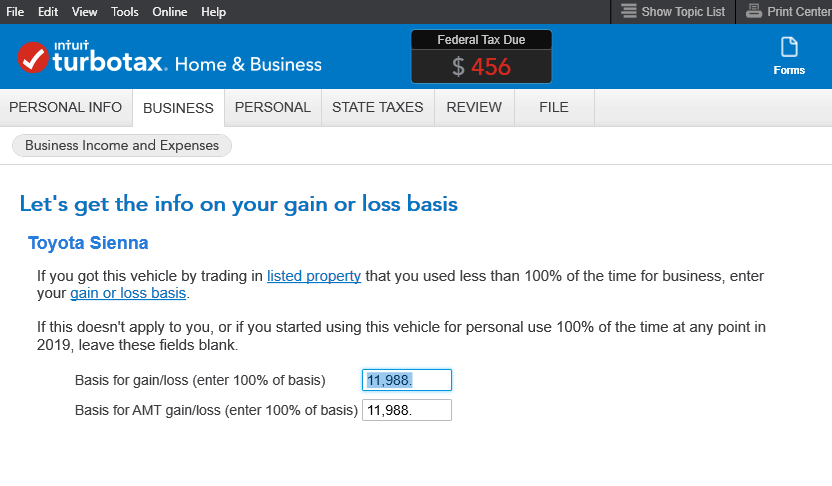

For basis for gain/loss I did $18,400 -$ 6,413 and got $11,988

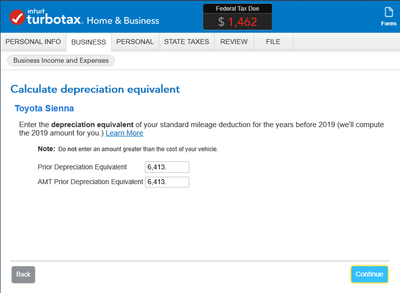

Then the next screen asks for depreciation equivalent so I entered in the $6413.

Then it tells me I have a gain of $745. How is that possible? I'm sure I am entering in something somewhere that I shouldn't be, but the directions make no sense.

If I don't put anything in the depreciation equivalent box I get a loss. HELP!