- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: upload from company

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

What? so what is the answer to the question?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

The Schedule D is the form that is produced from information put into TurboTax in the Investment Income section>Stocks, Mutual Funds, Bonds, Other.

If you received a 1099-B you may be able to download the information from your broker into TurboTax, or you can enter the information yourself.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

You said: "If you received a 1099-B you may be able to download the information from your broker into TurboTax, or you can enter the information yourself..." BUT - "enter the information" WHERE?? There does not appear to be any place to enter it....

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

Here is how you can enter your 1099-B.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

You said - "Here is how you can enter your 1099-B."

No, that doesn't work. That link says:

2. "In TurboTax, search for 1099-B and then select the Jump to link in the search results.

I tried several ways to "...search for 1099-B and then select the Jump..."

That does \nt seem to work, no matter what I tried... I have TTax Home&Business. I have already filled out the return and want to know how to add unrealized cost basis info. There doesn't seem to be any way to do that under the Persona Income 1099-B setup...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do i fill out of unrealized cost basis information for securities subject to amortization/accretion?

To enter your securities sales information from your 1099-B, you can do the following:

- Go back into your program and select the Personal tab.

- Then select Personal Income.

- Select the blue box that says I'll choose what I work on.

- Scroll down and select Update to the right of Stocks, Mutual Funds, Bonds, Other under the Investment Income section.

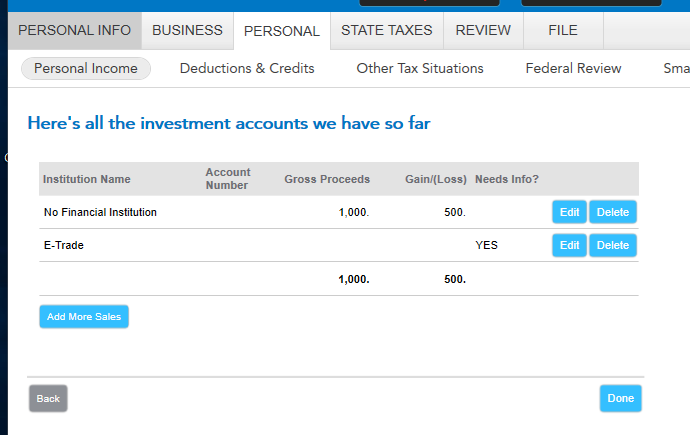

- You will be able to select Add More Sales on the screen titled Here's all the investment accounts we have so far. If your stock sales are already listed if you imported them, you can select Edit to the right of the applicable stock sale where you need to enter additional information.

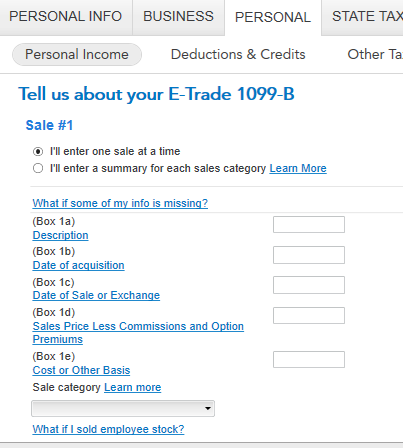

Once you select the appropriate section above, you will enter your detailed information in the screen titled Tell us about your ... 1099-B.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

doug-gerow

New Member

shenedavis091

New Member

user17727382039

New Member

berniedeany

New Member

user17683230746

New Member