- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

You are correct. Pennsylvania (PA) looks at each transaction in the tax year independently. Then after combining all capital gains and losses for a net result in that calendar year. If that net result should happen to be a negative or loss, it cannot be used against any other class of income on the PA return.

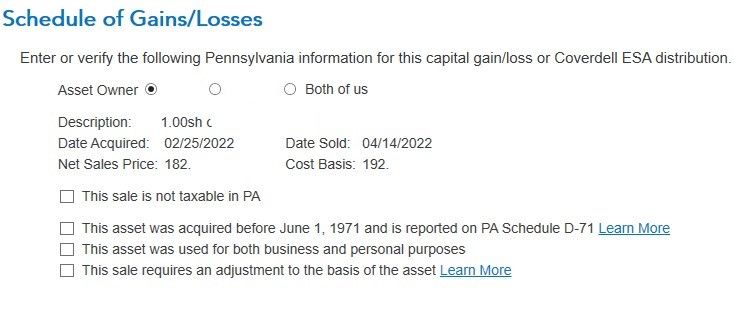

When you are preparing the PA return in the State interview, you will reach a page titled 'Schedule of Gains/Losses'. You should not need to edit the wash sale for PA, but review your sales on this page. Do not check the box beside 'This sale is not taxable in PA' (this could apply to a nonresident).

See the image below for assistance. In my example the loss was $100, named Wash Sale vs a stock name or symbol.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

can't read the example

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

I'm currently having this exact issue. Did you happen to figure out what to do? Did you have to manually adjust every trade? I have hundreds and hundreds of day trades. Did you actually mail in your entire 1099-b? Please share if you can!! Thank you!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

What should be done in TurboTax when reaching this wash sales portion of the Pennsylvania State income tax preparation. There is no clear guidance from TurboTax. Should I assume TurboTax computed the transactions correctly and just walk through them without adjustment to cost basis? HELP

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

Your Pennsylvania income tax return should be correct. PA does not recognize wash sales and TurboTax transfers transactions to the state return without wash sales.

PA says, “The federal wash sale provisions do not apply for Pennsylvania personal income tax purposes. For Pennsylvania purposes, every transaction is considered separate and independent of any subsequent transaction.”

Related Resource:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

I'm in PA with the same question and looking for some clarification. I have a number of wash sales (losses) in my Gains and Loss Summary. You say "Your Pennsylvania income tax return should be correct. PA does not recognize wash sales and TurboTax transfers transactions to the state return without wash sales." Does this mean we do not have to select "Edit" for any of the wash sales and choose from the available options (see screenshot), in particular the adjustment to the basis option? I.e. can the wash sales on the gains and loss summary be ignored?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

Yes. TurboTax adjusts for Pennsylvania wash sale rules and includes disallowed losses. You do not have to make any basis adjustments for wash sales in the PA section.

Out of an abundance of caution, you should always check to see whether your transactions are being reported properly.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

So just want to be sure I understand. I had losses on sales of securities federally, and now I am at my PA return and have that screen already listed by others asking those 4 questions (sale not taxable in PA, asset acquired before 1971, asset used for both business & personal, and sale requires adjustment to basis). Do I ignore those 4 questions completely because the Federal has transferred the amounts properly to the State? I have looked through all my paperwork from broker and can't seem to find an answer. Thanks.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

Yes. The first option is for nonresidents. The second option has a time period. The third must not apply to you. This leaves the 4th and if you have no other adjustment, none of these apply to you.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Since Pennsylvania does not comply with the wash rule. How do I adjust the cost basis of the asset?

I have the same issue with a wash sale loss. PA web page guidance states "The federal wash sale provisions do not apply for Pennsylvania personal income tax purposes." and "The gain or loss is computed by using the actual cost basis and actual adjusted sales price with no special rules." As usual, TurboTax provides little to no explanation on what to do or how their product works in this situation.

[Editing my previous reply after working through it]

You do NOT have to check one of the boxes to CONTINUE. Hit the CONTINUE button.

Turbotax recognized all gains and losses for me with no adjustment required.

After clicking through each individual transaction, Turbotax will pop-up a summary explanation that unfortunately I cannot copy or paste here

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kevinr12240

Level 3

dryfly1

Returning Member

cameron2028

New Member

DR2003

New Member

in Education

GreenApple123

Level 4