- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: "Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I nee...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I need to fix it. What am i missing?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I need to fix it. What am i missing?

I am not sure whether you want to claim the deferral or delete the entry.

In TurboTax Online Self-Employed, I was able to enter a self-employment tax deferral and pass Review. Then I was able to remove self-employment tax deferral and pass Review. Follow these steps.

- Down the left side of the screen, click on Federal.

- Across the top of the screen, click on Deductions & credits.

- Under Your tax breaks, scroll down to Self-employment tax deferral.

- Click on Edit/Add to the right of Self-employment tax deferral.

- At the screen Do you want more time to pay your self-employment tax?, click Yes.

- At the screen Let's start by getting your eligible income, I have left the dollar amount that was previously entered, others change this amount to $0.

- Click on Continue.

- At the screen Tell us how much you'd like to defer, delete the dollar amount.

- Click Continue.

- Click through Federal Review to make sure than the Review issue has been removed.

- At the screen Some of your self-employment taxes may be eligible, click Skip.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I need to fix it. What am i missing?

Hey James,

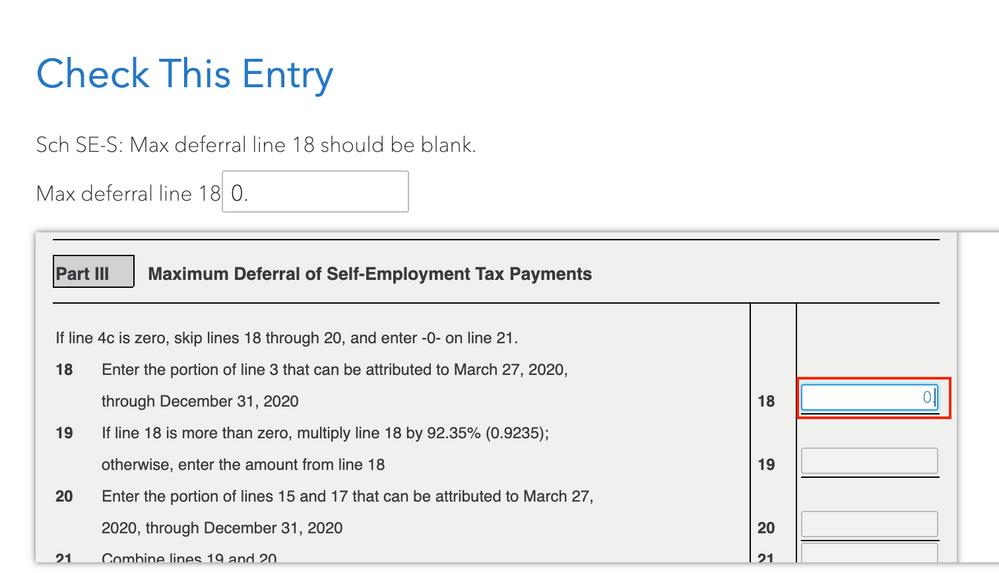

I'm having the same issue after trying selecting No to the tax deferral, the review prompts the form SE-T line 20 which automatically gets a 0. which corresponds to the 0.00 on the self-employment tax deferral under deductions and credits. I am unable to pass the review. Attached is an imagine to illustrate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I need to fix it. What am i missing?

Let me clarify your situation. If, at the screen Do you want more time to pay your self-employment tax?, you click Yes.

Does the screen say It looks like you're not eligible for this deferral.

Or does it say Let's start by getting your eligible income?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I need to fix it. What am i missing?

this did Not work.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

"Sch SE-T: Max Deferral line 20 should be blank." "Max deferral line 20: 0." Still says I need to fix it. What am i missing?

Have you tired leaving the field blank?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Tax_right

Level 1

RehbergW

New Member

salvadorvillalon54

Returning Member

flcastro-x

New Member

eastend19

Returning Member