- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

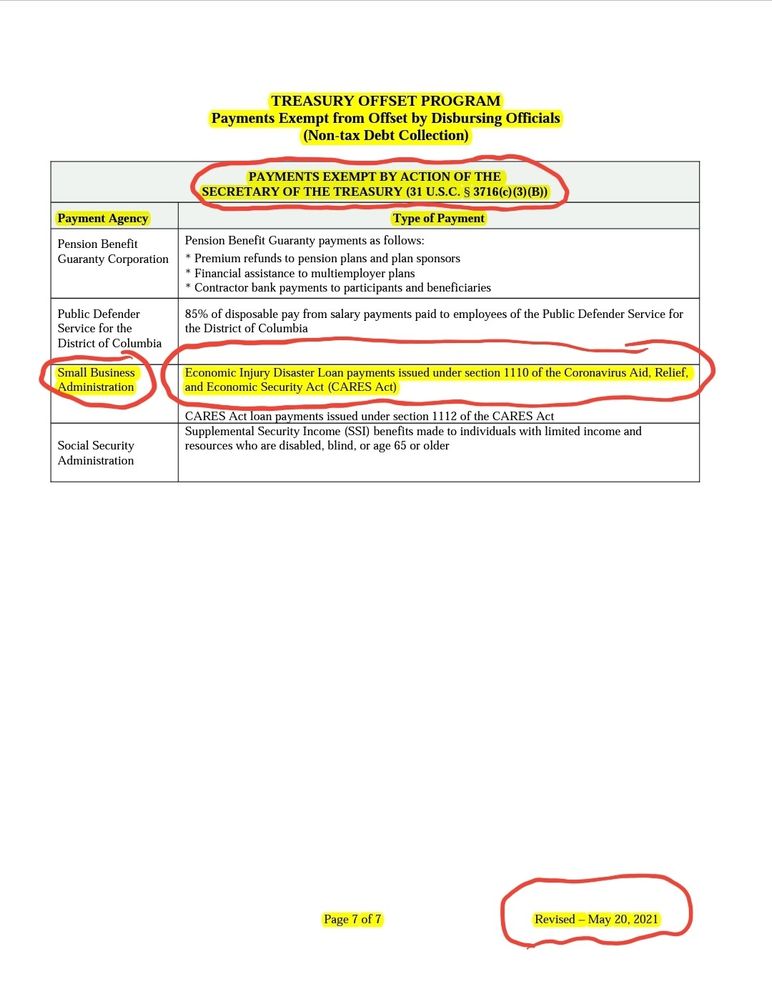

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

COVID-19 Tax Provisions make it clear that EIDL grants are non taxable and not included in general gross income.

The Treasury lists these payments as exempt from offset.

Why was both of my EIDL grants, Targeted Advance and Supplemental Targeted Advance, offset for a state debt ?

The creditor isn't allowing me the opportunity to dispute the offset.

Who do I need to contact to correct this issue to be issued a refund ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

Good ... so you know what happened but how can you rectify it ? You may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

They may have been exempt from fed or state income taxes but were some of them repayable ? You need to find out why they took the refund ... the state should send you a letter of explanation in a few weeks so you know where to start.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

No, these grants are not repayable. It was 2 weeks before I had to find out myself before I knew of these offsets. I received no notification of the offsets.

I have verified I owe no debts with the IRS and State Tax Commission, and I have a certified record of no lien from my state recorder of no liens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

If you received less than expected then you need to take this up with the feds or state both of which should send you notification of why any of the refund was reduced. This notification can take more than 2 weeks to come in the mail. If you have issues with the grant issuers then seek local professional assistance ... you may need an attorney.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

The first offset happened almost a month and a half ago. The second just happened May 19th.

I know what the alleged debt is and who it went to, but that is a whole nother issue that is off tax topic, but simply put its a debt.

According to federal law and my state laws of process and procedures, the collection of this debt is unlawful without a lien attached and filed...

Also before a creditor can garnish or levy any income or bank account, they must attach and file an execution lien and writ of execution.

Ultimately, they need a tax lien filed to perform tax refund offsets...

These liens must be attached before a creditor has any authority to use enforced collections against a debtor.

Without these any of these liens being filed by the creditor in the county and state of the debtor lives, the creditor has no authority to forcefully collect.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

Good ... so you know what happened but how can you rectify it ? You may want to contact a Taxpayer Advocate in your area. See this IRS website for Taxpayer Advocate in your area and a toll free number - http://www.irs.gov/Advocate/Local-Taxpayer-Advocate

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

So contacted the county recorder of liens and she verified twice that there was no liens against me filed. I also contacted the statewide recorder of liens and she mailed me back a certified record of no lien. All calls were recorded.

I took that letter from the statewide recorder of liens and filed it with my dispute of the debt on my credit report for fraudulent activities and the credit bureau gave the creditor 30 days to validate the debt.

The creditor failed to validate the debt and the credit bureau deleted the debt from my credit history, and fortunately my credit score went up.

What I'm saying is, the creditor needs a tax lien filed and recorded to offset any income I receive and that income can't be an exempt payment by law at that.

I clearly have the evidence to prove no validation of this alleged debt and the offset being unlawful, and I can present this evidence...

But to who ?

I've contacted everyone (SBA, Dept of Treasury, State Tax Commission, State Representative) except the IRS and these agencies have told me I'm correct but refer me to each other and all of them tell me there's nothing they can do that they know of (except the state rep who hasn't responded to my email yet).

I'm guessing because the IRS runs the program, I need to speak with them ? But man, they're hard to get ahold of...smh

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

SBA EIDL GRANTS AND THE TREASURY OFFSET PROGRAM

Thanks for the tax payer advocate info !

Yea I'm working on rectifying it now, I sent the creditor a debt validation request letter under the FRCPA.

That should raise some attention.

The creditor finally let me dispute it after fighting with their head office, but the hearing isn't set until September 27th, and I need those grants much sooner than 5 months from now, so I need to raise attention to the source of the apple.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

jahirthomas

New Member

Curt14

Level 2

gjgogol

Level 5

PTR1

Returning Member

23bambam23

Level 3