- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: On 2020 Home & Business software, TT does not reduce my self employment income (from LLC) by ...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2020 Home & Business software, TT does not reduce my self employment income (from LLC) by unreimbursed business expenses. Does anyone know how to handle this issue?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2020 Home & Business software, TT does not reduce my self employment income (from LLC) by unreimbursed business expenses. Does anyone know how to handle this issue?

An LLC is considered a disregarded entity meaning the profits and losses are taken on the individual tax return.

You should be claiming the business income and expenses on Schedule C.

This will resolve the unreimbursed business expenses as they will reduce net taxable income and reduce profit subject to self-employment tax.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2020 Home & Business software, TT does not reduce my self employment income (from LLC) by unreimbursed business expenses. Does anyone know how to handle this issue?

The program does not handle flow through on a Schedule K-1 as Schedule C income. Turbo Tax puts it on Schedule E. It them pulls the amount from line 14A of Schedule K-1 (self employment income) and moves it to line 2 of Schedule SE to compute SE tax. It fails to reduce it by the nonreimbursed business expenses and the sec 179 amount (both shown in Sch E). So I’m not sure your answer fits what the program does.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

On 2020 Home & Business software, TT does not reduce my self employment income (from LLC) by unreimbursed business expenses. Does anyone know how to handle this issue?

The Partnership Agreement must state you are required to pay business expenses on behalf of the partnership for which you are not reimbursed.

You can then deduct them as Unreimbursed Partnership Expenses in TurboTax Home & Business.

In the search box in the top left, type K1 and then click on the Jump to link.

Update your K1 from your partnership.

When you reach the Choose the Type of Partner screen, verify you have selected the Disregarded Entity box.

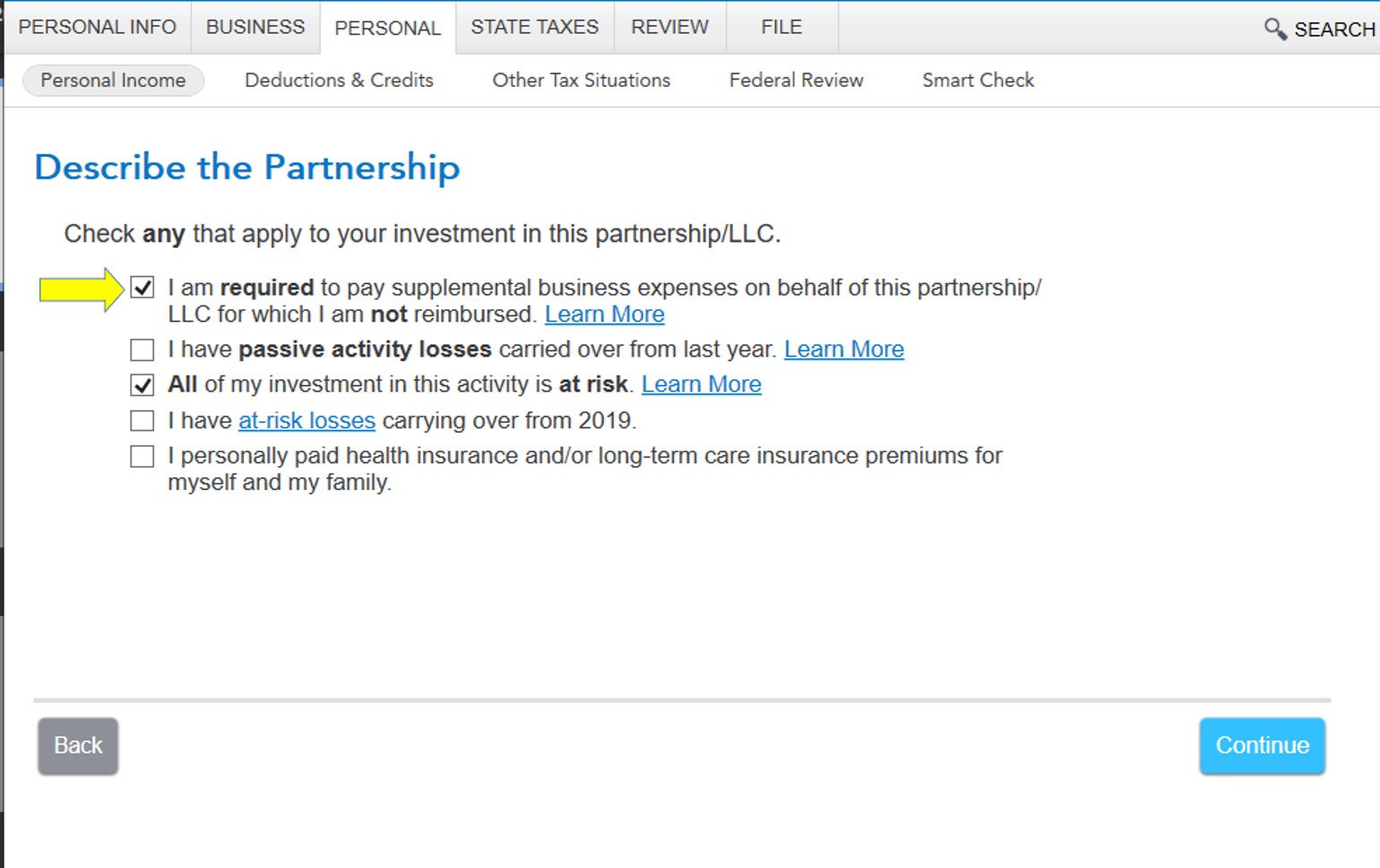

Continue through the interview until you reach the Describe the Partnership screen.

Verify the first box I am required to pay supplemental business expenses on behalf of this partnership/LLC for which I am not reimbursed.

The next screen asks to verify the Partnership Agreement requires you to pay expenses out of your own pocket.

Only If the Agreement states you are required to pay expenses out of your own pocket are expenses on behalf of this entity deductible.

The TurboTax interview will then allow you to enter various types of business expenses to reduce the amount of income passing from the partnership subject to tax on your individual return.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

VAer

Level 4

vgutierrez65

New Member

vgutierrez65

New Member

vgutierrez65

New Member

DennisK1986

Level 2