- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

The Partnership Agreement must state you are required to pay business expenses on behalf of the partnership for which you are not reimbursed.

You can then deduct them as Unreimbursed Partnership Expenses in TurboTax Home & Business.

In the search box in the top left, type K1 and then click on the Jump to link.

Update your K1 from your partnership.

When you reach the Choose the Type of Partner screen, verify you have selected the Disregarded Entity box.

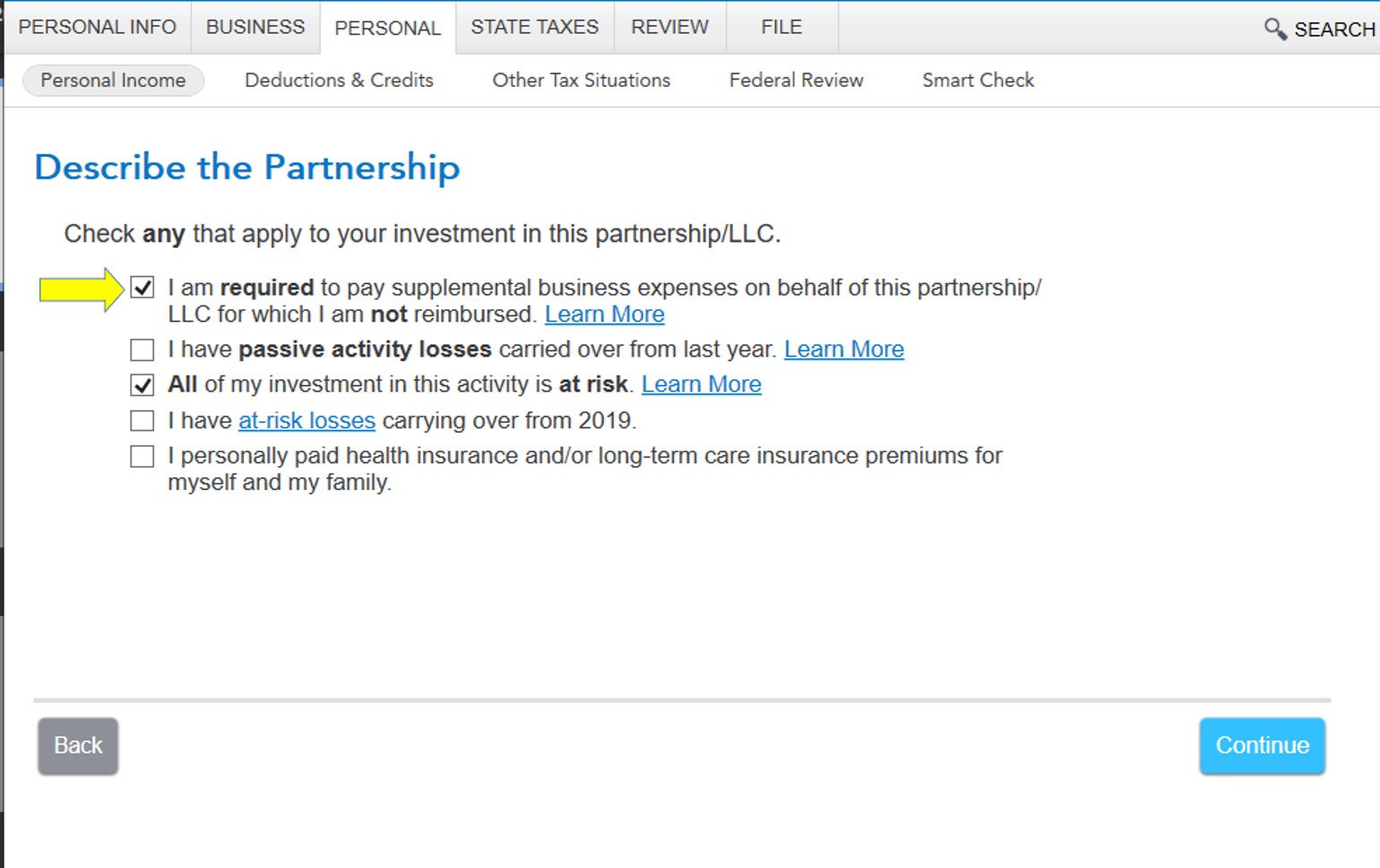

Continue through the interview until you reach the Describe the Partnership screen.

Verify the first box I am required to pay supplemental business expenses on behalf of this partnership/LLC for which I am not reimbursed.

The next screen asks to verify the Partnership Agreement requires you to pay expenses out of your own pocket.

Only If the Agreement states you are required to pay expenses out of your own pocket are expenses on behalf of this entity deductible.

The TurboTax interview will then allow you to enter various types of business expenses to reduce the amount of income passing from the partnership subject to tax on your individual return.