- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: I need to list Guam in the address section a trust on a K-1 form but there is no option for G...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to list Guam in the address section a trust on a K-1 form but there is no option for Guam. Is there a way to edit the info?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to list Guam in the address section a trust on a K-1 form but there is no option for Guam. Is there a way to edit the info?

You can list your own address as the address for the trust.

The IRS gets the correct address when the trust files its own tax return (Form 1041) and the K-1 you enter on your individual income tax return does not get transmitted to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to list Guam in the address section a trust on a K-1 form but there is no option for Guam. Is there a way to edit the info?

You can list your own address as the address for the trust.

The IRS gets the correct address when the trust files its own tax return (Form 1041) and the K-1 you enter on your individual income tax return does not get transmitted to the IRS.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to list Guam in the address section a trust on a K-1 form but there is no option for Guam. Is there a way to edit the info?

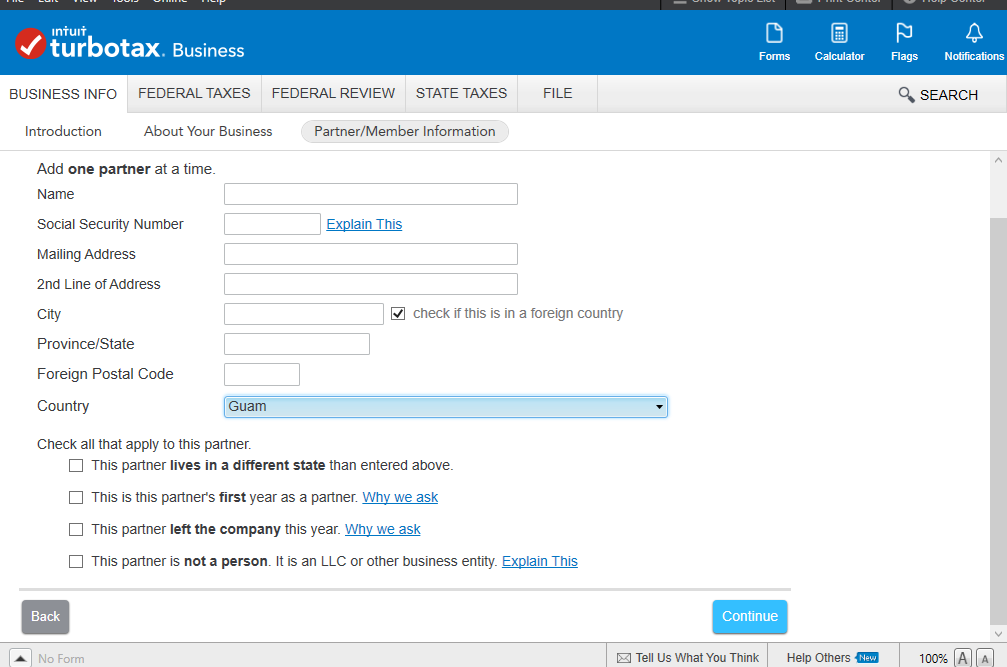

You do have the option of entering a foreign address for both the trust and a partner - you just have to "check if this is a foreign country. Guam is included as an option for "Country".

See the attached screenshot for an example:

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to list Guam in the address section a trust on a K-1 form but there is no option for Guam. Is there a way to edit the info?

@ToddL99 wrote:

You do have the option of entering a foreign address for both the trust and a partner - you just have to "check if this is a foreign country.

The screenshot is from TurboTax Business while @dpaulino21's post was from a personal version of TurboTax, which does not have that option when entering a K-1 that was received (see screenshots below).

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

rspalmera

New Member

Lewlew

Level 2

Cincolo

Level 3

BobTT

Level 2

edmarqu

Level 2