- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: I am inputting a Schedule K-1. I expect TurboTax to fill out a Form 1065 for me but it is fil...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1: TurboTax creates Form 1120S instead of Form 1065

I received a Schedule K-1 as a domestic, limited partner in a fund. I entered it into TurboTax and expected it to filling out a Form 1065. However it is filling out a Form 1120S, and subsequently it asks me for information about an S corporation that isn't applicable. How do I get it to fill out Form 1065 instead?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1: TurboTax creates Form 1120S instead of Form 1065

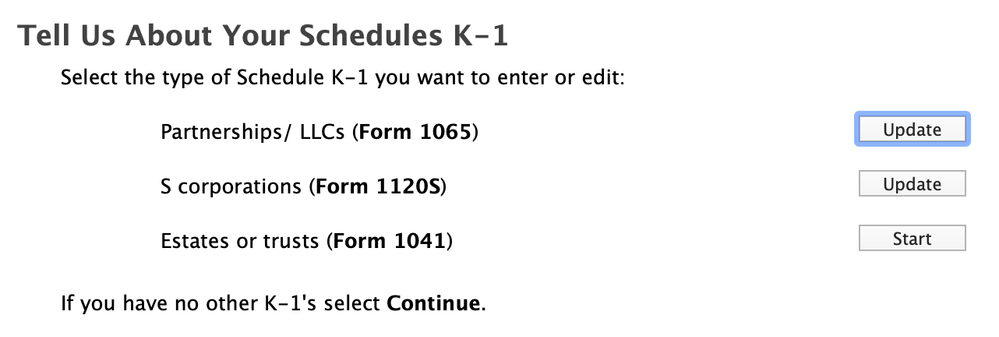

There are different entry areas for each type of K-1 (Parternship/1065, S-corp/1120S,and Trust/Estate (1041). Return to the K-1 entry screen and be sure to select that you are entering one for a 1065. It should look similar to this:

If you're trying to prepare the 1065 return that issues the K-1 (and not trying to enter K-1 data onto your personal tax return, or have any other questions, you can return to this thread and ask us without any limitations on characters.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1: TurboTax creates Form 1120S instead of Form 1065

Thanks @SusanY1 for the quick response. I am using the desktop edition.

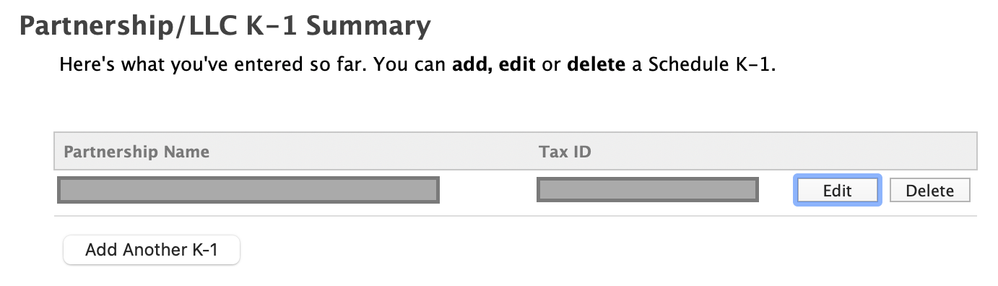

I did enter the Schedule K-1 as a Partnership/LLC.

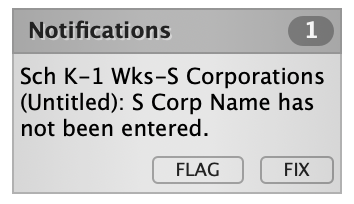

I think this is a bug in TurboTax. I went ahead and filled out bogus information for the "S Corporation" it was asking me about, then deleted the Form 1120S, and the notification went away. But it keeps coming back.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1: TurboTax creates Form 1120S instead of Form 1065

There may be another form related to the entry you deleted that remains in your return. You can check this using Forms Mode in TurboTax for Desktop.

- Open your return and click the Forms icon in the TurboTax header.

- In the list of Forms in My Return on the left, scroll down and look for any form than includes "K-1 S Corp" or "K1S."

- Click the form name to open it in the large window.

- If the form is related to the K-1 you deleted, click the "Delete Form" button at the bottom of the form and confirm.

- Click Step-by-Step in the header to return to the main screens.

- Now run SmartCheck again to see if the error has been resolved.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Schedule K-1: TurboTax creates Form 1120S instead of Form 1065

This is definitely a bug and it’s extremely frustrating. I had to file my return with this S Corporation form and I’m concerned this will be flagged. I’m going to save this issue and response for Intuit if I need to explain why I filed my taxes incorrectly

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

cdt0794

New Member

chrissyo

New Member

user17631449562

Level 1

hjw77

Level 2

ponsuke

New Member