- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

How do I deduct junked phones with a $400 loss on an 1120-S?

A Form 4797 does not seem appropriate as they were not sold.

Can't this be an ordinary expense? I can find instructions for other tax programs but not TurboTax.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

@Anonymous_ wrote:Thus, if the phone had been held longer than one year, the transaction belongs in Part I. If held for one year or less, it is entered in Part II.

I disagree. The OP is correct, and as far as I know, TurboTax (and ProSeries) is faulty in this situation and can not handle this correctly without an override.

As is noted in the Instructions for Form 4797, an Abandonment goes in Part 2 of 4797. If you put it in Part 1, it incorrectly affects the 1231 carryover rules.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

Were these phones used in a business?

If so, were they listed as business assets in the business assets section and depreciated over time? Or were they expensed and claim in the first year they were purchased and placed in service for the business?

If so, are/were the phones completely depreciated at the time of disposition?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

The instructions say to report the abandoned property as an ordinary loss on Form 4797 on LINE 10.

How do I get TurboTax to move it to line 10?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

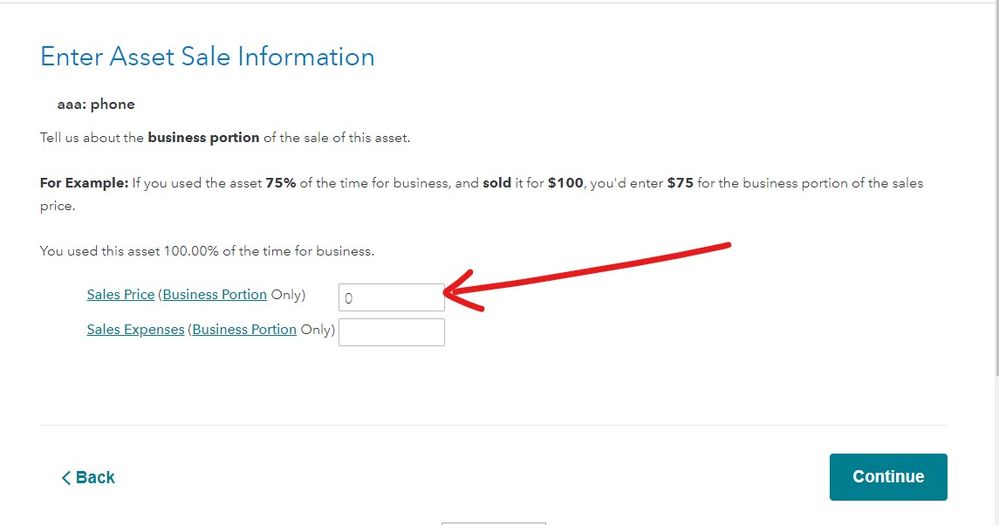

Answer Carl's questions so that we can assist you better. And you did "sell" them when they were retired and you sold them for $0...report this in the asset section.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

Business phones, not Sec 179, and $400 left to depreciate when abandoned.

I think I figured it out. I can override "Part I" with "Part II" for the 4797, which moved it to line 10 & 17

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

You should not override anything as that will void the accuracy guarantee and could keep you from efiling. If you had this listed as assets then you will indicate that you disposed of them for $0 and the 4797 will be filled in automatically.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

I know that TurboTax instructs us to "sell" them even though we did not sell them, but after reading publication 544, etc., they belong in section II of the 4797

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

As much as I want to trust software. "An abandonment of property is not treated as a sale or exchange. Thus, an abandonment loss is an ordinary loss regardless of whether or not the abandoned asset is a capital asset."

Abandonment and Obsolescence Losses

A taxpayer is allowed a deduction for a loss sustained upon the abandonment of property used in a trade or business or a transaction entered into for profit. In the case of property depreciated under the Modified Accelerated Cost Recovery System (MACRS), an asset is abandoned if the taxpayer discards it irrevocably so that the taxpayer will neither use the asset again nor retrieve it for sale, exchange, or other disposition. If a MACRS asset that is not subject to nonrecourse indebtedness is disposed of by physical abandonment, loss is recognized in the amount of the adjusted depreciable basis of the asset at the time of the abandonment, taking into account the applicable convention ( Reg. §1.168(i)-8(e)(2)). If only a portion of a MACRS asset is abandoned, a taxpayer generally must make a partial disposition election in order to claim a loss ( ¶1239) ( Reg. §1.168(i)-8(d)). An abandonment of property is not treated as a sale or exchange. Thus, an abandonment loss is an ordinary loss regardless of whether or not the abandoned asset is a capital asset. The loss is reported on Form 4797 ( IRS Pub. 544).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

Business phones, not Sec 179, and $400 left to depreciate when abandoned.

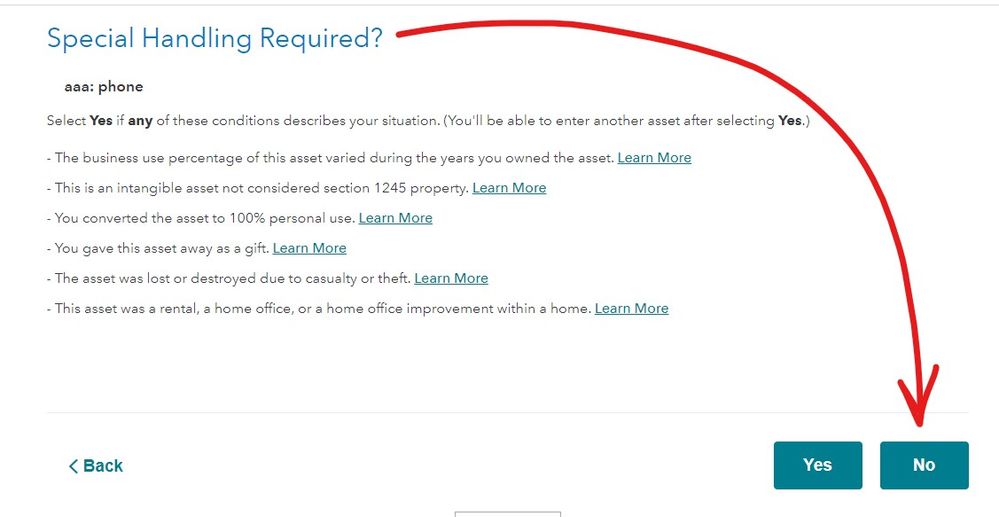

Work through the asset, and indicate that you stopped using the asset in 2021 and press on. A screen or two later you'll have a screen for "Special Handling Required?". Read that screen so you'll understand why I'm telling you to click YES. Then click YES. You're done.

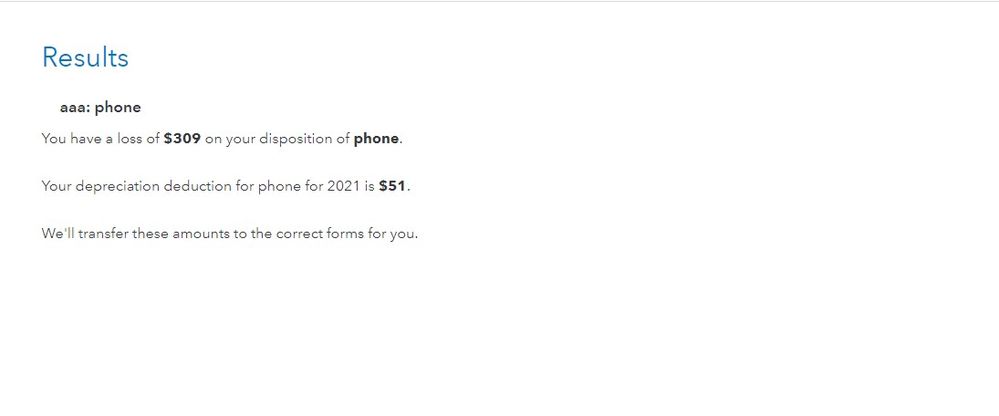

Any remaining depreciation (if any) is deducted as a misc. expense.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

To get this to the form 4797 like you want you MUST take this route ... it will take the allowed depreciation and put the disposition on the form 4797.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

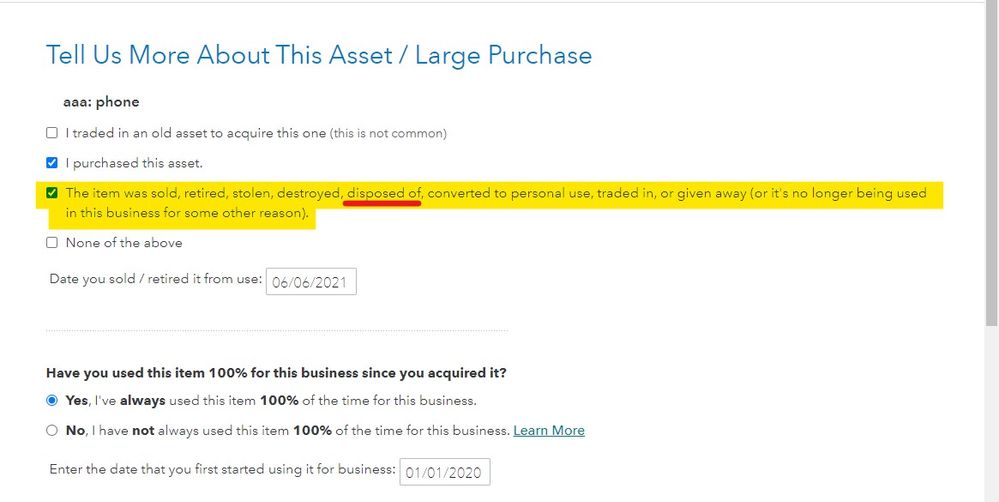

In TurboTax Business, you will indicate you disposed of the phones as shown in the screenshot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

@Anonymous_ is correct ... I was giving instructions on the personal return. However both programs will treat this as a business asset that was disposed of before it was fully depreciated putting this on the form 4797 to be taxed as ordinary income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

@Critter-3 is correct.

If depreciation deductions had been taken on the phones on an annual basis, then there will be a loss to the extent of the remaining depreciation deductions not taken. If the phones were fully depreciated (e.g., zero basis), there will be no gain or loss on their disposal (if they were junked for $0).

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

I must be using a different version of TurboTax. I am using the business version installed on my PC.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How to deduct junked phones with loss. Form 4797 does not seem appropriate as they were not sold.

Yes, of course. Remaining depreciation is a loss, as stated in my question.

My issue is how to get the ordinary loss in Part II of the 4797 as the items were junked/abandoned, not sold or exchanged.

I’m obviously using a different program as I’m not stupid and can follow screens.

I overrode the Form and replaced “Part I” with “Part II” and it worked.

1120-S is filed. What a miserable waste of my Sunday. My return should have taken an hour max.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

ca4591203

New Member

alisafuller216

New Member

latdriklatdrik

New Member

shuli05131999

New Member

mormor

Returning Member