- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How should I report a cash adjustment from accrued interest on my Schedule K-1? Is this a QBI...

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report a cash adjustment from accrued interest on my Schedule K-1? Is this a QBI or would this be considered "other" income? Box 20, Code Z, 199A is used

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How should I report a cash adjustment from accrued interest on my Schedule K-1? Is this a QBI or would this be considered "other" income? Box 20, Code Z, 199A is used

If the amount is reported as box 20 code Z, the number is used in the calculation of your QBI deduction.

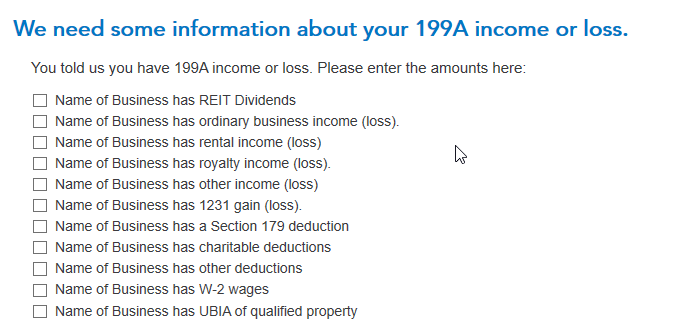

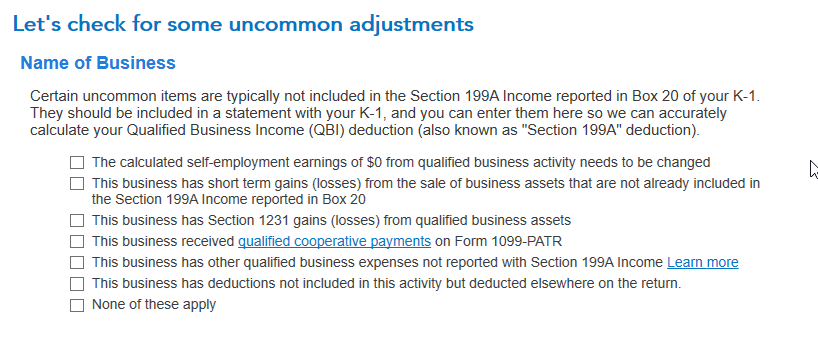

After you enter the K-1 code Z for the box 20 screen (net necessary to enter an amount on the box 20 screen), Continue on until you see the screen "We need some information about your 199A income or loss". That screen has boxes for "Other Income" and "Other Deductions" if your amount doesn't "fit" in any other box on that screen (or the following screen "Other uncommon adjustments". Here are the two screens where your code Z statement amounts are entered:

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

yingmin

Level 1

Kh52

Level 2

realestatedude

Returning Member

tbduvall

Level 4

in [Event] Ask the Experts: Tax Law Changes - One Big Beautiful Bill

breanabooker15

New Member