- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: How do I enter the 1250 gain from a 1099-div into turbotax buisness

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the 1250 gain from a 1099-div into turbotax buisness

I received a 1099-DIV from a brokerage account looks to be from a REIT in the account. Turbotax did not ask me to enter the amount.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the 1250 gain from a 1099-div into turbotax buisness

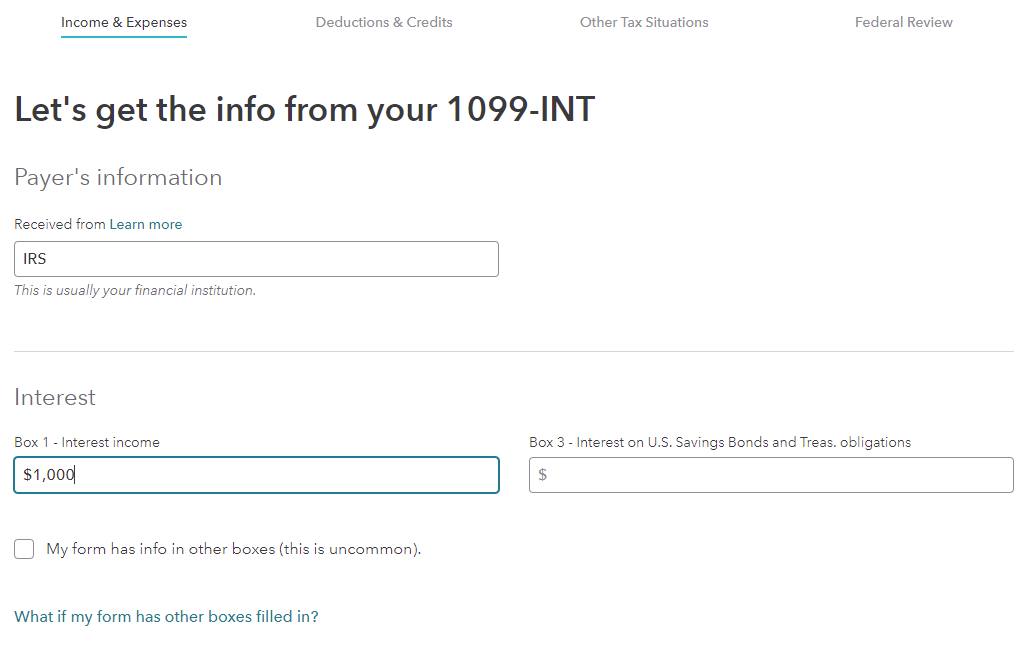

You would have to click the box that allows you to enter more information. It is the same as the one on the 1099-INT screens.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the 1250 gain from a 1099-div into turbotax buisness

Turbotax Business for an LLC does not have that box and it only asks for the total of

Ordinary Dividend Income

Qualified Dividend Income

Dividend Equivalent

Section 199A (REIT) Dividends

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the 1250 gain from a 1099-div into turbotax buisness

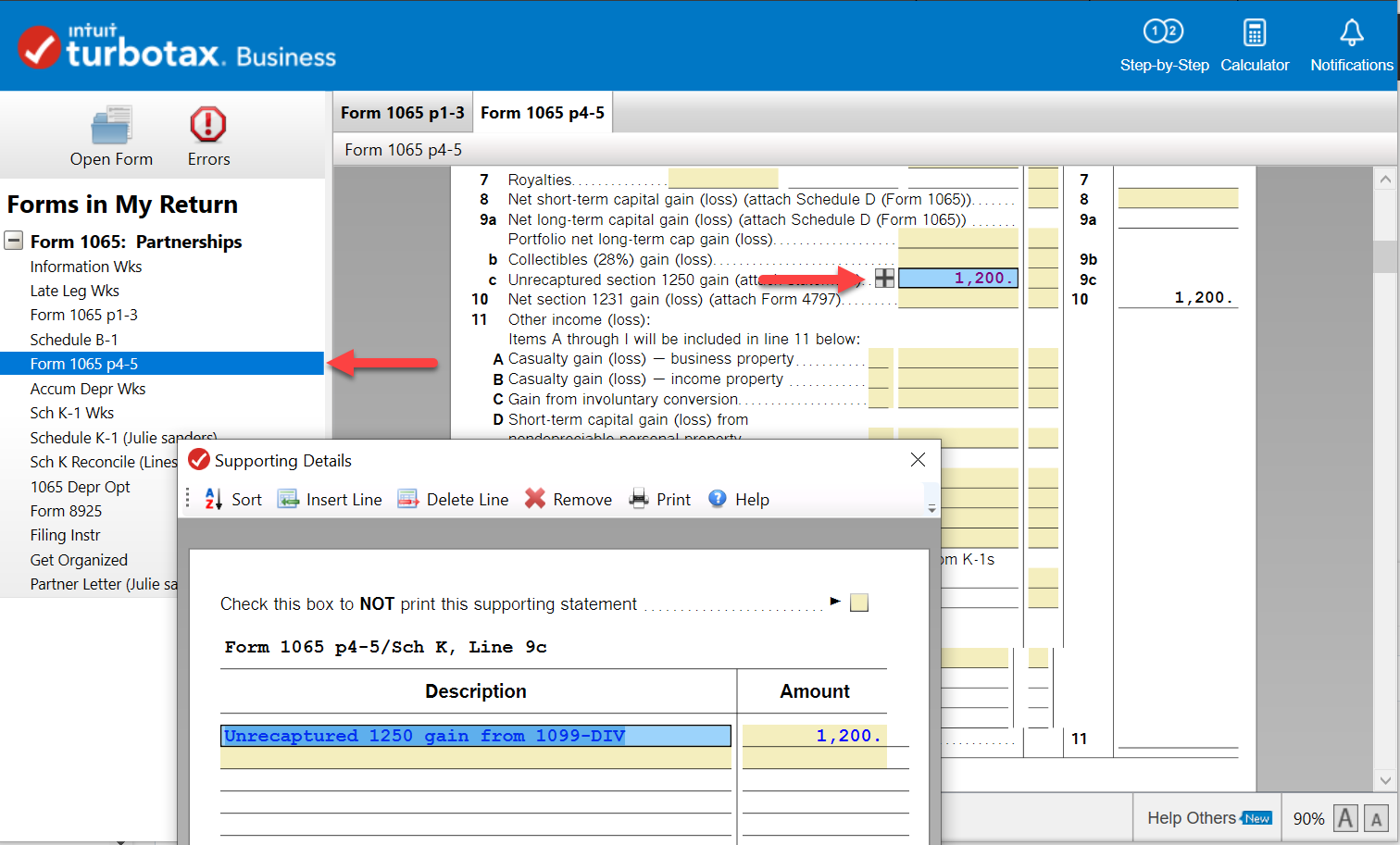

I am assuming you are filing a Form 1065 for your LLC.

You can enter this information using Forms mode:

- Select the white Forms icon in the upper right corner.

- Find Form 1065 p 4-5 in the list on the left and highlight it.

- Scroll down to line 9c.

- Click on the plus sign to the left of this field.

- Create your supporting statement by entering Unrecaptured 1250 gain from 1099-DIV as the description and enter the amount to the right.

- When you are done, you can return to the interview by clicking on Step by Step in the upper right corner.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter the 1250 gain from a 1099-div into turbotax buisness

Tried that already, It puts a value in line 10 which is wrong and then says its an error to place a value directly in line 10. Says to use form 4797. So I looked at 4797 and the smart worksheet for it has an entry for 1250 gain from a pass thru entity. I entered the info there and it filled out line 9c and line 10 correctly and also the generated K1s for the LLC. Don't know if it was the right way to do it since the 1250 gain was from a 1099-div and not a K1 that the worksheet calls out, but I figured the entity in the brokerage account that generated the 1250 gain is a REIT and would be a pass thru entity.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Rayjgizmo

New Member

Daniel123456

Returning Member

KMSapphire

Level 1

phillipschina

New Member

britt-godsell

New Member