- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: forgiven PPP loans on Schedule M-2 for 1120S

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

Thank you very much!

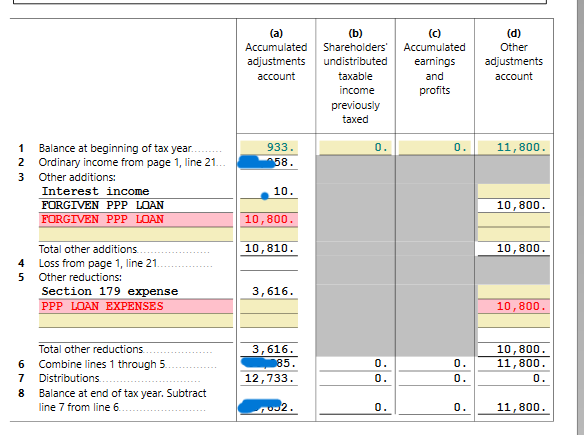

I was very confused... My 2020 PPP loan $11,800 was forgiven in JAN, 2021, so I reported as if forgiven in 2020. As you see on line1 M2, beginning of tax year , AAA $933 and OAA $11,800. (I hope this part is reported correctly)

I followed the instruction carefully along with your advice. I hope it's fine now.

I took the distribution $12,733 which is AAA $933 and OAA $11,800. Do I need to enter $933 on line 7 col (a) and $11,800 on line 7 col(d) separately?

Please advise me. I am a small company trying to do everything all by myself...

Thank you very much!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

No, you do not. But, the $10,800 is already reported in column d for line 3 - it should NOT also be in column a. Otherwise this is correct!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

I am so sorry... I feel that I might not understand this instruction (below). My forgiven PPP loan was used for my payroll 100%, so line2 of M2 includes PPP loan expenses that used for my payroll. So I entered $10,800 on line3 col (a) as well. If I don't enter $10,800 on line3 col (a), my stock basis amount is not consistent with the total of line8 col(a) and line 8 col(d) on M2. My stock basis is bigger by $10,800. My understanding is that my stock basis should equal to the total of line8 col(a) and (d) on M2. Am I not understanding correctly?

I am almost ready to file except this part... I should probably wait for Turbotax to be updated with this M2 instruction changes??

If column (a) on line 2 or line 4 of the Schedule M-2 includes expenses paid with proceeds from forgiven PPP loans, an S corporation should report that amount in column (a) on line 3 and in column (d) on line 5 of the Schedule M-2.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

You should enter $10,800 on line 3a AND on line 5d. 5d takes it back out.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

This is so confusing to a non Accountant, who just wants to file their Business Taxes. Return is due March 15th, and I have been watching these conversations about PPP and how it should appear and what overrides can be done. The same as other users, when I override, I get errors, etc. I have tried answering NO to PPP loan question and all shows up on M1 and M2 as expected. I have tried answering YES to PPP Loan, This results in a loss for the year, and the PPP loan, but nothing appears in M2 Line 5 Column D. Depending which way I do this, changes the M1, M2 & K1, plus sometimes the Balance Sheet will not reconcile. IS TURBOTAX GOING TO UPDATE THE PROGRAM TO HANDLE THIS CORRECTLY AND WHEN CAN WE EXPECT THAT?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

Will Turbotax be updated on M2 before MAR 15? Should I file an extension?

I am hesitating to file 1120S without M2 update as well. Would it be OK?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

forgiven PPP loans on Schedule M-2 for 1120S

Some things I know about my return, PPP loan forgiveness, and TurboTax:

- I'm finishing up on 03/15/22, and TurboTax is still doing this incorrectly. No update has fixed it.

- TurboTax 2021 is for sure handling PPP loans differently than it did for 2020.

- It has an interview prompt about forgiveness.

- This populates to schedule M-2 line 7D "Distributions." This is wrong and unfortunately can affect your "Distributions in Excess of Retained Earnings" number, (depending on YOUR retained earnings and YOUR distributions). For me, if for sure did.

- What I did is just select "No" to using the M2/Retained Earnings Worksheet Amount. This allowed me to fill in the Schedule M2 correctly. Start with the values and lines that were auto-populating and just enter them. Distributions in line 7D are zero, as they should be for me. I added the line for loan expenses to 5d, per the IRS instructions. I even changed my line 1D, which was wrong because TurboTax handled this wrong in 2020, and because the IRS recently released guidance about PPP loan forgiveness and the Other Adjustment Account. I tried to include a statement with the explanation about this, but TurboTax refuses to included it with the return when I print, so oh well.

- In the end, my Other Adjustment Account is at zero, where it should be without PPP loans affecting it.

- When I didn't use the Worksheet amounts, in the error check, TurboTax made me move interest income from the worksheet where it originally was directly to Schedule K, line 4. No big deal.

- I was able to e-file.

I think (but am not 100% sure) that covers everything I did, but if you have questions, reach out and I can look at my return and worksheets for you.

TurboTax really needs to ask you if you got forgiveness, how much was used for expenses, and do all this for you. Insane that it doesn't. And not printing that supporting statement? Well that's just buggy.

Good enough for me! If the IRS wants to question anything, I'll let them. I seriously doubt it will be an issue.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bwcland1

Level 1

zalmyT

Returning Member

ew19

New Member

bravehomesnc

New Member

Filing jill

Level 1