- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

Thank you very much!

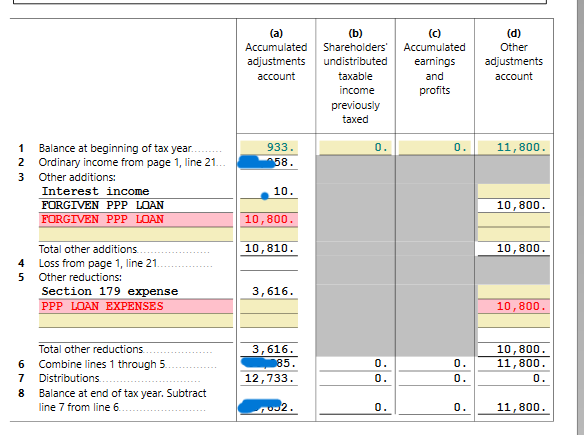

I was very confused... My 2020 PPP loan $11,800 was forgiven in JAN, 2021, so I reported as if forgiven in 2020. As you see on line1 M2, beginning of tax year , AAA $933 and OAA $11,800. (I hope this part is reported correctly)

I followed the instruction carefully along with your advice. I hope it's fine now.

I took the distribution $12,733 which is AAA $933 and OAA $11,800. Do I need to enter $933 on line 7 col (a) and $11,800 on line 7 col(d) separately?

Please advise me. I am a small company trying to do everything all by myself...

Thank you very much!

February 15, 2022

4:45 PM