- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: Dispose of an Asset

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

I had a piece of equipment for our business that had a catastrophic failure and wasn't worth repairing so it was just disposed of. How do I indicate that on TT? We didn't get any money for disposing of it, so there was a loss. Thanks so much.

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Report it as if you sold it with proceeds of $0.00. This will result in a loss of whatever the undepreciated cost basis is. If the equipment was fully depreciated, then there will be no loss (or gain) on the disposition. To report in TurboTax Home & Business:

- Type "Sale of Asset" into Search

- Click on "Jump to sale of asset"

- Follow the Step-by Step to enter your asset sale.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Thank you, exactly what I needed!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

You're welcome. Thanks for using TurboTax!

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Actually, reporting it as a sale of $0 is just flat out wrong. If you work through the asset, when you come to the screening "Did you stop using this asset in 2020?", select YES. Then one or two screens later you will have a screen called "Special Handling Required?" Read the information on that screen so you will understand why I am telling you to click YES. Then click YES.

Note that you will "NOT" be asked for any sales information then.

If the item was not fully depreciated, then you can claim the difference between the depreciation value and the depreciation already taken, as a loss. Otherwise, if the item was fully depreciated, then you have no loss to claim since the item was fully depreciated and deducted from taxable business income already.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Hi Carl,

I've read many of your posts on this subject regarding disposition of depreciated assets with regard to the sale of a rental property which has appreciated. You often say one of two things I believe:

1) Answer YES to the "Special Handling Required?" question so that you won't be asked about sales info, or

2) If you DO NOT say YES to the"Special Handling Required?" question (and therefore you are asked to input a sales price), if the overall asset (say a rental property) has appreciated, when disposing of an appliance like a refrigerator, you have also said that a person should enter a sales price of $1 more than the original cost basis of that asset (so it does not cause problems when you recapture depreciation).

I'm confused - which one should I do?????

Also, regarding the second option above, what if that asset (refrigerator that originally cost $1000) has depreciated to $0 over many years? Should you enter the sales price of $1001 or $1 (current value has depreciated to 0)?

Thanks!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Many are of the mistaken belief that depreciation is a permanent deduction. It is not, except under specific circumstances. The bottom line is, if you did *not* sell the asset, click YES.

Otherwise, if you sold the rental property at a gain then you must show a gain on all assets. The sale price for all assets needs to be "at least" $1 more than the original cost basis. Doesn't matter if it's $1 more or $10,000 more. A gain is a gain regardless. This is the only way the TurboTax program will "correctly" recapture the depreciation and tax it at the ordinary income tax rate, instead of the capital gains tax rate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Thanks Carl. Understood.

And then based on other posts I have seen, I would add the total of the sub-assets (refrigerator, countertops, flooring) and subtract them from the house sales price so that the total (land/improvements) equals the actual overall selling price.

Perfect timing as I’m trying to finish my taxes up tonight. Happy Easter.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

I would add the total of the sub-assets (refrigerator, countertops, flooring) and subtract them from the house sales price so that the total (land/improvements) equals the actual overall selling price.

I think I"m following you. Bottom line is, the total sales price of the structure, land and all other assets equals your total contracted sales price as shown on the ALTA closing document.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

We are on the same page Carl. Thanks for all the help. I was stymied by this as this was the first time selling a rental that was depreciated and had depreciated improvements that I installed later. Actually sold 2 of them in 2021. TT good about so many things but lacking in explaining this to first time sellers. Cheers.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Carl,

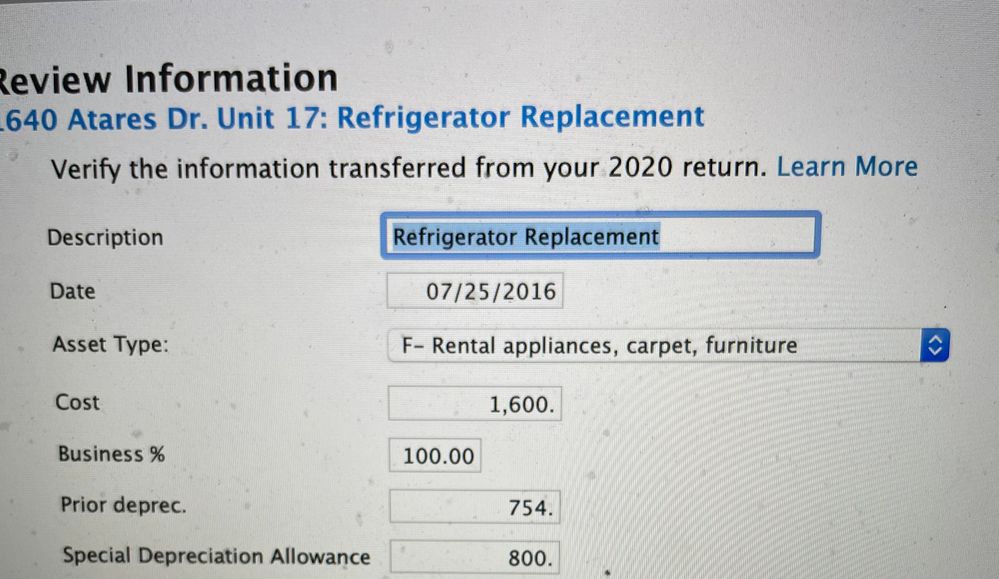

Forgot to clarify one thing. What if the assets have been depreciated, and in my case, depreciated almost to zero? Do I add a dollar to the current depreciated value or to the original cost? Also there is something called “special depreciation allowance” which I don’t understand relative to regular prior depreciation. Any insight would be helpful. For example, if something has been depreciated from $1000 to $500, do I make the sale price $1001 or $501?

Attached is a screen price of my refrigerator replacement as another example.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

The amount of depreciation taken is not relevant here. It could be 1% depreciated or 100% depreciated. If you sold the property at a gain, then you must show a gain on all assets sold as a part of that sale. The amount you enter must be "at least" $1 over the original cost of the asset. That is the only way the total depreciation taken can be completely and correctly recaptured and taxed as ordinary income, instead of being taxed at the capital gains tax rate.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Dispose of an Asset

Thank you Carl. I completely appreciate you taking time during busy tax season to help people like me answer these questions. It is very generous of you. I wish I could buy you a beer. Have a great day Sir!!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

user17549413515

New Member

Kenn

Level 3

shari-l-w-coles

New Member

eedavies4

New Member

Thomasketcherside2

New Member