- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- Re: 1099-NEC?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Non-employee compensation is now reported on Form 1099-NEC instead of a 1099-MISC. To enter the income you received:

- Click Wages & Income

- Under the Self-Employment section, click the Start/Revisit box next to Self-employment income and expenses.

- Continue through the screens, entering the requested information.

- On the screen, Let's get some details from, XX's 1099-NEC, enter the amounts on the form.

@toolrep

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I am 18 years old and worked part time for a goat farmer and received a 1099 NEC for my $3400 income. I am not a business, but Turbo Tax wants me to fill out a business form.

Please help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Cannot enter the dollar amount into 1099 NEC, Need upgrade forms.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

For tax purposes, self-employment income includes any part-time businesses or "side work" performed in which you are in business for yourself, rather than another person. You are also considered self-employed if you engage in business-like activities where you intend to make a profit.

After you input your 1099-NEC, you must answer all of the questions after the input screen so it flows to either a Schedule C (self-employment income) or Other Income. Please keep in mind that if you have your 1099-NEC flow to Other Income, you will not be able to deduct any expenses in connection with earning this income.

To assign your 1099-NEC to either a Schedule C or Other Income, please follow the steps below:

- Open your return.

- Search for 1099-NEC with the magnifying glass tool at the top of the page.

- Click on the Jump to 1099-NEC link at the top of the search results.

- Click Edit next to your 1099-NEC.

- On the page titled Guess what? You can deduct expenses for the example work choose Yes, I have expenses to deduct to assign this income to a Schedule C or No, I don't have expenses related to this income if it should flow to Other Income.

- If you answer Yes to #5, on the page titled Self-employed 1099-NEC Income, you can add a new self-employment business on this screen.

If you go the Schedule C route, please confirm your 1099-NEC was linked to your Schedule C and enter any relevant expenses connected with this income.

Please follow the instructions below:

- Search for Sch C with the magnifying glass tool at the top of the page.

- Click on the Jump to Sch C link at the top of the search results.

- On the page titled Your 2020 self-employed work summary, you should see your 1099-NEC listed with the corresponding amount.

- Click review next to the income from your 1099-NEC.

- Follow the on-screen instructions on the following pages.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

Where do I enter my 1099-NEC income?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

There is a section in the federal screens to enter your 1099-NEC. You can either enter your nonemployee compensation so it flows to a Schedule C (self-employment income) or enter it so it flows to Other Income. It is important to note that if it is considered Other Income, you will not be able to deduct any expenses that relate to your 1099-NEC income.

For tax purposes, self-employment income includes any part-time businesses or "side work" performed in which you are in business for yourself, rather than another person. You are also considered self-employed if you engage in business-like activities where you intend to make a profit.

To enter your 1099-NEC, please follow the steps below:

- Open your return.

- Search for 1099-NEC with the magnifying glass tool at the top of the page.

- Click on the Jump to 1099-NEC link at the top of the search results.

- Click Add a 1099-NEC.

- Enter the information as shown on your form.

- On the page titled Guess what? You can deduct expenses for the example work choose Yes, I have expenses to deduct (if you would like it to flow to a Schedule C) or No, I don't have expenses related to this income (if you would like it to flow to Other Income.

- If you choose to have this income flow to a Schedule C, you will see a page titled Self-employed 1099-NEC Income. You can select the Schedule C you are inputting this income for. If this is a new Schedule C for this year, you can add a new business on this screen.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

i forgot file this

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

@ cironey

If you’re saying that you didn’t file 1099-MISC or 1099-NEC with your original return and you should have, please see the TurboTax Help article How to amend (change or correct) a return you already filed for instruction on how to amend your previously-filed tax return.

If that’s not your issue, please re-post.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

How do I enter the amount on the 1099-NEC into Turbotax

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

The following FAQ provides the steps: Entering 1099-NEC in Turbo Tax @jeff2721.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I am still not finding the 1099-NEC option. I tried walking through both of your steps with no luck.

Please help. Do I just add my information into the blank lines in General?

So frustrating. Thank you for any help.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

@Kimbyk Type 'schedule c' in the Search area, then click on 'Jump to schedule c'.

If you have not set up your Business yet, you will be asked a few questions about your Business.

Choose 'Add Income for this Business'.

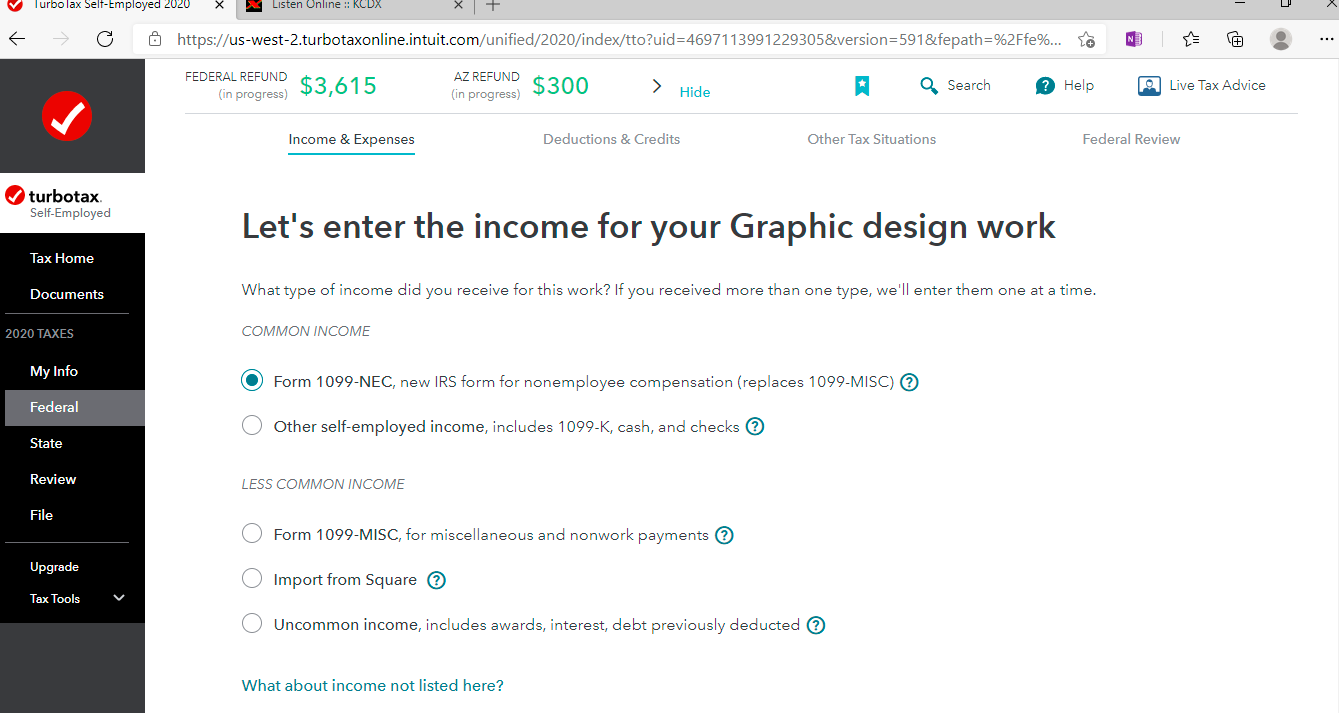

On the next screen, indicate you want to enter a 1099-NEC (screenshot).

Click this link for more info on Form 1099-NEC.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

I followed directions to enter the new 1099-NEC. TT transferred my former 1099-Misc files to my 2020 tax form and processed my business expenses under 1099-Misc. However, on the error check-out, TT wants more information on the 1099-NEC. Now my income on the 1099 has been counted twice. I only have one amount of income which is correctly stated on the 1099-NEC. How do I correct this ?

jbw12

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

If you did not receive a Form 1099-MISC, you would need to remove the 1099-MISC from the program. Here are the steps:

In TurboTax online,

- Sign into your account, select Pick up where you left off

- From the left menu, select Tax Tools, click on the drop down arrow

- Select Tools

- Under Other helpful links, choose Delete a form

- Select Delete next to the Form 1099-MISC and related worksheets and Continue with My Return

Then, you will need to enter the information in both Form 1099-NEC and Schedule C sections. You would start from the 1099-NEC section under "1099-MISC and Other Common Income". You would then follow prompts to tell the program you are filing a Schedule C. As it creates a Schedule C for you, you will need to go to the Schedule C portion separately to confirm your income amount, add related expenses and complete required information.

In TurboTax online, here are the steps:

- Sign into your account, select Pick up where you left off

- From the upper right menu, select Search and type in 1099nec and Enter

- Select the Jump to 1099nec

- Follow prompts to complete the section

Then

- From the upper right menu, select Search and type in schedule c and Enter

- Select the Jump to schedule c

- Next screen, "Your 2020 work summary" under your self employed business, select Review

- Continue to enter related expenses and other required information

@ jbw12

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

1099-MISC or 1099-NEC?

If i get 1099 misc from Ford for a bonus for sell ina specific truck, do I need to file a self employment tax return.

I work for a dealership network and our truck suppliers offer spiffs. I used to just file these as other income on a 1040 ??

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

Bradley

New Member

ngdonna2020

Level 2

Alex012

Level 1

ARJ428

Returning Member

rio4

New Member