- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- No these do not need to be reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

No these do not need to be reported.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

I submitted my federal tax for 2019 and it was accepted.

I just receive a Schedule K-1 (form 1065) with $0 dollars of income/loss. Do I have to file an amended federal return?

Thank You,

Susan

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

No, if there is no taxable income you do not have to amend.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

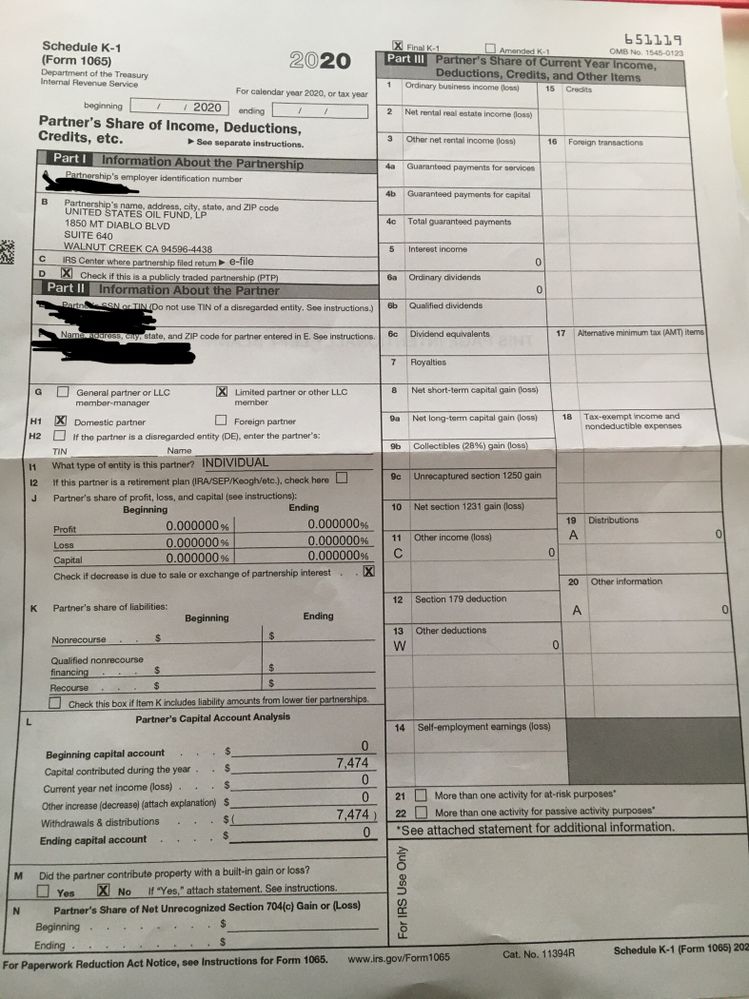

Hi,

I just received a K1 (form 1065) a tax package from USO. I sold all my shares in 2020 with a loss. On the paper, it said $0 interest income, dividends, and negative number in Other income (loss). Basically, I did not make any profit and sold the stocks. Do I still have to fill the tax package or report this ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Yes, you need to include Form K-1 to your tax return, even if there is no income. The loss form the partnership can offset your other income.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

so is it mandatory for me to report it or I can choose not to?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

It is not mandatory that you report it. The IRS matches income, not negative income.

It would probably be to your benefit to include the loss since it would reduce your taxable income.

Here is a link to help in entering a K-1.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

I sold my ETF - USO LP completely at loss.

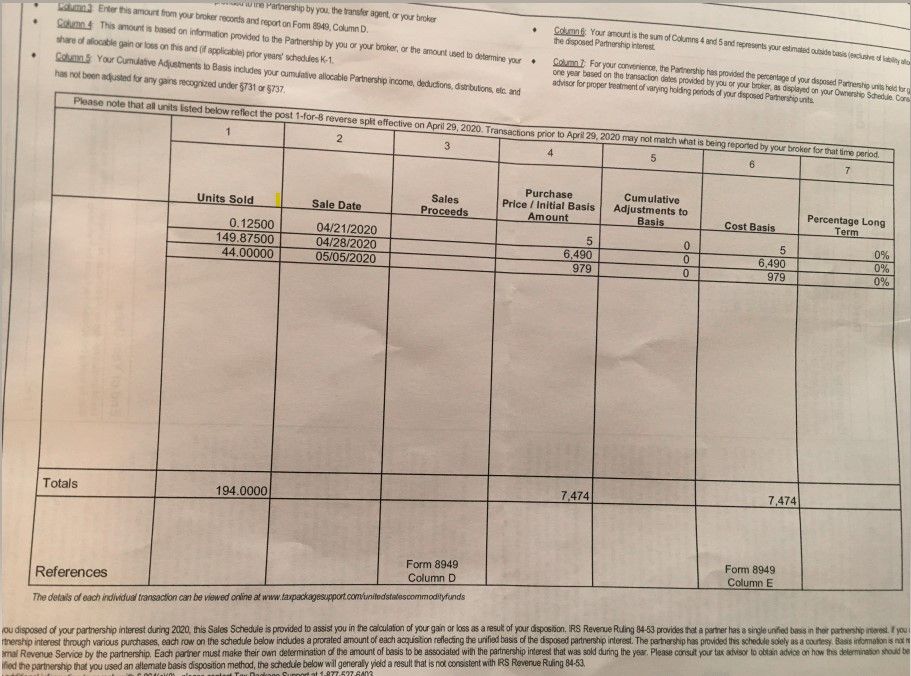

My 1099-B correctly shows the loss amount, but my Schedule K-1 1065 are all empty and has just 0 amount from box 1 to 22 on the right side of the form. Except on the left side, in Capital account Analysis, it shows a positive number in line Capital contributed during the year and same number but in parenthesis in line Withdrawals & distributions, that specific dollar number is my cost basis.

1. Does this Schedule K-1 needs to be amended to show my final loss since I sold all shares and has a loss?

2. If I just correctly report my loss in form 8949 based on number found on 1099-B, do I still have to file the Schedule K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Yes, the Schedule K-1 should be amended, and yes, you must enter in the K-1 and report the 1099-B using the basis and the loss info from the K-1.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Thanks Renee,

I contacted them, and they are saying as long as the transaction is correct (they mean Schedule K-1 Ownership Schedule page showing correct number of shares bought and sold and the final number of share is 0), there is no need to amend the Schedule K-1...

In the Page of Sales Schedule, my Schedule K-1 asks me to reference my own Form 8949 for Sales Proceeds which shows empty again on my Schedule K-1 Sales Schedule Page. And the Cumulative Adjustments to Basis are showing all 0, should I enter the adjustment myself and file the K-1?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

If the K-1 form does not show any income or loss and you report the gain/loss correctly on your form 1099-B entry, you do not need to make the K-1 entry in my opinion.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Hi Thomas,

I just have received my K-1 form from 2015 to 2019, which have never been filed in my previous tax returns. But they all have no gain or loss, do I need amend previous return to add my K-1 Form 1065?

Thanks,

Belle

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

PenelopeLively

New Member

nanjlo

Level 1

kevinbsmith

New Member

avast

New Member

alecbhamani8

New Member