- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- K1 No Income - Do I need to report?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

The IRS requires you to report your income, not "tax forms".

If you have K-1s that do not report any income, there is no reason to report them on your tax return - especially if they were prior year returns you would have to amend.

There may be favorable tax items on those K-1s that aren't obvious, but as long as you aren't missing any taxable income you don't need to enter them.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

The Schedule K-1 shown here came in after I have filled my 2019 return in 2020. It has losses in Part II and Part III. Do I have to amend my 2019 return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Filing an amended return to report losses reported on a K1 received after filing our tax return may result in a refund.

You are required to file an amended return to report all of your income.

You are not required to amend to report losses.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

What if it shows $1 for ordinary, interest income and long term gain?

do I still need to report it?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

A Schedule K-1 is like a W-2 or 1099. K-1 information is reported to the IRS and the IRS will likely compare the information on the tax return that has been submitted against the information that the IRS received independently.

Would recommend that you report the K-1 information.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

I have this exact same thing. It happens if you sell in the same month as you buy so the futures contracts dont get sold/purchased by the fund in the case of USO. Still not sure what to do, if anyone has any further guidance.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

I traded UNG in 2022 so received schedule K-1.

I held UNG position for a couple of weeks and sold with a small profit.

However, at Box 8. Net Short-Term Capital Gain/loss, zero amount. Actually all boxes in Part III are empty.

2022 Sales Schedule lists unit sold, sale date, purchase price, cost basis

Transaction schedule lists buy and sell, end of year units is 0

I am confused if I need to report the short term gain, even though it is zero in Box 8?

I called the firm sent out the report, they asked to consult with Tax pro.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

If the K-1 form does not show any income or loss and you report the gain/loss correctly on your form 1099-B entry, you might be ok excluding the K-1 from your return. However, if this is a Final K-1, you should include this in your return and indicate "Final" when prompted in the K-1 Interview.

Please review your Form 1099-B to see if it correctly reflects these sales.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Thanks for your quick response.

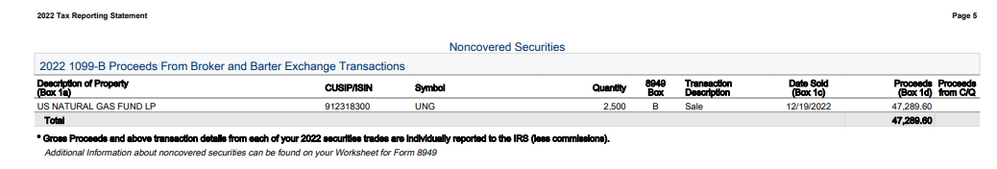

I look at 1099B, Proceeds for UNG is $47,289.60, no gain or loss shown there. Pls see screen shot below.

While on my Schedule K-1, cost in 2022 Sales Schedule, Box 4 (Purchase price) and Box 6 Cost Basis is $44,705.00.

Pls advise what I should do? Thanks a lot!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Since the K-1 shows the Cost Basis you should enter this amount when completing the sale of the investment on Form 1099-B if you have not done so yet.

Also, review the Supplemental Pages that should be attached to the K-1 package for additional information to support completing the K-1 entries.

Here's where you enter or import your 1099-B in TurboTax:

- Open or continue your return, if you haven't already

- Select Search, enter 1099-B, and select Jump to 1099-B

- You can also go to Federal, then Wages & Income, then Investments and Savings

- Select Start or Revisit next to Stocks, Cryptocurrency, Mutual Funds, Bonds, Other (1099-B)

- Select Okay! on the screen, Time to kick off your investments! OR Yes on the screen Did you sell any of these investments? then Continue

- If you see Your investments and savings or Your investment sales summary, select Add investments or Add more sales

- When you reach Let's import your tax info, choose how you want to enter your 1099-B:

- To import your form, select your brokerage or a financial institution from the list. Enter your sign-in credentials for your account, then select Get my form

- If you want to enter your 1099-B manually, select Enter a different way, then select your investment type on the next screen

- On the following screens, answer the questions about your 1099-B

- When you reach the Review your sales screen, the form you just entered should be listed

- If you need to add another 1099-B, select Add another sale. Otherwise, Continue

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K1 No Income - Do I need to report?

Thanks a lot! That makes prefect sense.

I update accordingly.

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

kimbev1202

New Member

hcaltrend2_4

New Member

msbt4747

New Member

reece-davidj

New Member

rwourman2001

New Member