- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- K-1s for Multiple States

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

I was hoping that Turbotax can help me with that, instead go to each State to read and calculate manually

can TT help for this matter?

tnx

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

Amy, great answer. In my case, the tax was paid by the trust to District of Columbia. So how do I get my credit for that tax paid from my home state?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

@mike296 Make sure to do the DC tax return as a non-resident first and then start your home state tax return. TurboTax will transfer the tax paid to your resident state return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

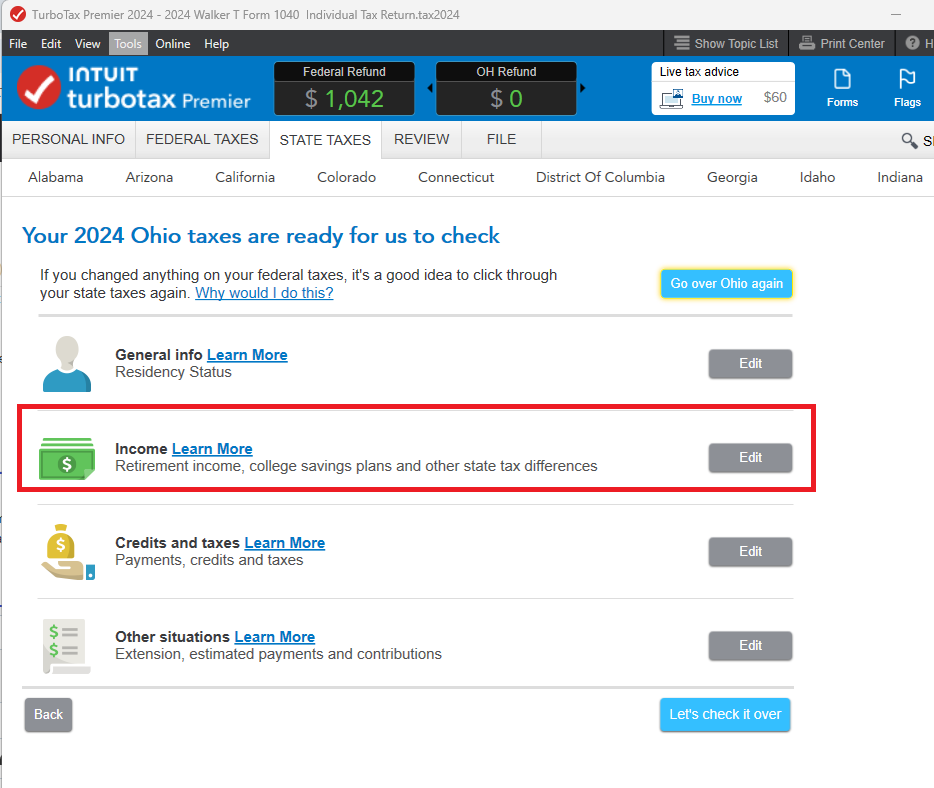

I am struggling to figure out how TT is pulling the income on US treasury notes from my K1 and dividing it between my two state returns. To be clear, pretty sure my issue is user error. I lived part year in Ohio and the rest of the year in Virginia. It appears to be deducting my income on US treasury notes from both states equally. Not the roughly 1/3 2/3 like it should.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

In most state interviews, TurboTax presents different income items and asks you to allocate the amount from your Federal return to that state (or to allocate what does NOT belong to that state; watch the wording on that screen).

If you have calculated the amounts that should belong to each state, you can enter them yourself. You may need to step through each state interview to locate where it asks about income on US Treasury notes.

Otherwise, make sure the dates you reported that you lived in each state are correct.

Here's more info on Allocating Income for a Part-Year Resident..

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

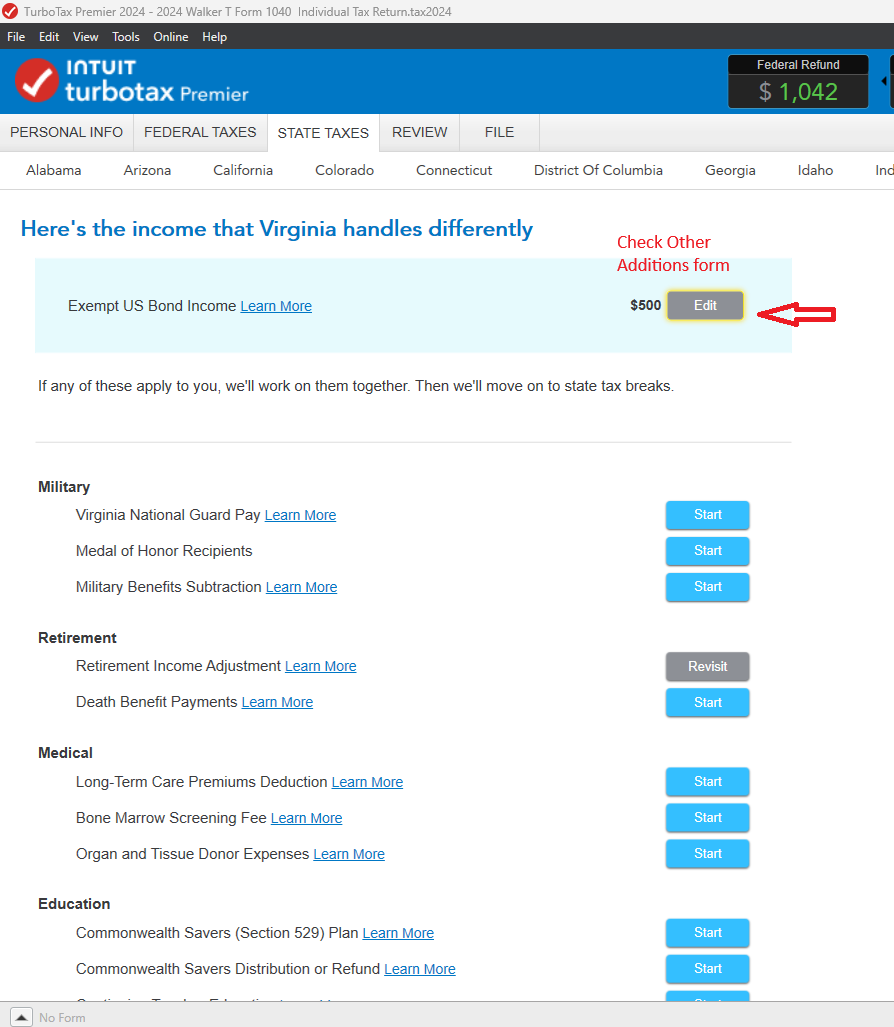

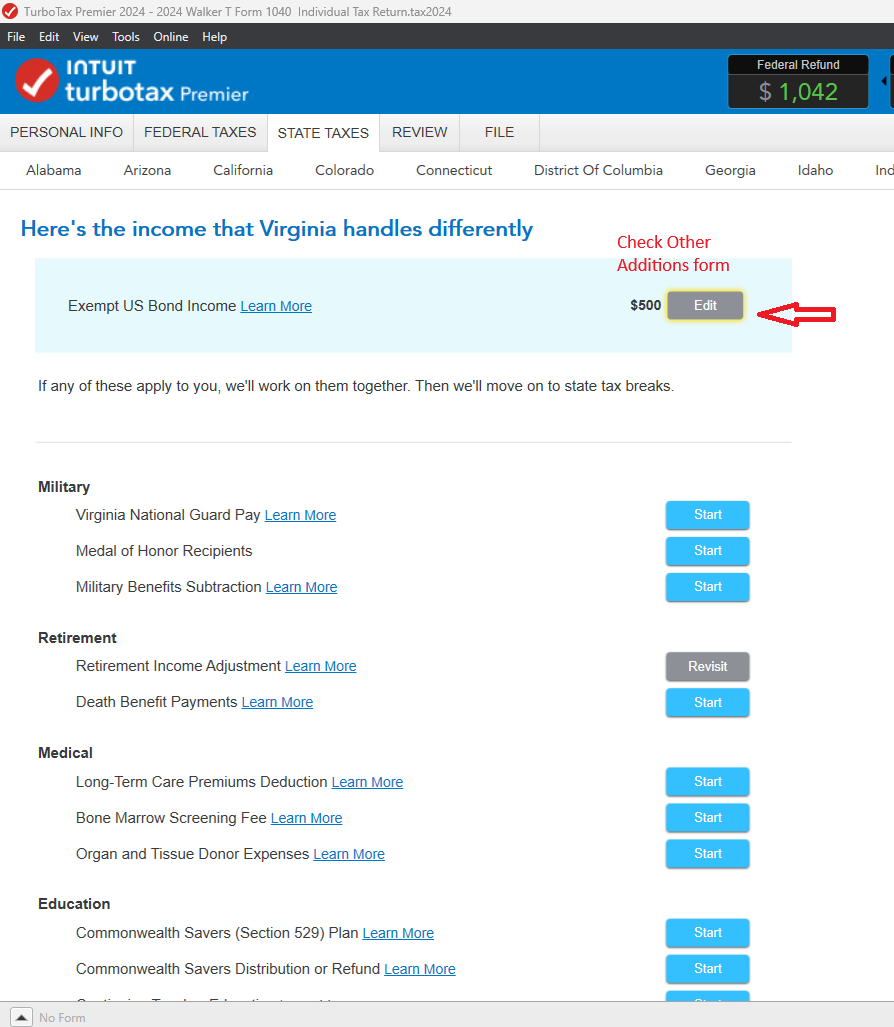

The Interest income from U.S. Treasury notes is exempt from state and local income taxes but is subject to federal income tax.

What is the reason to split per States that income?

I think it should not be reported to a State, or should it?

Each state will get copy from Federal return , where the Interest income from U.S. Treasury notes is reported and taxed.

p.s. my original question remains - how to split single K-1 across multiple States without creating so many K-1 per State and per Box 1 and Box 2?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

K-1s for Multiple States

In your state interviews, info is carried from your Federal return. Each state has its own filing requirements, so you may not need to file in all states if the income is below that. You can look up filing requirements from this state DOR Link

If the interest income from US Treasury Bonds is exempt from tax in any state, you can deduct it out in your State Return, if your state did not automatically exclude it (if you're required to file in that state).

Go through the state interview carefully. Look for a screen that says 'Here's the income that xxxx handles differently'.

Here's more info on How to File a Non-Resident State Return and Why Would I File a Non-Resident Return.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- « Previous

-

- 1

- 2

- Next »

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

anth_edwards

New Member

user17525140957

Level 2

Babyelise88

Returning Member

orenl

New Member

K1 form multiple boxes checked

Returning Member