- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

In your state interviews, info is carried from your Federal return. Each state has its own filing requirements, so you may not need to file in all states if the income is below that. You can look up filing requirements from this state DOR Link

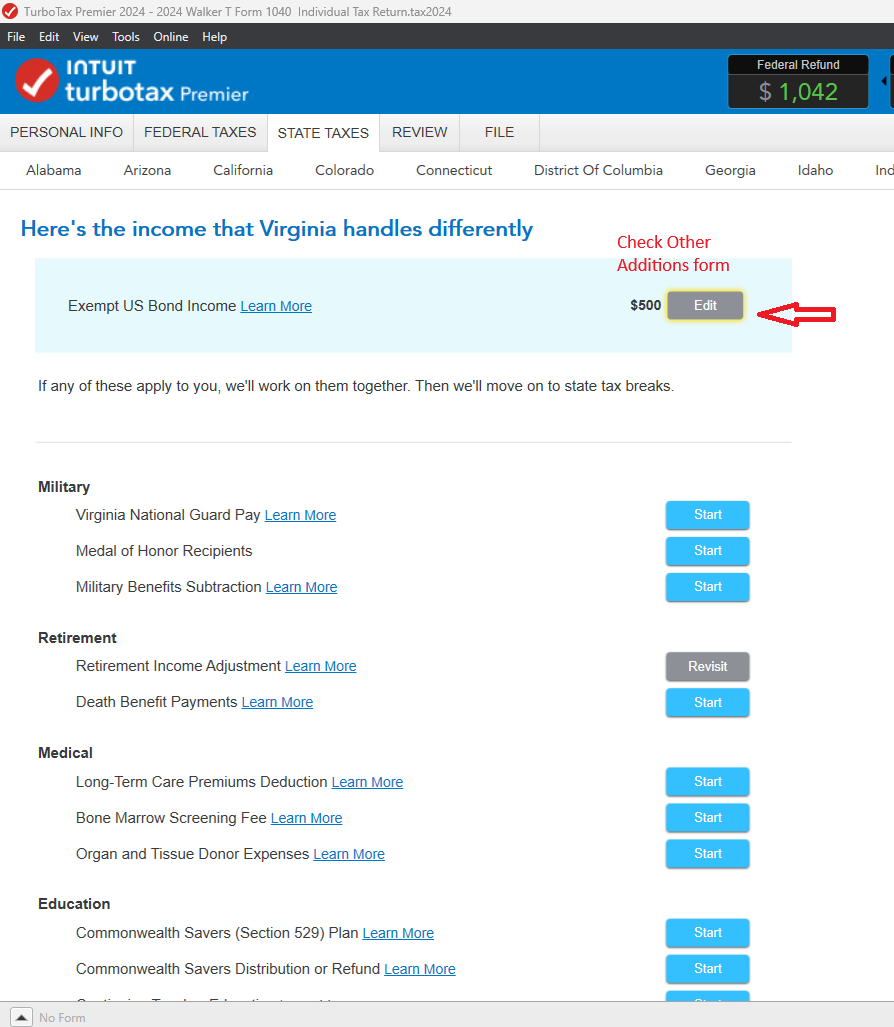

If the interest income from US Treasury Bonds is exempt from tax in any state, you can deduct it out in your State Return, if your state did not automatically exclude it (if you're required to file in that state).

Go through the state interview carefully. Look for a screen that says 'Here's the income that xxxx handles differently'.

Here's more info on How to File a Non-Resident State Return and Why Would I File a Non-Resident Return.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

March 5, 2025

7:33 PM

1,025 Views