- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

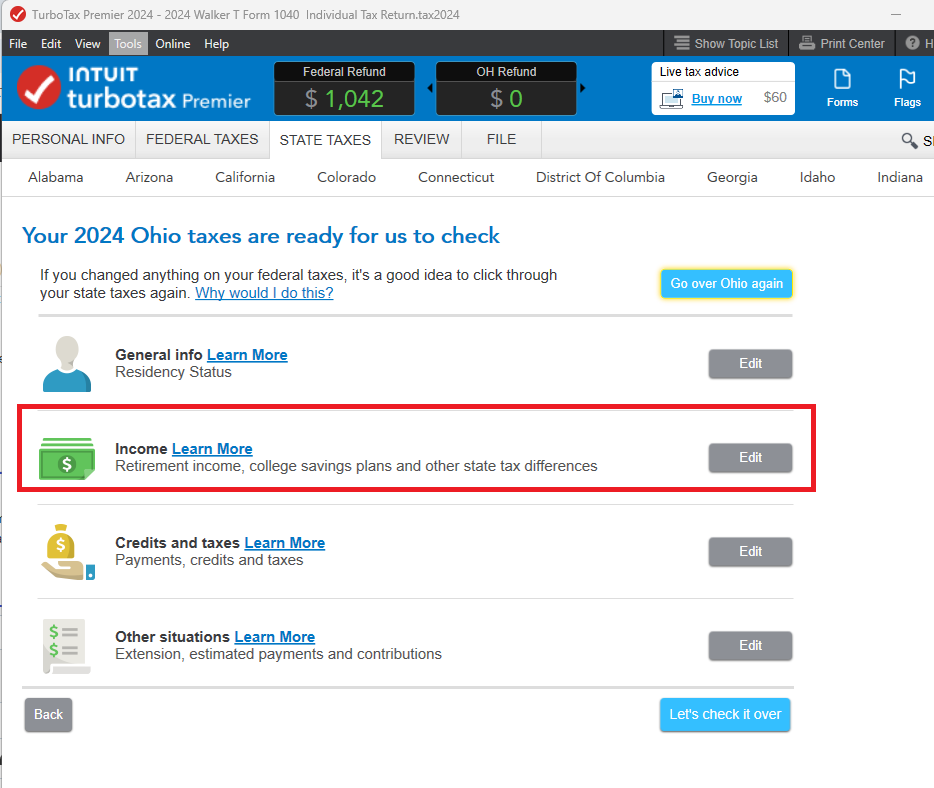

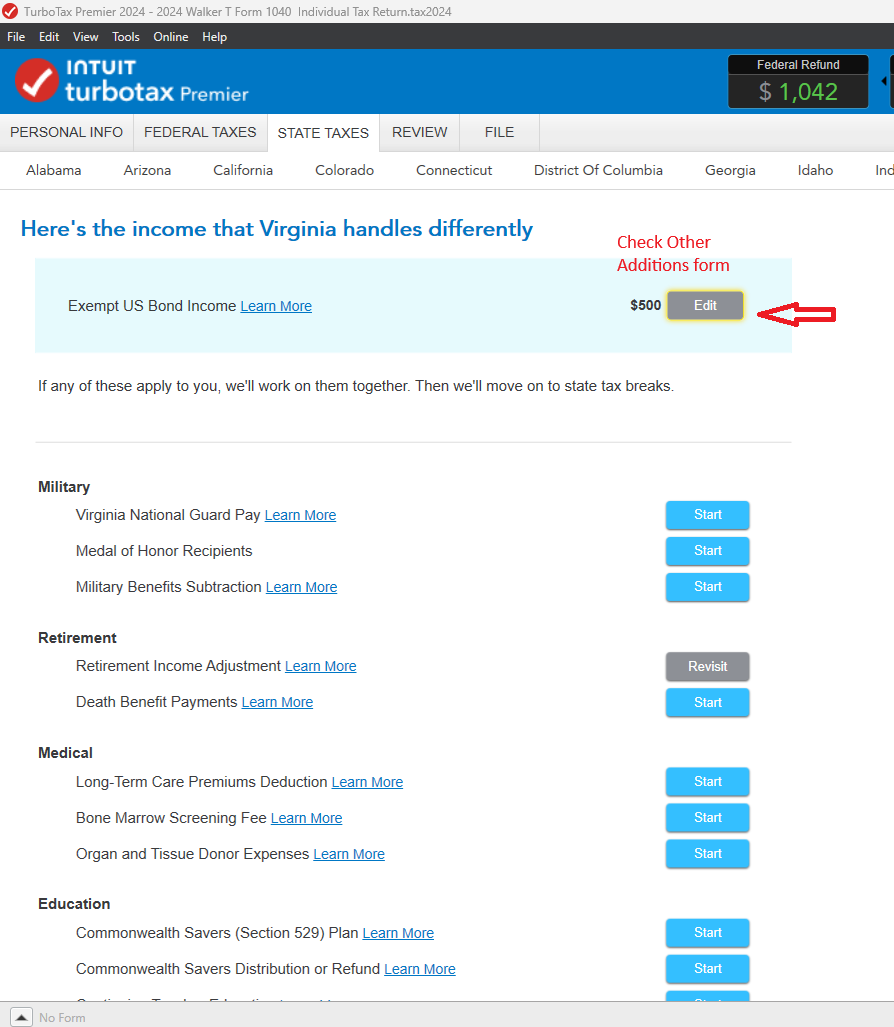

In most state interviews, TurboTax presents different income items and asks you to allocate the amount from your Federal return to that state (or to allocate what does NOT belong to that state; watch the wording on that screen).

If you have calculated the amounts that should belong to each state, you can enter them yourself. You may need to step through each state interview to locate where it asks about income on US Treasury notes.

Otherwise, make sure the dates you reported that you lived in each state are correct.

Here's more info on Allocating Income for a Part-Year Resident..

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 27, 2025

5:45 PM