- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I received a 1099-K from Ebay for online sales. I entered it on Schedule 1 (by TurboTax H&B) but there was no way to enter my costs, should I enter instead Schedule C ?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-K from Ebay for online sales. I entered it on Schedule 1 (by TurboTax H&B) but there was no way to enter my costs, should I enter instead Schedule C ?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-K from Ebay for online sales. I entered it on Schedule 1 (by TurboTax H&B) but there was no way to enter my costs, should I enter instead Schedule C ?

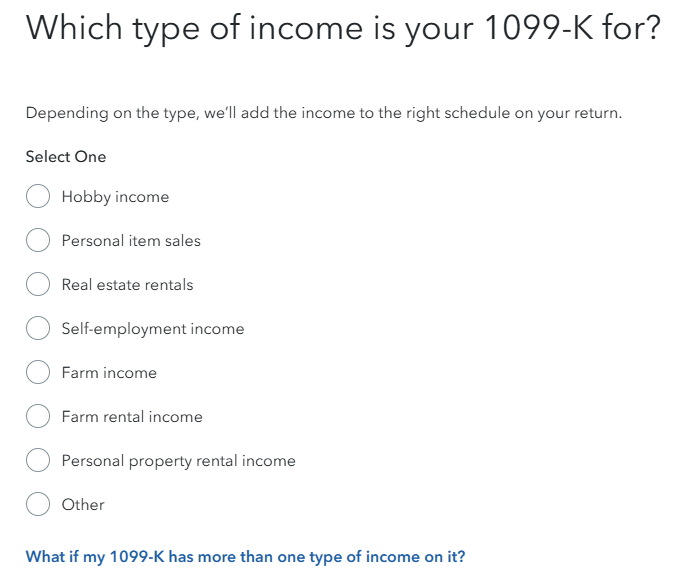

An IRS form 1099-K from Ebay reporting online sales could report hobby income, personal item sales and self-employment income among other kinds of income. A complete list is here.

Schedule C presumes that you are engaged in a self-employment activity. You may claim ordinary and necessary expenses against the self-employment income claimed. Self-employment income is subject to self-employment tax as well as income tax.

If you elect to report self-employment income, first create your self-employment activity under BUSINESS and BUSINESS INCOME AND EXPENSES across the top of the screen. Then select Start to the right of Profit or Loss from Business.

Report the IRS form 1099-K income by selecting Start to the right of Forms 1099-MISC, 1099-NEC, 1099-K, gross receipts and sales.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-K from Ebay for online sales. I entered it on Schedule 1 (by TurboTax H&B) but there was no way to enter my costs, should I enter instead Schedule C ?

Hi James, thanks for your answer but it brings up a question for me. Hobby or self employment? I'm retired and got into this business to support my hobby of collecting coins. To me, I feel it's more a hobby as I don't need the income. I originally, entered it on schedule 1 but I couldn't find how to claim my expenses (buying stock, mailing cost, and fees). I didn't think taking the amount on my 1099-K, subtracting my expenses, and using that number on schedule 1 would work. It think that would trigger some IRS action because I didn't use the number on my 1099-k.

Thanks in advance for your reply,

John

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I received a 1099-K from Ebay for online sales. I entered it on Schedule 1 (by TurboTax H&B) but there was no way to enter my costs, should I enter instead Schedule C ?

You are correct. Hobby activity or activity not for profit limits deductions for expenses against the income.

IRS Publication 525 Taxable and Nontaxable Income, page 32 states:

Activity not for profit

You must include on your return income from an activity, even if you don't expect to make a profit from that activity. An example of this type of activity is a hobby or a farm you operate mostly for recreation and pleasure. Enter this income on Schedule 1 (Form 1040), line 8j. Deductions for expenses related to the activity are limited. They can't total more than the income you report from the activity and can be taken only if you itemize deductions on Schedule A (Form 1040).

This TurboTax Help explains that beginning in 2018, the IRS doesn't allow you to deduct hobby expenses from hobby income. You must claim all hobby income and are not permitted to reduce that income by any expenses.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

DavidRaz

New Member

robgriffith

New Member

scatkins

Level 2

niyidukundaplacide7

New Member

SB2013

Level 2