- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

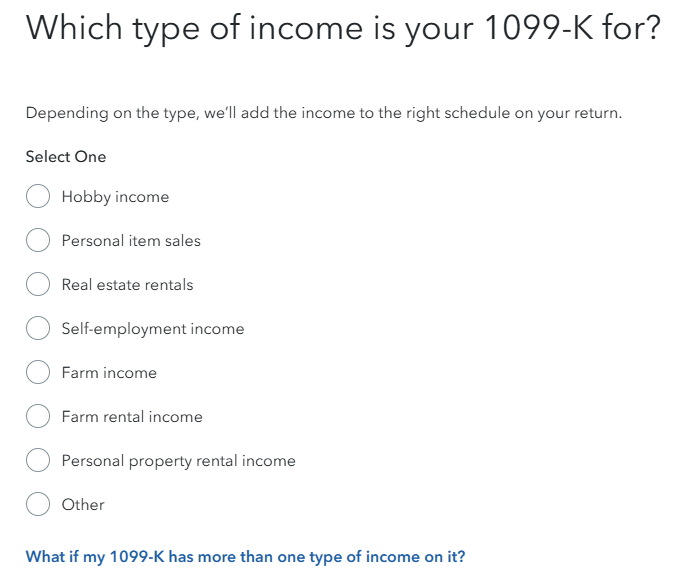

An IRS form 1099-K from Ebay reporting online sales could report hobby income, personal item sales and self-employment income among other kinds of income. A complete list is here.

Schedule C presumes that you are engaged in a self-employment activity. You may claim ordinary and necessary expenses against the self-employment income claimed. Self-employment income is subject to self-employment tax as well as income tax.

If you elect to report self-employment income, first create your self-employment activity under BUSINESS and BUSINESS INCOME AND EXPENSES across the top of the screen. Then select Start to the right of Profit or Loss from Business.

Report the IRS form 1099-K income by selecting Start to the right of Forms 1099-MISC, 1099-NEC, 1099-K, gross receipts and sales.

**Mark the post that answers your question by clicking on "Mark as Best Answer"