- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

Frontline Worker Pay is entered in the Wages and Income section:

- Select Less Common Income, at the bottom

- Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable Income

- Use description Frontline and the amount

If this is in Minnesota, it will not be taxable on your state return. Please see additional information at Frontline Worker Pay Website.

When you enter your return for MN, you will be asked if you received income from the MN Frontline Worker Pay because it is not taxable on the state return.

However, the IRS had a press release on Feb 3rd that they are reviewing the taxability of state payments such as Frontline Worker Pay. You may wish to wait until that is reviewed and they give revised guidelines for reporting. It may change entry into the return in TurboTax.

Feb 3, 2023

The IRS is aware of questions involving special tax refunds or payments made by states in 2022; we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers. There are a variety of state programs that distributed these payments in 2022 and the rules surrounding them are complex. We expect to provide additional clarity for as many states and taxpayers as possible next week.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

Frontline Worker Pay is entered in the Wages and Income section:

- Select Less Common Income, at the bottom

- Select Miscellaneous Income, 1099-A, 1099-C

- Select Other reportable Income

- Use description Frontline and the amount

If this is in Minnesota, it will not be taxable on your state return. Please see additional information at Frontline Worker Pay Website.

When you enter your return for MN, you will be asked if you received income from the MN Frontline Worker Pay because it is not taxable on the state return.

However, the IRS had a press release on Feb 3rd that they are reviewing the taxability of state payments such as Frontline Worker Pay. You may wish to wait until that is reviewed and they give revised guidelines for reporting. It may change entry into the return in TurboTax.

Feb 3, 2023

The IRS is aware of questions involving special tax refunds or payments made by states in 2022; we are working with state tax officials as quickly as possible to provide additional information and clarity for taxpayers. There are a variety of state programs that distributed these payments in 2022 and the rules surrounding them are complex. We expect to provide additional clarity for as many states and taxpayers as possible next week.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

It is saying that in order for me to do that, I have to upgrade to the Live Deluxe. Is there necessary for this since I am required to add this to my federal return?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

The free version of TurboTax is meant to handle very limited tax situations. Whether you have to file a form or not is separate from whether you can use the free version.

For example, if you receive unemployment, self-employment or income from selling stocks, you must report those on your return, but you will have to upgrade.

You do need to file a return with Minnesota Frontline Worker Pay because the amount is reported to IRS and they will be looking for it on your tax return.

If you do not wish to upgrade, you can file your taxes through the IRS Free File alliance. TurboTax is not a member of this program so I can’t tell you whether or not your situation will be covered under the free file agreement.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

when I enter the frontline worker pay under Miscellaneous Income into turbo tax it also takes taxes from MN state. the state of MN is saying that it is not taxable income in the state of mn.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

I need to report frontline worker pay on line 8 of federal Schedule 1 (Form 1040). Where can I find this on turbotax?

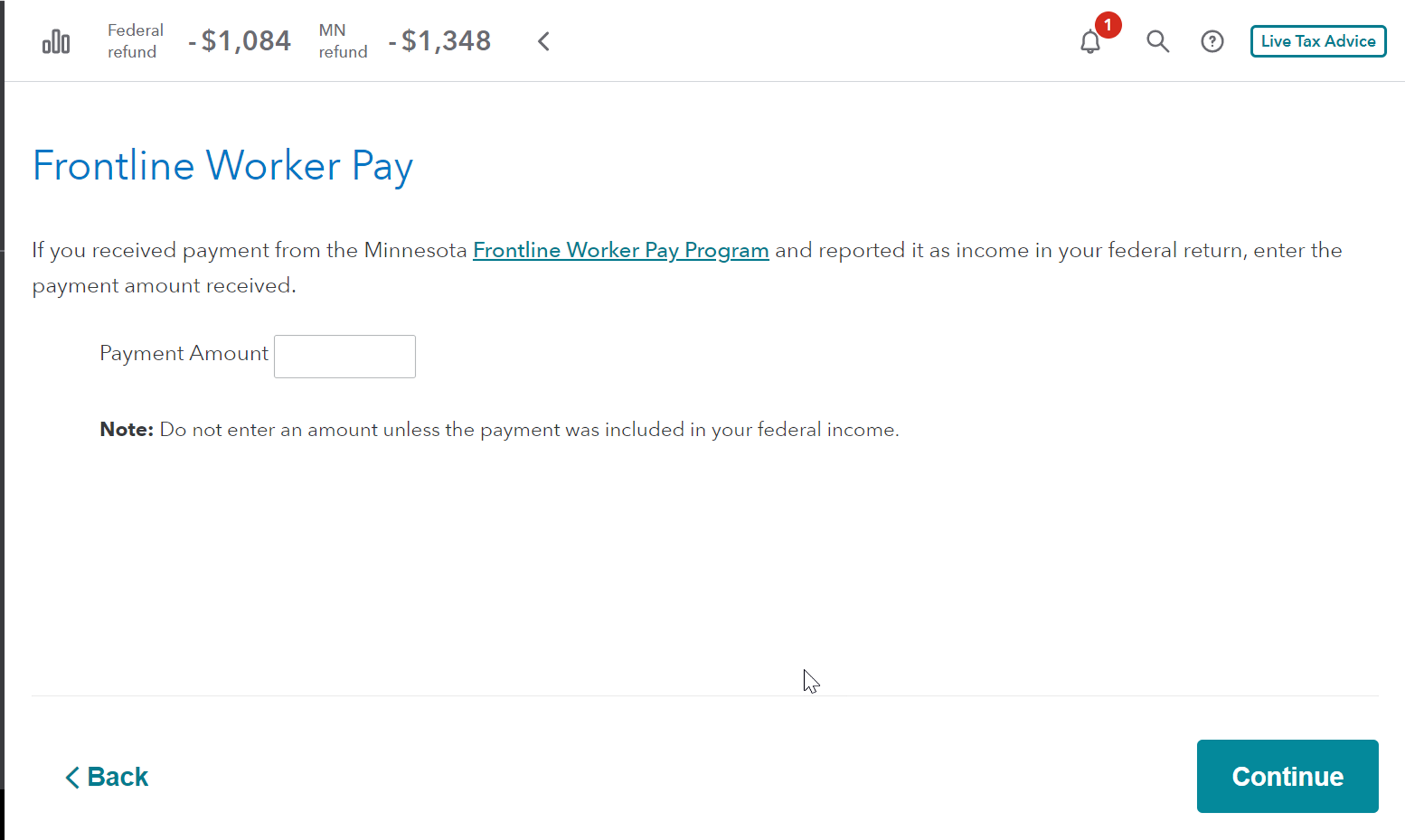

There's an additional step in Minnesota to remove frontline worker pay. TurboTax does not to this for you.

To remove Minnesota Frontline Worker Pay from your MN return:

- Continue in Minnesota until you see the screen “Frontline Worker Pay”

- Enter the Payment Amount (Do not enter an amount unless the payment was included in your federal income)

**Mark the post that answers your question by clicking on "Mark as Best Answer"

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

tz3019

New Member

taxhard47

Level 3

planetkreitlow

New Member

jrW9A8dBAY

New Member

dcx

Returning Member