- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Our farm business got a 1099-G with a box 6 taxable grant. I've found answers about how to enter a 1099-G in the personal income section, but when I try to enter it as income for the farm business I have two problems. First, the software is defaulting to an individual name and SSN for the payee and I its not letting me change it in either EasyStep or directly in the Form. Second, in EasyStep there is no option for box 6 and when I put an amount in box 6 directly on the Form it doesn't get picked up as income when I go back to EasyStep.

Thanks!

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

Accepted Solutions

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

According to the instructions for Form 1099-G, box 6, since the grant relates to an activity for which you are required to file Schedule F, do not enter the amount on the 1099-G entry form. Instead, report the taxable amount as income on the applicable Schedule F.

You can enter this income using these steps:

- While in your return click Business > Continue > I'll choose what I work on.

- On the screen, Let's gather your business info, click on the Update box next to Farm Income and Expenses.

- On the Farm Summary, click Edit next to your farm name.

- On the next screen, Your Farming Income and Expenses, in the Farm Income section, click on the Start/Update box next to Other farm income.

- Enter the amount in Form 1099-G, box 6 on the next screen, Any Other Income or Credits?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

According to the instructions for Form 1099-G, box 6, since the grant relates to an activity for which you are required to file Schedule F, do not enter the amount on the 1099-G entry form. Instead, report the taxable amount as income on the applicable Schedule F.

You can enter this income using these steps:

- While in your return click Business > Continue > I'll choose what I work on.

- On the screen, Let's gather your business info, click on the Update box next to Farm Income and Expenses.

- On the Farm Summary, click Edit next to your farm name.

- On the next screen, Your Farming Income and Expenses, in the Farm Income section, click on the Start/Update box next to Other farm income.

- Enter the amount in Form 1099-G, box 6 on the next screen, Any Other Income or Credits?

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

I had the same problem with the Farm Rental Form 4835. When you try to enter 1099G data it doesn't let you enter box 6. If you follow the procedure above to enter it in Other Income, it says "Other Income not reported on 1099Misc or 1099G." So, it is not appropriate to enter the data from box 6 in Other Income. Do you just go ahead and put it there anyway?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

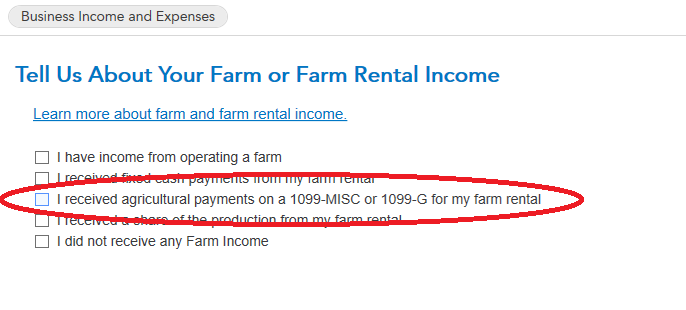

The fact your farm may be registred as an LLC is irrelevant. Farm income is reported on SCH F. As you start the SCH F section of the program, you ***MUST*** select the option to indicate you have income reported on a 1099-MISC or 1099-G. Then press on through the program. Screen shot below.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Having the same problems as other users here....after going through the procedure to add a 1099-G to the Schedule F, there is no place to add taxable grant income. Your choices are Boxes 2, 7, or 9. Now what?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

To add a 1099-G taxable grant shown in Box 6, please follow the instructions below:

- Open your return.

- Click on Federal on the left-hand side.

- Click on Income & Expenses.

- Scroll down to Other Common Income.

- Click Start next to Other Common 1099-G Income.

- Follow the on-screen instructions.

[Edited 2/9/22 l 6:30PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Finally, finally, finally....I think I understand this. All of us TT users think that we are entering 1099 data for the IRS when, in fact, we are entering it so that TT can enter the income on to the forms. If we were doing our taxes on the paper forms, we wouldn't do 1099 data entry. We would simply take the income from the form, whether it be listed as a "box 6, taxable grant" or "box 7, agricultural payment" and enter it into the correct form whether it be "other income", Schedule C or F. This year, we received 1099-G forms from the USDA with income in box 6 in one and box 7 on the other, so in our case, all I really needed to do was put this income on Schedule F under taxable income. I could put it under "other income" and avoid SE tax, but since this income made our farm show a profit, we gained the ability to include healthcare as a deduction and picked up qualified business deductions. Placing it on the Schedule F (or C in some cases) also provides the ability to deduct associated costs to complete the practice. Putting it down under "other income" does not give you the ability to do so. Maybe if your farm or business was very profitable, you would include the income under "other income" to avoid the SE tax, but it really benefited us to not do so this year. Thanks for all of your help. This has been an issue with me for the last 3 years...but now I think I have it and truly understand what and why it is this way!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Yes, you are correct and you have a good understanding of what is taking place. If you perform farming operations and you receive any taxable USDA funds, reported on Form 1099-G, then it should be income on your Schedule F. Since you have followed this on your tax return you can be confident of your entry on your return..

The instructions for completing the Schedule F also provide guidance for these payments.

- IRS Instructions for Schedule F (See page F-4)

Please enter any additional questions here for assistance.

[Edited: 02/10/2022 | 9:43a PST]

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

So I am having this same issue, Received a 1099G box 6 taxable grant, that we then turned around and paid to the contractor that NRCS hired to perform the work. I cannot enter any amount on on the "other Income" line on schedule F as TT does not allow that. Also do I then take the payment out on Custom Hire in expensives of schedule F. Mine should be a total wash because the grant we received was the exact amount the contractor hired by NRCS charged. Can anyone help with this?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

You can add the grant amount to your ordinary income for your Schedule F. You should also include the amount you paid to the contractor as an expense of the business.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Go back to the 1099 that you entered into TT. Change your entry from box 6 to box 7 and it should put your grant money onto the Schedule F. Make sure that it ends up as taxable on the Schedule F. It bothered me to "change the entry" on the 1099, but in actuality, you are just making the program work for you and put the info onto the right schedule and in the right box. If I recall, leaving the amount in box 6 puts the income on to the 1040 as "Other Income"....you probably don't want that to happen. Getting it right this year saved us a couple of thousand dollars. Then you can offset your income on the Schedule F by using either box 13 "Custom Hire" (machine work) or box 32 miscellaneous. You should also make sure that you send a 1099-NEC to the person or firm that was paid to cover yourself as that shows proof that you actually paid the money out.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Thank you, thank you!!! That is exactly what I needed. Not sure why they made that so darn difficult!!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

Well, as I said above in this thread before you asked the question, we are not entering data into Turbo Tax forms for the IRS, we are entering it so that TT can put the data on to the correct forms. The IRS will get the original copy which shows the data in box 6. We just change it to box 7 so that TT will bring it over to the Schedule F and put it into the correct box. Not sure why TurboTax is like that, but it sure does simplify things once you make that conclusion!

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

It's more a matter of why was the income reported in Box 6 if it should be in Box 7.

According to the IRS:

"Box 6. Taxable Grants

Enter any amount of a taxable grant administered by a federal, state, or local program to provide subsidized energy financing or grants for projects designed to conserve or produce energy, but only with respect to energy property or a dwelling unit located in the United States. Also, enter any amount of a taxable grant administered by an Indian tribal government.

Report amounts of other taxable grants of $600 or more. State and local grants are ordinarily taxable for federal income purposes. A federal grant is ordinarily taxable unless stated otherwise in the legislation authorizing the grant. Do not report scholarship or fellowship grants. See Scholarships in the Instructions for Forms 1099-MISC and 1099-NEC.

Box 7. Agriculture Payments

Enter USDA agricultural subsidy payments made during the year, including market facilitation program payments. If you are a nominee that received subsidy payments for another person, file Form 1099-G to report the actual owner of the payments and report the amount of the payments in box 7."

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I properly enter info for a taxable grant reported to my farm business (LLC, own EIN) on a 1099-G?

I totally agree. I read that discription to. That discription his nothing to with our payment. It should have never been in the grant box. Thank you all for your help with this.

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

scatkins

Level 2

ilenearg

Level 2

johntheretiree

Level 2

kngambill

New Member

shtomlin

Level 1