- Community

- Topics

- Community

- :

- Discussions

- :

- Taxes

- :

- Business & farm

- :

- How do I enter CSA1099R information (Box 5) so the program does NOT deduct the pretax insurance premiums listed in Box 5 later in Medical Expenses, Schedule A?

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter CSA1099R information (Box 5) so the program does NOT deduct the pretax insurance premiums listed in Box 5 later in Medical Expenses, Schedule A?

Do you have an Intuit account?

You'll need to sign in or create an account to connect with an expert.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter CSA1099R information (Box 5) so the program does NOT deduct the pretax insurance premiums listed in Box 5 later in Medical Expenses, Schedule A?

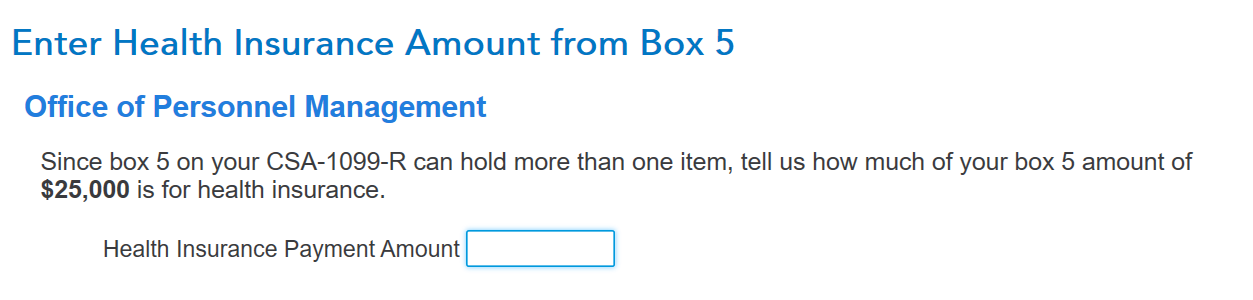

Please check to make sure the amount entered on box 5 (screenshot 2 below) is correct. It is this amount that the IRS considers a return of your previously taxed contributions and is therefore not taxable. Since Box 5 on your CSA-1099 can hold more than one item, continue through the TurboTax Interview to this page on the screenshot below. You would enter the health insurance premium amount. This will flow to Schedule A itemized deductions. However, it will only be deductible if you are itemizing and the amount for your total medical expenses (including health insurance premium) is more than 7.5% of your Adjusted Gross Income.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter CSA1099R information (Box 5) so the program does NOT deduct the pretax insurance premiums listed in Box 5 later in Medical Expenses, Schedule A?

Hi there, Thank you very much for your reply. The screenshot is exactly the place where I face a major question. Comparing the CSA1099R with my OPM Summary of Payment report, I can determine that Box 5 is composed entirely of my FEHB plan premiums and my Medicare premiums. My understanding (and I may be wrong) is that these are pre-tax dollars, and thus do not qualify for deduction on Schedule A, Medical and Dental Expenses. The program simply asks to enter the amount in Box 5 which is for medical insurance premiums, and I enter the full amount, which then goes automatically into Schedule A in TurboTax. So the question is really a tax question about deducting insurance premiums that have been paid (as I understand it) with pre-tax dollars.

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter CSA1099R information (Box 5) so the program does NOT deduct the pretax insurance premiums listed in Box 5 later in Medical Expenses, Schedule A?

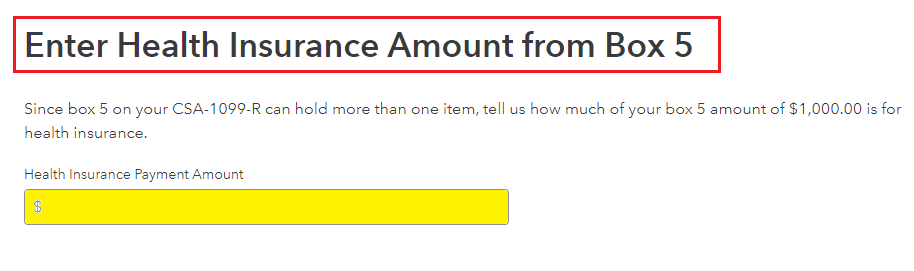

No, it is not pre-tax dollars. Since you are retired, these are not pre-tax health insurance benefits. For retired Federal employees, all of Box 5 is for Health insurance premiums paid by you. Since it is part of your taxable income, the deduction can be used on Schedule A.

Be sure that only health insurance amounts are entered in the follow-up screen shown below.

**Mark the post that answers your question by clicking on "Mark as Best Answer"

- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

How do I enter CSA1099R information (Box 5) so the program does NOT deduct the pretax insurance premiums listed in Box 5 later in Medical Expenses, Schedule A?

Again, many, MANY thanks for clearing that up. Finally..... I understand!

Still have questions?

Questions are answered within a few hours on average.

Post a Question*Must create login to post

Unlock tailored help options in your account.

Get more help

Ask questions and learn more about your taxes and finances.

Related Content

amy

New Member

user17523314011

Returning Member

swick

Returning Member

justine626

Level 1

tucow

Returning Member