- Mark as New

- Bookmark

- Subscribe

- Subscribe to RSS Feed

- Permalink

- Report Inappropriate Content

Business & farm

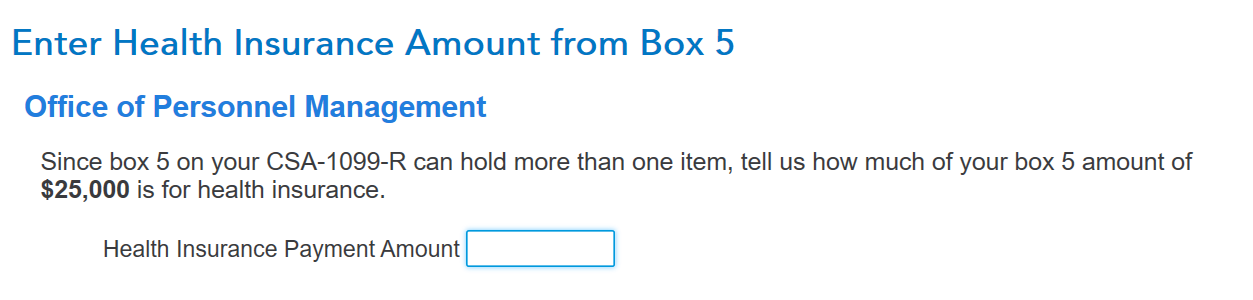

Please check to make sure the amount entered on box 5 (screenshot 2 below) is correct. It is this amount that the IRS considers a return of your previously taxed contributions and is therefore not taxable. Since Box 5 on your CSA-1099 can hold more than one item, continue through the TurboTax Interview to this page on the screenshot below. You would enter the health insurance premium amount. This will flow to Schedule A itemized deductions. However, it will only be deductible if you are itemizing and the amount for your total medical expenses (including health insurance premium) is more than 7.5% of your Adjusted Gross Income.

**Say "Thanks" by clicking the thumb icon in a post

**Mark the post that answers your question by clicking on "Mark as Best Answer"

**Mark the post that answers your question by clicking on "Mark as Best Answer"

February 8, 2023

7:35 AM